LPL tops breakaway brokers’ bucket list

LPL Financial is the top destination for brokers who are thinking about leaving their current firms within the next two years, according to new research. How does the rest of the industry stack up?

LPL Financial is the top destination for brokers who are thinking about leaving their firms within the next two years, according to a new survey by Cogent Research.

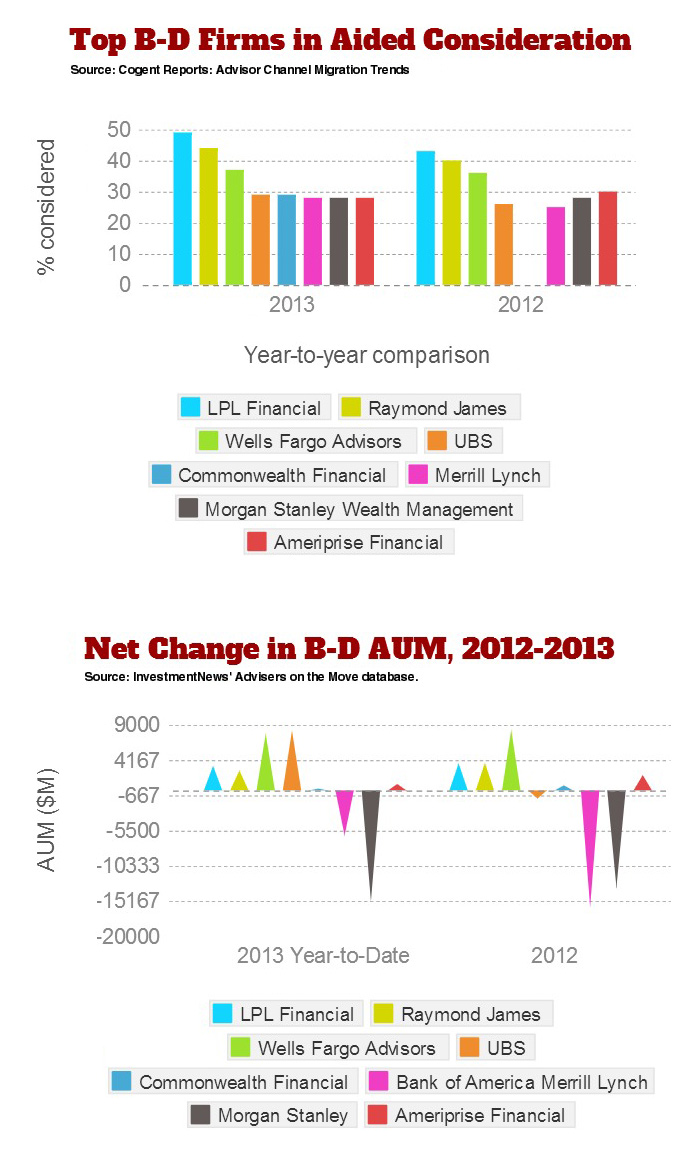

Nearly half the 326 potential breakaway brokers surveyed by Cogent said that they were highly likely to consider LPL, the second year in a row that it ranked first.

Last year, 43% of potential breakaways ranked it first.

INFOGRAPHIC: How the B-Ds stack up in adviser preference, AUM

Cogent defines potential breakaways as brokers who say that they are considering leaving their firm within the next two years.

Nearly one of four of the 1,749 brokers surveyed by Cogent said that they were considering leaving within that time frame.

The survey results come on the heels of an exceptionally strong third quarter of recruiting for LPL, which added 154 net new registered representatives and financial advisers during the period.

“LPL is living up to the promise of offering independent platforms, greater independence and superior operational support,” said Meredith Rice, senior product director at Cogent.

Raymond James came in second with 44% of potential breakaways saying that they would strongly consider it, up from 40% last year.

Raymond James is ramping up its recruiting efforts now that its acquisition of Morgan Keegan & Co. Inc. is complete, chief executive Paul Reilly said during the company’s latest earnings call.

Higher earning potential was the biggest draw for brokers, unsurprisingly, but this year, having greater control over the investment process was cited as a consideration by more potential breakaways — one-third, up from 25% a year ago.

That has played a part in why adviser satisfaction is lowest in the bank and wirehouse channels, where model portfolios are most used.

“Being independent means you can build portfolios the way you want to,” said Tim Welsh, president of Nexus Strategy, a wealth management consulting firm.

“That’s the real challenge when you have a massive institution like a wirehouse or big bank. They tend to manage to the lowest common denominator for compliance reasons,” Mr. Welsh said.

“They don’t want people doing all sorts of risky investing,” he said. “They want to control that.”

Wells Fargo Advisers placed third, ranking as the most desirable wirehouse for the second year in a row with 37% of potential breakaways giving it strong consideration, up from 26% last year.

UBS Wealth Management, however, made the biggest leap in terms of perception. It ranked fourth among all companies with 29% of potential breakaways considering it, up from 26% in 2012.

Morgan Stanley Wealth Management and Merrill Lynch Wealth Management tied for fifth, with 28% of potential breakaways saying that they would strongly consider the two firms.

The two giants rank as the first- and second-largest wirehouses, even though they had shed some advisers over the one-year period that ended Sept. 30.

Morgan Stanley employed 16,517 advisers Sept. 30, down from 16,829, while Merrill Lynch has 15,624 advisers, down from 16,759 last year.

Officials at both wirehouses recently suggested that recruiting across the industry would slow down.

Learn more about reprints and licensing for this article.