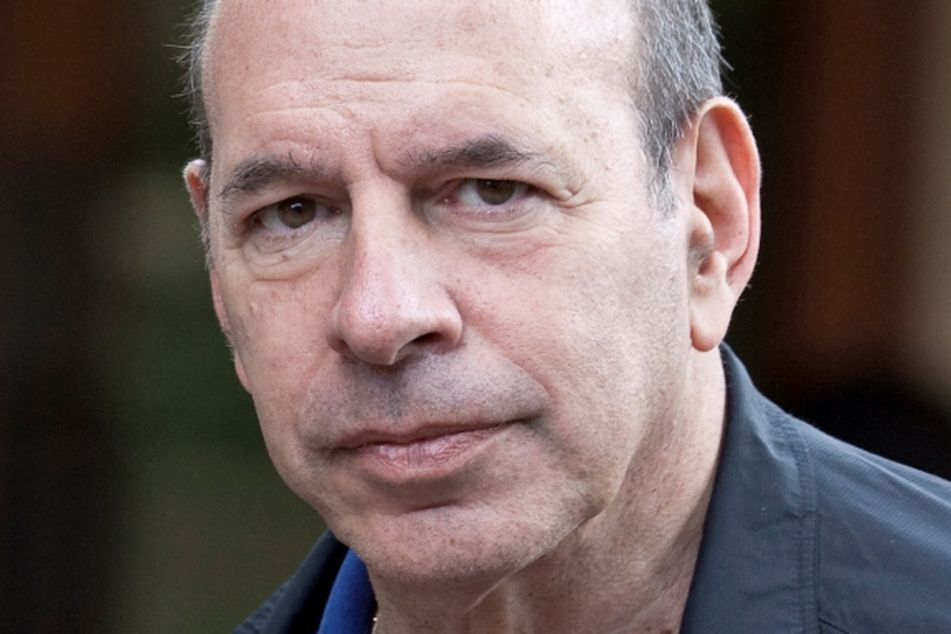

Ken Starr indicted; clients’ estimated losses double

Kenneth Ira Starr, the New York investment adviser who represented actors Sylvester Stallone and Wesley Snipes, was indicted for stealing at least $59 million from clients, almost double the amount previously thought. Starr studded: Adviser's celebrity client list

Kenneth Ira Starr, the New York investment adviser who represented actors Sylvester Stallone and Wesley Snipes, was indicted for stealing at least $59 million from clients, almost double the amount previously thought.

Starr, 66, of Manhattan, was charged in the indictment by a federal grand jury in New York with 20 counts of wire fraud and one count each of securities fraud, money laundering and fraud by an investment adviser.

Yesterday’s indictment replaces a May 27 criminal complaint filed by federal prosecutors in the office of U.S. Attorney Preet Bharara. That complaint alleged Starr stole at least $30 million from seven clients. The indictment expands the number of victims to 11.

(See a list of Mr. Starr’s celebrity clients here.)

“In the less than two weeks since Kenneth Starr’s arrest, this investigation has maintained its velocity,” Bharara said in a statement. “The scope of the alleged fraud has doubled and is now up to $59 million and counting.”

If convicted of wire fraud, Starr faces as long as 20 years in prison.

Abbe Lowell, a lawyer representing Starr in a civil lawsuit brought by the U.S. Securities and Exchange Commission, couldn’t immediately be reached for comment yesterday. Peggy Cross, a public defender appointed to represent Starr, didn’t immediately return a voice-mail message left at her office after regular business hours yesterday.

Starr was arrested May 27 and accused of defrauding clients, including heiress Rachel “Bunny” Mellon, in a scheme to buy a $7.5 million Manhattan apartment. He has been held in jail since his arrest.

Starr used his access to famous and powerful clients “to burnish an image of trustworthiness, leading his clients to entrust him with management and control of their financial affairs,” sometimes assuming “total control” over their financial lives, the indictment charges, repeating an earlier allegation by prosecutors.

Starr, who hasn’t entered a plea in the case, may again ask for bail, which was denied earlier when the government argued he was a flight risk. His bank accounts have been frozen, and the former manager of more than $700 million was being represented by a public defender because he couldn’t afford a lawyer.

His company “performs accounting, bookkeeping and tax return preparation services” for 30 to 40 clients, Aurora Cassirer, temporary receiver for his Starr & Co., said June 4 in a report to a judge. The company collects and deposits their income into their bank accounts, and arranges for payments of rent and mortgage bills, she wrote.

Personal clients at New York-based Starr Investment Advisors and Starr & Co. fell from 140 a month or two earlier and were still dropping at the time of her report, according to Cassirer, of the law firm Troutman Sanders LLP.

Arrested with Starr last month was Andrew Stein, former president of the borough of Manhattan and the New York City Council. Stein, who is accused of a tax crime and of lying to investigators, wasn’t part of yesterday’s indictment.

The indictment broadens the charges, alleging that Starr stole at least $28 million by transferring client funds to accounts he controlled and defrauding them of $29 million by lying about their investments.

According to the indictment, Starr used at least $2.5 million in client money in 2009 and 2010 to pay Starr & Co. operating expenses and to make payments to himself and his wife. This year, he also took money from three clients to repay $4 million to an elderly client, and he stole $5.75 million from five clients to buy the five-bedroom, 6 1/2-bathroom Manhattan apartment, according to the indictment.

Prosecutors say Starr diverted another $1 million to an account held by an entity called Marose LLC. Marose is registered in New York State records to Marvin Rosen, a former Democratic National Committee finance chairman and Starr’s partner at Diamond Edge Capital Partners, which markets investments to public pension funds. Rosen didn’t return a call seeking comment.

Separately, Starr is accused of promising to invest $29 million in client funds in “sure deals” and instead routing the money to riskier ventures. He promised an “elderly actress” that her investments were “going well” when he had actually put her funds in a money-losing restaurant chain, according to the indictment.

Prosecutors want Starr to forfeit at least $57.3 million in property owned by him and his fourth wife, Diane Passage, a former stripper. The assets sought by the U.S. include their Manhattan apartment and funds in bank accounts including one in the name of “Poledance Superstar.”

The victims of Starr’s alleged fraud aren’t named in the indictment. They are described in the indictment as including a former hedge fund manager, an actress, a former executive of a talent agency, the stepson of a deceased heir to a business fortune, a 99-year-old heiress, a jeweler and his wife, a film producer in his late 70s, a playwright and screenwriter in his 80s, the ex-wife of a wealthy investor, and an actress in her 80s.

Starr & Co. was a financial adviser to photographer Annie Leibovitz and actress Joan Stanton, the voice of Lois Lane in the “Adventures of Superman” 1940s radio series, according to various lawsuits. She died in 2009 at 94 after suing Starr in 1998 accusing him of misappropriating “tens of millions of dollars.”

Starr was sued in 2002 by Stallone, who claimed the financier’s advice caused him to lose $10 million on the stock of Planet Hollywood International Inc., a theme restaurant chain.

Among the alleged victims was Mellon, the 99-year-old of widow of philanthropist Paul Mellon, according to Alex Forger, manager of Oak Spring Farms and attorney for Mellon’s family- owned company Oak Spring Farms LLC. Oak Spring lost more than $5 million to Starr’s theft, prosecutors said.

Other victims included former Chief Executive Officer Jim Wiatt of the William Morris talent agency and actress Uma Thurman, said people familiar with the situation. Another client was Snipes, who was convicted by a federal jury in Ocala, Florida, of failing to file income tax returns. Starr testified at Snipes’ trial.

Louisa Sarofim, heiress of the Brown & Root construction fortune, and playwright Neil Simon were also clients, according to court papers in the Stanton suit.

The criminal case is U.S. v. Starr, 1:10-mj-01135, U.S. District Court, Southern District of New York (Manhattan). The SEC civil lawsuit is SEC v. Starr, 1:10-cv-04270, U.S. District Court, Southern District of New York (Manhattan). The Stanton Suit is Stanton v. Starr, 08601122, New York State Supreme Court, New York County (Manhattan).

–Bloomberg

Learn more about reprints and licensing for this article.