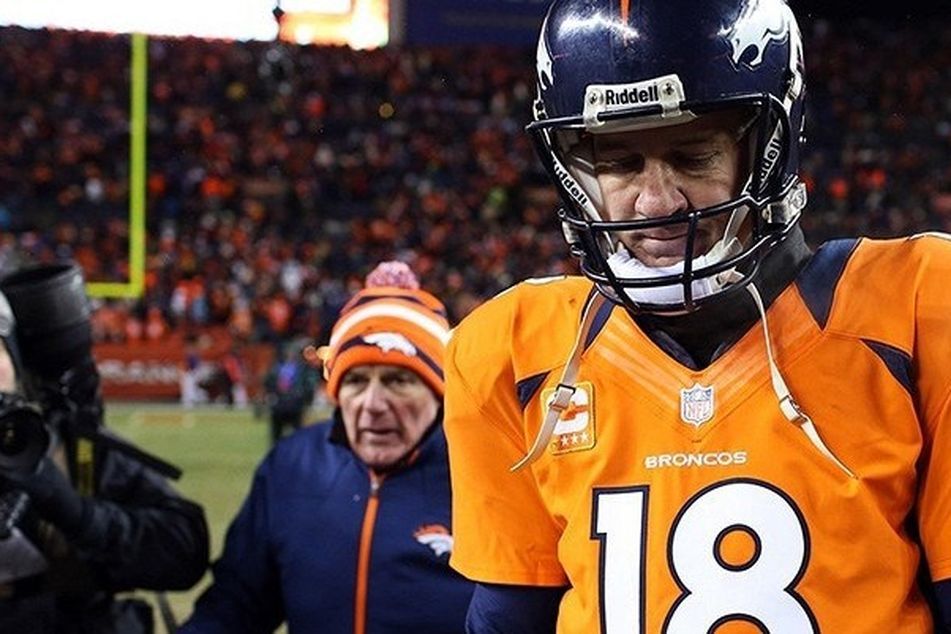

Peyton Manning’s happy retirement hinges on good planning, smart decisions

Athletes need to save during short careers to pay for long retirements.

With a little luck, and a lot of good financial planning, Peyton Manning’s extraordinary record of success during his 18 years in the National Football League will continue well into retirement — something that can’t be said for many former athletic superstars.

Many athletes who play in professional sports leagues overspend, invest badly, or find themselves victims of unscrupulous business partners or financial advisers.

One analysis found that 15% of NFL players drafted from 1996 to 2003 declared bankruptcy a dozen years after retiring. Neither higher income during their careers or long periods in the NFL seemed to protect against that destiny, the authors of the May 2015 American Economic Review article said.

Part of the problem is that NFL careers are often short and post-NFL retirements are usually long.

“Given the rise in contract values across all major sports, it’s easy for athletes and fans to assume the money will last throughout their retirement,” said Todd LaRocca, managing director of the Sports and Entertainment Group at SunTrust Private Wealth Management. “But if the athlete has not examined their lifestyle and the length of their retirement, they may have to make changes to their lifestyle in the later years of their retirement.”

He warns retired athletes not to invest in businesses outside their areas of expertise.

Professional athletes sometimes are challenged during the transition to retirement and will attempt to replace that career void with an investment in a new business venture, Mr. LaRocca said.

The 40-year-old quarterback reportedly has earned $400 million in salary, bonuses, endorsements and licensing, making him the NFL’s all-time leader in earnings both on and off the field, according to Forbes. He earned about $250 million on the football field and $150 million off the gridiron.

In addition to his two Super Bowl rings, he owns 32 Papa Johns in the Denver area.

During his sometimes tearful retirement announcement on Monday, Mr. Manning said: “Life is not shrinking for me, but morphing into a whole new world of possibilities.”

Mitchell Halpern, a tax principal at Kahn Litwin Renza, said he hopes that Mr. Manning’s retirement planning “was done well before his announcement today and it is simply a matter of having set aside enough to live off of his savings/investments without fear of running out during his lifetime.”

Mr. Manning also likely will generate future earnings as a broadcaster, speaker or product endorser, he said.

Mr. Halpern said he advises athletes – whether they are at the upper echelon of their sport like Mr. Manning or a low-earning player – to practice a lifestyle they can support after their sports career with the money they’ve saved and invested, expecting a conservative rate of return.

That mindset should be established based on their current contract, or even better, the guaranteed portion of their current contract, he said.

“If this overall plan is adhered to it should make the transition to retirement seamless from a financial perspective,” Mr. Halpern said. “Unfortunately, this type of plan is not followed by nearly enough of today’s athletes.”

In an especially egregious case involving NFL players a few years ago, wide receiver Terrell Owens and 30 other players were bilked by a Florida broker out of more than $40 million through a crooked casino project.

But the NFL doesn’t own financially cursed athletes.

Five-time Major League Baseball All-Star Mike Sweeney sued his former broker and UBS Financial Services for $7.6 million of losses from investments he said were misrepresented or hidden from him by the broker.

Learn more about reprints and licensing for this article.