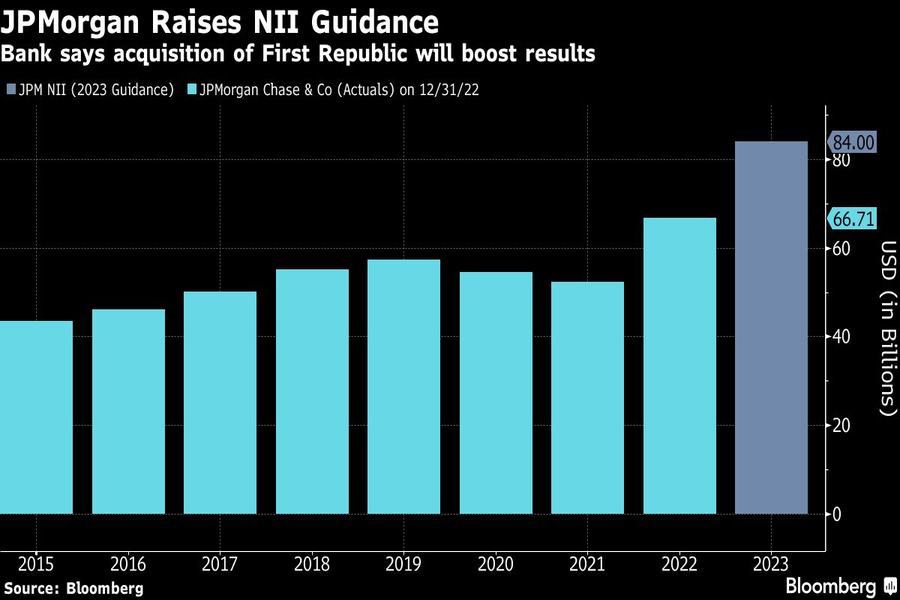

JPMorgan raises year net interest income view to $84 billion due to First Republic deal

JPMorgan President Daniel Pinto

JPMorgan President Daniel Pinto

The biggest US bank said the integration costs tied to the acquisition would total about $3.5 billion, about half of which will be borne this year.

JPMorgan Chase & Co. will gain an even bigger benefit from rising interest rates because of its purchase of First Republic Bank.

The biggest U.S. bank raised its guidance for net interest income this year to $84 billion, excluding its trading business, up from a previous forecast of $81 billion, according to an Investor Day presentation on its website Monday. At the same time, the bank issued a pessimistic forecast for trading and investment banking.

The lender said several “sources of uncertainty remain,” including the Federal Reserve’s plans and how consumers react to higher borrowing costs. President Daniel Pinto said that while the economy is doing “fine” right now, there are signs of deterioration emerging.

JPMorgan bought First Republic Bank earlier this month after it became the second-largest bank failure in U.S. history and the fourth regional-bank collapse this year. JPMorgan Chief Executive Officer Jamie Dimon, the only major bank CEO from the financial crisis still in command, said last week that “we need to finish the bank crisis” and regulators should “not be surprised constantly.”

The largest banks have been mostly immune to the problems plaguing their smaller rivals, with JPMorgan reporting a surprise jump in deposits in the first quarter as customers sought safety. Chief Information Officer Lori Beer said in a presentation Monday that the bank had increased its retail-deposit market share by about 60 basis points during the past year. It added roughly 600,000 net new checking accounts this year through April, the company said.

Shares of the biggest U.S. bank, which are up 3.1% this year, fell 0.7% to $138.19 at 1:09 p.m. EDT in New York.

TRADING FORECAST

JPMorgan said at the event that it expects second-quarter revenue from investment banking and trading to each slump 15% from a year ago.

The debt-ceiling impasse is a short-term theme weighing on the market, with most investors expecting a resolution, according to the bank’s global markets head, Troy Rohrbaugh. Once there’s a resolution to that issue, focus will turn to expectations for the Federal Reserve and inflation as well as prospects for a recession, he said.

The bank’s markets franchise is strong, with small “pockets of underperformace,” Rohrbaugh said.

Pinto said the industry’s trading revenue is likely to decline 4% this year.

The bank said in its presentation that the outlook for 2023 expenses remained unchanged at roughly $81 billion, excluding the costs tied to the First Republic acquisition. It said those would total about $3.5 billion. About half the integration costs will be borne this year, Jeremy Barnum, chief financial officer, said in a presentation.

“Credit remains benign, but we expect continued normalization throughout the year,” the New York-based bank said. The lender has set aside reserves based on expectations for peak unemployment of 5.8% in late 2024.

Learn more about reprints and licensing for this article.