Senators ask Obama to speed up multistate insurance registry

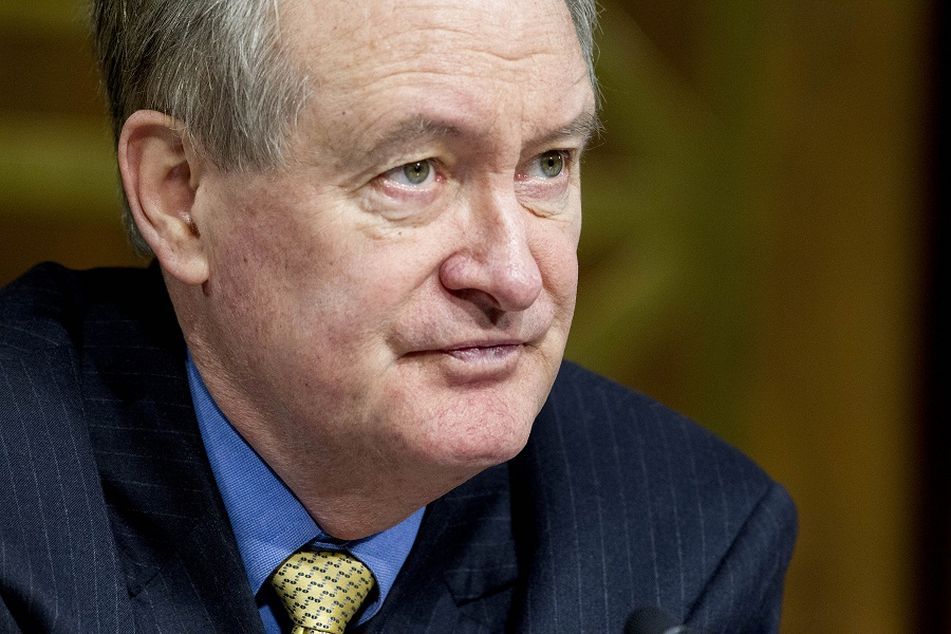

Mike Crapo, R-Idaho

Mike Crapo, R-Idaho

The initiative, signed into law in January, can't get off the ground until the president nominates members to the registry's board.

Several senators are nudging the Obama administration to speed up the implementation of an initiative that would help insurance agents practice in multiple states.

In January, President Barack Obama signed a law that included a provision establishing the National Association of Registered Agents and Brokers, a clearinghouse for insurance professionals who want to register in one or more states outside their own.

But the administration has yet to nominate anyone to the board of the new agency, which will be comprised of eight state insurance regulators and five industry representatives. The nominees would then have to be confirmed by the Senate.

The board was supposed to have been appointed within 90 days of the bill being signed. Its first meeting could occur within 45 days of a confirmed board.

Instead, the NARAB is adrift, and some members of the Senate are losing their patience.

“Until nominations are announced and then confirmed by the Senate, no progress can be made in setting up NARAB and making important policy and administrative decisions,” wrote Sens. Mike Crapo, R-Idaho, Jon Tester, D-Mont., and five of their Senate colleagues in a letter to Mr. Obama Tuesday.

The Obama administration did not immediately return a request for comment.

The NARAB has been a legislative priority for more than a decade for insurance groups, such as the National Association of Insurance and Financial Advisors, who say it will make obtaining insurance licenses in multiple states easier and less expensive.

“For NAIFA members, NARAB is much-needed reciprocity in producer licensing,” NAIFA President Jules Gaudreau said in a statement. “NARAB will benefit consumers as well by allowing them to maintain their preferred insurance agent or broker should they move to a different state.”

In order to achieve consumer gains, “it is important that the process to establish NARAB begin quickly,” the lawmakers wrote.

Learn more about reprints and licensing for this article.