Inflation-safe ETFs see record $17 billion exit

Exchange-traded funds designed to protect against inflation have faltered in the face of still sticky price pressure, leading many investors to rush for the exits.

Exchange-traded funds designed to protect against inflation are staring down a record exodus after faltering in the face of still sticky price pressure.

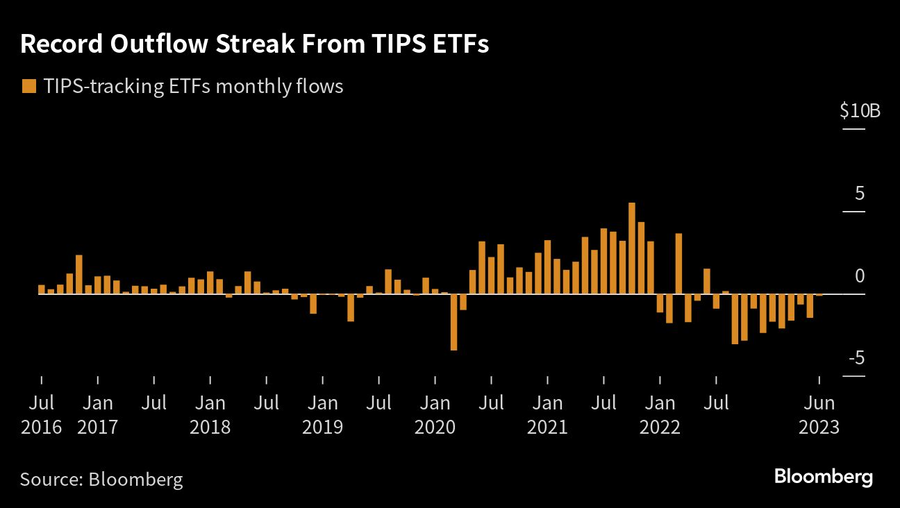

Nearly $17 billion has exited from Treasury-inflation securities ETFs over 10 consecutive months of outflows, an unprecedented streak in data going back to 2016, Bloomberg Intelligence data show.

The biggest such fund, the $21.6 billion iShares TIPS Bond ETF (TIP), is on track to bleed another $1.5 billion this year after investors pulled nearly $10 billion in 2022.

That rush to the exits follows a bruising stretch of underperformance for the asset designed to protect against inflation. While TIPS weather against price erosion, real yields — which strip out the impact of inflation — have soared over the past year, shredding returns even as price pressures remain stubbornly high. That’s soured the appetite of investors who piled into TIP and similar ETFs to curb inflation.

“You got killed and, in many cases, underperformed nominal Treasuries of similar maturities by owning TIPS,” Laird Landmann, TCW Group co-director of fixed income, said on Bloomberg Television’s Real Yield. “So it really has been a bad ride and it’s not surprising the retail side of the equation bailing out of the ETF at this point.”

The $11.5 billion Schwab U.S. TIPS ETF (SCHP) is leading outflows this year with a $2.6 billion loss, followed by the $14.4 billion Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)’s $2 billion loss. SCHP has fallen about 2.4% on a total return basis over the past year, compared to a 1.5% drop for the $29 billion iShares 7-10 Year Treasury Bond ETF (IEF), which holds similarly dated debt.

The distaste for TIPS-tracking ETFs contrasts with reignited demand for the securities in the primary market. Investors snatched up about 96% of the $19 billion in Treasury Inflation Protected Securities auctioned last week, leaving less than 4% to firms authorized as primary dealers.

JPMorgan Asset Management is among the firms eschewing TIPS at the moment. The duration risk in TIPS — a security’s sensitivity to interest-rate changes — dims their appeal with the Federal Reserve poised to keep rates on hold after the most aggressive hiking cycle in decades.

“TIPS do not really represent tremendous opportunity in our opinion because the duration — and they do tend to be longer-duration instruments — tends to dominate the risk there,” JPMorgan Asset Management Head of Market Strategy Oksana Aronov said on Bloomberg Television’s Real Yield. “To the extent that we believe the Fed is going to continue to either be on that pause or even hike further, these aren’t going to be immune to that interest-rate risk.”

Will AI remain one of the market’s ‘megatrends’?

Learn more about reprints and licensing for this article.