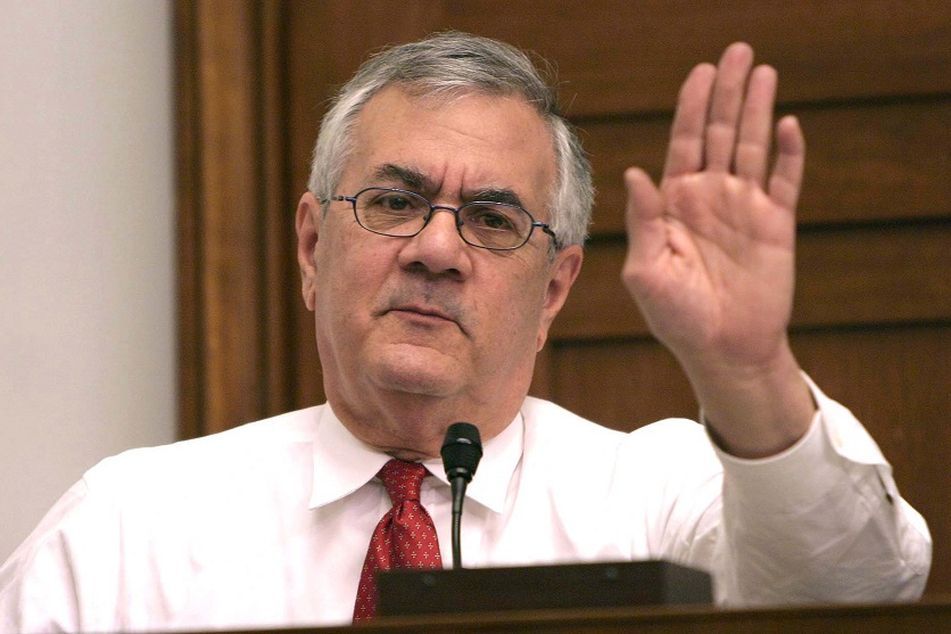

Dodd-Frank architect Barney Frank blasts decision to overturn MetLife SIFI status

Barney Frank

Barney Frank

The former House Financial Services committee chair criticized the ruling and said it could ultimately lead other institutions to try to overturn their SIFI status.

One of the Dodd-Frank financial reform law’s chief architects Wednesday blasted a judge’s recent order overturning MetLife Inc.’s status as a systemically important financial institution, saying it would be “very troubling” if an appellate court upheld the decision.

Barney Frank, former chair of the House Financial Services Committee (D-Mass.) and a co-sponsor of the Dodd-Frank Act, criticized several aspects of U.S. District Judge Rosemary Collyer’s decision to rescind the insurer’s non-bank SIFI status, especially the contention that the government failed to conduct a cost-benefit analysis.

A strict cost-benefit analysis such as the one called for in the March ruling would be “very debilitating,” Mr. Frank said on a media conference call.

“This is not a case where MetLife was being penalized in any serious way,” according to Mr. Frank, who stressed MetLife wasn’t being convicted criminally or civilly through the designation, but was rather being subject to regulation as “a safeguard for society.”

Judge Collyer is imposing obstacles contrary to intent of Congress, and making decisions based on “criteria she invented,” Mr. Frank said.

The Financial Stability Oversight Council handed MetLife its SIFI designation in December 2014, in a 9-1 vote. MetLife, America’s largest life insurer, subsequently challenged the “too big to fail” label, which would have put it under tighter government scrutiny and forced it to hold more money in reserves.

Analysts have estimated escaping SIFI status could let MetLife free up $2.5 billion or more that could be returned to shareholders.

Judge Collyer, in overturning the government’s label, faulted FSOC’s process rather than its overall findings, calling the decision “unreasonable.”

MetLife was one of four non-bank institutions given the SIFI label, the others being Prudential, American International Group and General Electric’s GE Capital (which has since been divested).

The government is appealing the district court’s decision in the MetLife case, but if that challenge fails it could promote action from other non-bank SIFIs.

“It’s conceivable that some that have been designated might bring a suit” in the event a higher court ultimately upholds MetLife’s district court decision, Mr. Frank said. “I have to say, I doubt AIG would have to chutzpah to do that given their central role in the [financial] crisis.”

“I think the last thing we need is this extra uncertainty about what the statute means,” he added.

In a brief filed in the U.S. Court of Appeals for the District of Columbia Circuit, current and former congressmen offered support for the government’s position in the case, arguing FSOC followed procedures and criteria Congress laid out in the Dodd-Frank law.

“The district court’s conclusions are inconsistent with Dodd-Frank’s text and fundamentally misunderstand its structure and operational design — in particular, the role that FSOC is empowered to play, in conjunction with the Fed, in preventing another calamitous financial meltdown like the one the nation just experienced,” according to the brief.

Learn more about reprints and licensing for this article.