T. Rowe Price to pay out $194 million to shareholders in four mutual funds, other clients

Firm's moves stem from error it made in voting on the 2013 buyout of Dell.

T. Rowe Price said Monday it would pay about $194 million to fund shareholders and other clients for an error it made in voting on the 2013 buyout of Dell.

The shareholders held about 31 million Dell shares at the time.

At the time of the buyout, T. Rowe Price thought that the $13.75 share price offered by Michael Dell and others undervalued the company. “Several T. Rowe Price funds, trusts, and clients subsequently filed a petition with the Delaware Court of Chancery to seek a fair value appraisal for their Dell shares,” the company said in a press release. The court ruled that Dell’s fair value was $17.62 per share.

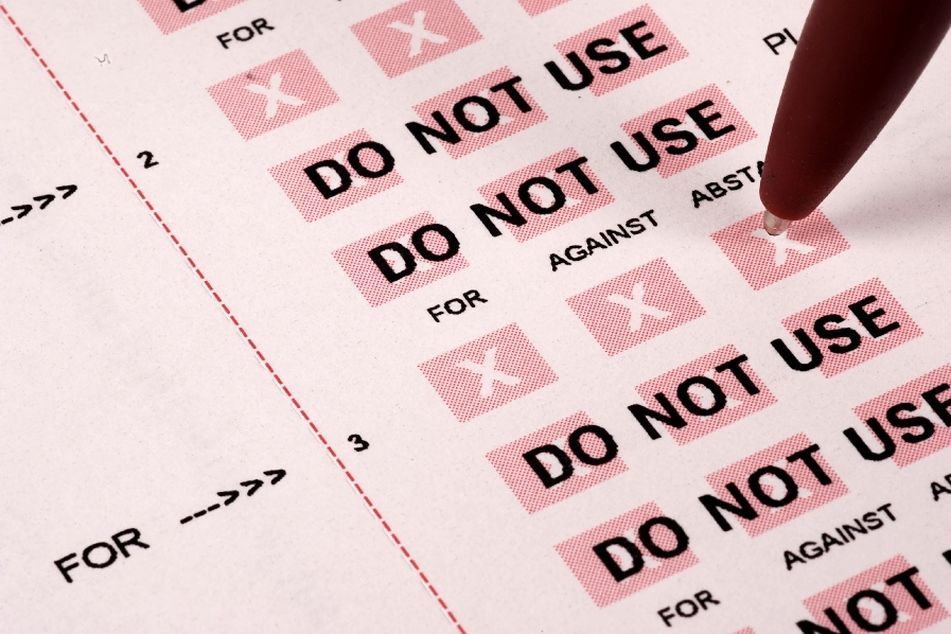

Unfortunately, T. Rowe inadvertently voted for the merger, rather than against. The court ruled last week that the vote made T. Rowe’s shares ineligible to pursue the higher share value. While this validated T. Rowe’s thinking on the shares, it was cold comfort to shareholders.

“As a result, T. Rowe Price expects to record a one-time charge of approximately $194 million in its second quarter of 2016, which is expected to reduce net income, after tax, by about $118 million—or approximately $0.46 in diluted earnings per share of common stock,” the Baltimore-based investment firm says. The company will fund the payments from available cash.

Some T. Rowe Price fund shareholders will see a boost on the next-computed share value of their funds. They are:

– Equity Income: 14 cents a share, or 0.45% of the net asset value

– Science and Technology: 42 cents a share, or 1.20% of NAV

– Institutional Large-Cap Value: 4 cents a share, or 0.21% of NAV

– Equity Income Portfolio: 15 cents a share, or 0.53% of NAV.

“Since this situation began, our focus has been on securing fair value from the Dell buyout for our clients,” T. Rowe Price president and CEO William Stromberg said in a statement. “The court’s determination that the original buyout consideration offered by Dell was too low validated our original investment view. By compensating our clients based on the court’s May 31, 2016, ruling, clients will come out ahead as compared with how they would have fared had they taken the merger consideration.”

Learn more about reprints and licensing for this article.