Convergence of retirement and wealth management is next ‘battleground’

The ultimate goal is to engage all 401(k) participants by offering in-plan financial advice.

Brokerage executives and financial advisers see the convergence of wealth management and the retirement business as a major moneymaking opportunity, and are implementing measures to capitalize on it.

This convergence, which sees wealth managers do more business with 401(k) plans and participants, and 401(k) advisers do more wealth management for individual clients, is occurring as firms see the need to diversify revenue streams and cater to client demand, executives said at InvestmentNews‘ recent Retirement Plan Adviser Broker-Dealer Think Tank in New York.

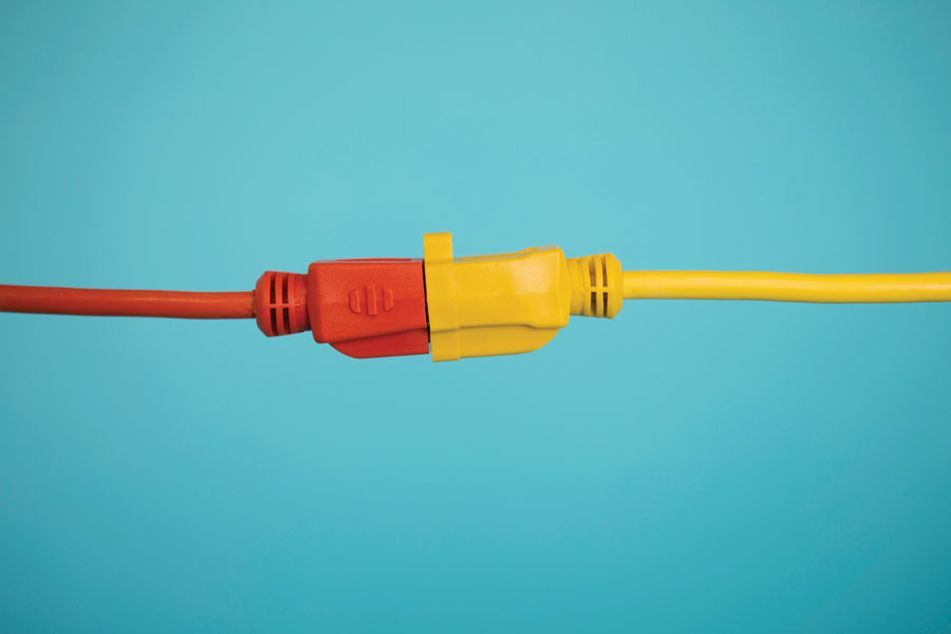

Blurred lines

“The lines are blurring now. It is not so much siloed,” said Bryan Hodgens, senior vice president, retirement partners, at LPL Financial, said of wealth management and retirement. “I think it’s just going to continue to merge together. I absolutely do.”

Being able to do both 401(k) and wealth management work provides a natural referral system for new business. For instance, a business-owner wealth management client may need help managing the company 401(k) plan, and vice versa. 401(k) participants also represent a captive audience of potential retail customers — for the vast majority, a 401(k) adviser will be the only financial adviser with whom they ever come in contact.

The ultimate goal is to engage 401(k) participants, from the highly compensated C-suite executives through the rank-and-file employees, by offering in-plan financial advice. That allows advisers and broker-dealers to potentially capture both retirement and other household assets.

“To me that will be the battleground over the next 10 years,” said Dick Darian, CEO at consulting firm The Wise Rhino Group.

Broker-dealers aren’t the only group to recognize the opportunity. Many retirement-focused aggregator firms, which acquire advisory shops specialized in the 401(k) market, are aggressively building out their wealth management capabilities. Record-keepers are building out financial-wellness services to address participants’ financial issues, in some cases giving them the opportunity to buy in-house retail products like insurance. And, in a sign of the times, a private-equity firm bought 401(k)-focused managed account provider Financial Engines for $3 billion last year and merged it with Edelman Financial Services, a retail advisory firm.

Fewer rollovers

The result will be fewer rollovers from 401(k) plans to retail accounts as more investors keep their money in plan or with the 401(k) adviser, Mr. Darian said. That’s significant because in the past, a rollover event is historically where many brokers and advisers have gotten new business.

While executives see the opportunity, they concede that firms haven’t yet succeeded in capitalizing.

Jon Anderson, head of retirement plan solutions at Cetera Financial Group, said he was recently addressing a room of 150 401(k) investors, all making roughly $150,000-$200,000, and asked how many had ever been contacted by their plan’s 401(k) adviser. Only two raised their hands.

“I don’t know exactly why that’s happening, but I know it’s happening at scale out there and the participants are just not getting that connection,” Mr. Anderson said.

“Whoever does that best and first, I think, is going to be a leader in the marketplace,” he said.

There are some challenges to tackling the issue.

One primary challenge: figuring out ways to mitigate corporate risk across thousands of advisers who may be doing retirement-plan business but most likely are not specialists. Many wirehouse and independent brokerages in recent months and years have offered options to relatively inexperienced 401(k) advisers interested in working with retirement plans; such services give responsibility for fiduciary investment management to the home office rather than the adviser to help control risk.

Scaling financial advice for all plan participants also becomes a drain on advisers’ time and resources, which many executives see as a reason to implement technology as one part of the equation. Changing advisers’ mindsets toward more of a long-term asset-gathering framework is also tough, they said, since 401(k) participants are not the wealthiest of clients.

“This isn’t an immediate game. You need to build a pipeline of people who are going to build wealth over time,” said Christina Marschinke, senior vice president, retirement partners, LPL Financial. “That’s going to change and I don’t think that’s been the mindset of advisers two years ago, three years ago, five years ago.”

Support infrastructure

Some brokerage firms have taken concrete steps to build an infrastructure to support the convergence of wealth and retirement.

David Curylo, a pension consultant at MML Investor Services, who works with the firm’s roughly 9,000 advisers on retirement-plan issues, said the broker-dealer is looking at tiering advisory firms and advisers based on their book of business and recent sales to identify their quantity of retirement business.

Ultimately, the firm’s goal is to have an identified retirement-plan specialist in each firm considered to be a “two-plan Tony,” or one with only a handful of 401(k) plan clients.

Fred Barstein, founder and CEO of The Retirement Advisor University, said it’s imperative for broker-dealers to find a way to support these advisers dabbling in the 401(k) business from the point of getting more small-business employees access to a 401(k) plan, since more experienced advisers tend to focus on larger plans.

“I think it is that wealth management adviser, the dabbler, the one who maybe doesn’t have that billion-dollar book, we’ve got to help them, we’ve got to enable them,” Mr. Barstein said. “They’re the future.”

Learn more about reprints and licensing for this article.