Finra elects Vanguard’s John Brennan chairman to replace Richard Ketchum

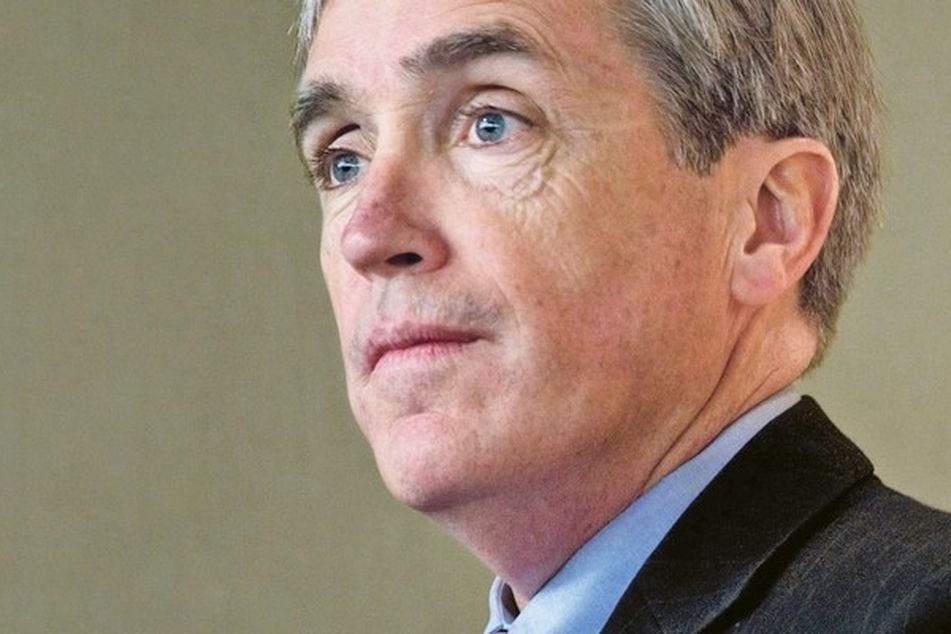

John J. "Jack" Brennan

John J. "Jack" Brennan

He will begin Aug. 15, at about the same time Robert Cook, a former division director at the SEC, takes over as chief executive.

The Finra board of governors elected John J. “Jack” Brennan as its new chairman Friday.

Mr. Brennan, a former chief executive and now chairman emeritus and senior adviser at Vanguard Group, will become chairman on Aug. 15. At about the same time, Robert W. Cook, a former division director at the Securities and Exchange Commission, will take over as chief executive of the Financial Industry Regulatory Authority Inc.

The two moves complete the transition from Richard G. Ketchum, who is retiring this summer as chairman and chief executive of Finra, the industry-funded broker-dealer regulator.

At the Finra annual conference in May, Mr. Brennan addressed concerns that have been raised by investor advocates about whether a self-regulatory organization can effectively police brokers. He called industry oversight “fabulous.”

“The idea that self-regulation doesn’t work is specious in my view,” Mr. Brennan said in a question-and-answer session with Finra executive vice president Gregory Ahern. “I know we’ve made progress in terms of investor protection, market integrity because of the engagement of the industry.”

He also responded to criticism that has been leveled by brokers that they don’t have enough say in the organization’s decisions.

“Members have a loud voice,” he said.

Mr. Brennan has been serving as the lead governor of the Finra board since 2011. He became a member of the board of governors of the National Association of Securities Dealers in 2007 and stayed on the board as the NASD merged with the New York Stock Exchange Regulation in 2007 to form Finra.

The 22-member Finra board includes both industry and public, or non-industry, members with a public majority.

Learn more about reprints and licensing for this article.