Dimensional Fund Advisors flips $8 billion of assets into ETFs

With the two most recent conversions, the firm boasts nine exchange-traded funds with about $40 billion in assets.

Dimensional Fund Advisors converted two more of its equity mutual funds into exchange-traded vehicles, further boosting the quant giant’s heft in the $6.8 trillion arena.

The Austin, Texas-based firm’s Tax Managed DFA International Value Portfolio and its T.A. World ex U.S. Core Equity Portfolio are now the Dimensional International Value ETF (DFIV) and Dimensional World ex U.S. Core Equity 2 ETF (DFAX), respectively, according to a press statement Monday.

The move adds two more funds and about $8.1 billion in assets to Dimensional’s ETF lineup. The firm founded by David Booth now boasts nine ETFs worth around $40 billion, according to data compiled by Bloomberg.

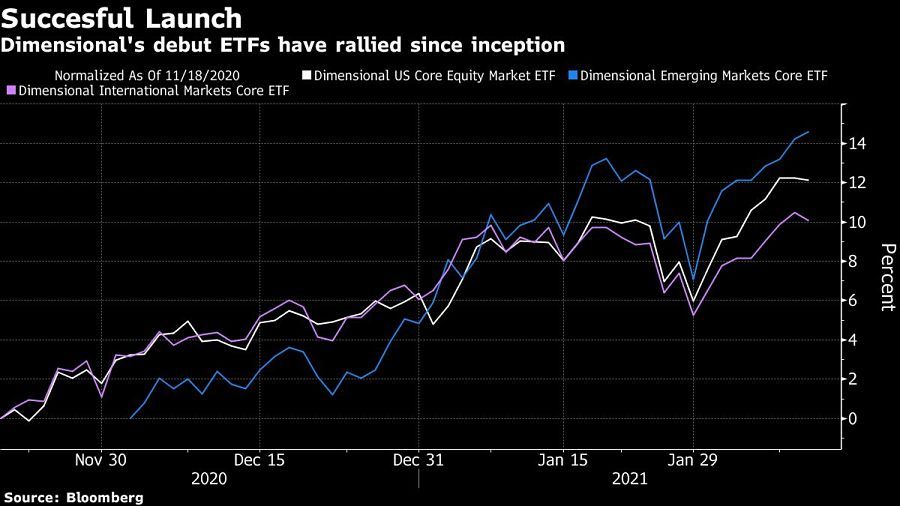

In June, Dimensional became only the second U.S. issuer to pull off a conversion, transforming $29 billion worth of mutual funds into ETFs in an industry record. The asset manager — which controls $660 billion — has aggressively targeted the ETF universe since launching its first products last November, touting the structure’s tax advantages and client demand.

Citigroup analysts said in a June forecast that Dimensional’s conversions would be one of several factors behind a $21 trillion shift from mutual funds to ETFs over the next decade. Bloomberg Intelligence expects $1 trillion worth of such switches to take place over the next 10 years.

JPMorgan Asset Management has announced plans to switch four funds with $10 billion in assets into ETFs next year.

Pay attention and learn about crypto now, even before the asset rules are set

Learn more about reprints and licensing for this article.