Market tumult pushes Federal Reserve rate hike expectations out

A long-anticipated move by the Fed to raise interest rates next month would be “very strange,” given the volatility rocking financial markets, according to the top bond strategist for Charles Schwab's retail research unit.

A long-anticipated move by the Federal Reserve to raise interest rates next month would be “very strange,” given the volatility rocking financial markets, according to the top bond strategist for Charles Schwab & Co.’s retail research unit.

Kathy A. Jones said the “odds are pretty low now” that the Fed would raise the benchmark lending rate despite previously settled predictions that such a hike would come as soon as September.

A top BlackRock Inc. portfolio manager, Rick Rieder, on Monday also said volatility has made it more difficult for the Fed to raise rates. But he said the markets “would be in better shape if they do.”

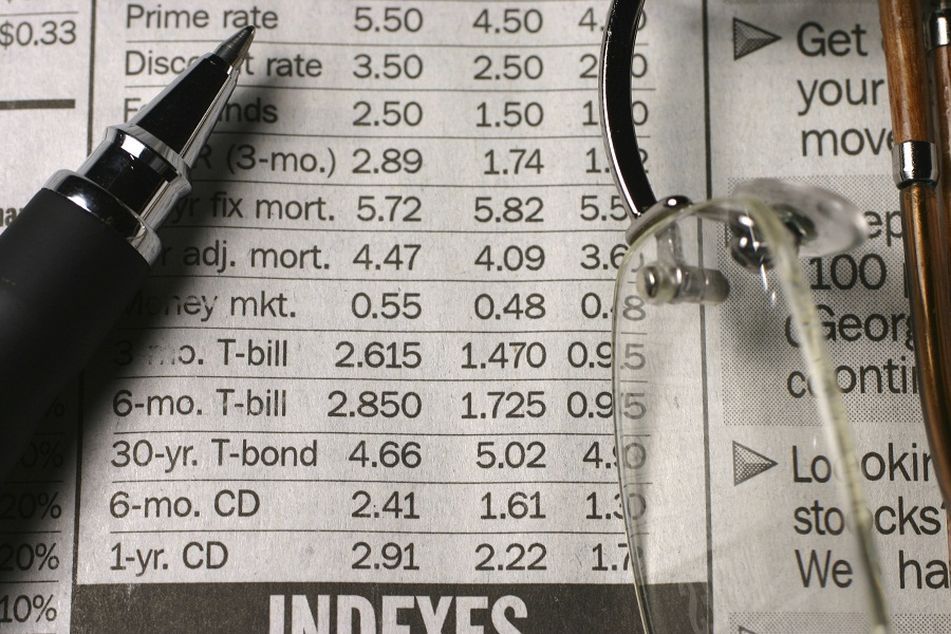

Stocks on Tuesday rebounded after a rollicking trading day Monday that at one point wiped more than 1,000 points off the Dow Jones Industrial Average. The blue chip barometer ticked up 1.6% in trading Tuesday morning. The U.S. 10-year Treasury note moved up to 2.08%; it traded at 1.94% Monday morning.

SEPTEMBER CAMP

“We were in the September camp for a really long time,” Ms. Jones, chief fixed income strategist for the Schwab Center for Financial Research, said in an interview. “We think that it would be very strange given the current situation or the Fed to hike in September, largely because of the inflation side of things.”

Despite the consistent growth in U.S. output, upward pressure on prices have been minimal amid concerns about the growth of China and sinking prices for commodities, including oil.

“Now you have all this disruption in the global economy, which is somewhat deflationary, and they have to worry that they’ll only compound that problem,” said Ms. Jones, who said December is likely the first realistic time frame for a hike. “They have to wait for financial conditions to settle down.”

The Fed has not raised the benchmark interest rates it controls for the first time since December 2008.

Expectations of a September hike were heightened earlier this month when a voting member of the committee that controls those rates said the Fed was close to making such a move.

On Monday, that official, Federal Reserve Bank of Atlanta President Dennis Lockhart, said the Fed is still likely to raise rates “sometime this year.”

The timing of a rate hike has confounded many top bond investors. Many incorrectly positioned for a hike last year only to find that many rate-sensitive bonds benefited from a rally.

HIGH-YIELD BOND FUNDS RISKY

Schwab is warning investors that an allocation to high-yield bonds and unconstrained bond funds is potentially risky, especially when coupled with the fact that some investors have moved money from bonds to dividend-paying stocks.

By comparison, Ms. Jones said, investment-grade corporates look to be undervalued by the market. But those companies too have increased the debt on their balance sheet to pay for dividends and other maneuvers designed to benefit stock shareholders. That debt could come back to haunt some of those companies.

Collin Martin, a Schwab analyst focused in part on the high-yield market, said the volatility of that market was far less than expected on Monday. But that may not necessarily mean they’ll withstand the next bout of volatility.

Ms. Jones said she’s bullish on municipal bonds, whose issuers — U.S. cities and states — are in a stronger financial position than before the 2008 financial crisis.

“We think munis provide a lot of value here, especially relative to Treasuries, when that spread moves out,” according to Ms. Jones, who noted that the last couple of trading days have provided investors “a real opportunity to step in.”

Learn more about reprints and licensing for this article.