Historic rout isn’t over yet, Bank of America strategists say

“Paralysis rather than panic best describes investor positioning,” BofA's Michael Hartnett says.

The global market selloff that saw the S&P 500 Index post its worst first four months of a year since 1939 has further to run, according to Bank of America Corp.

“Base case remains equity lows, yield highs yet to be reached,” BofA strategists led by Michael Hartnett wrote in a note.

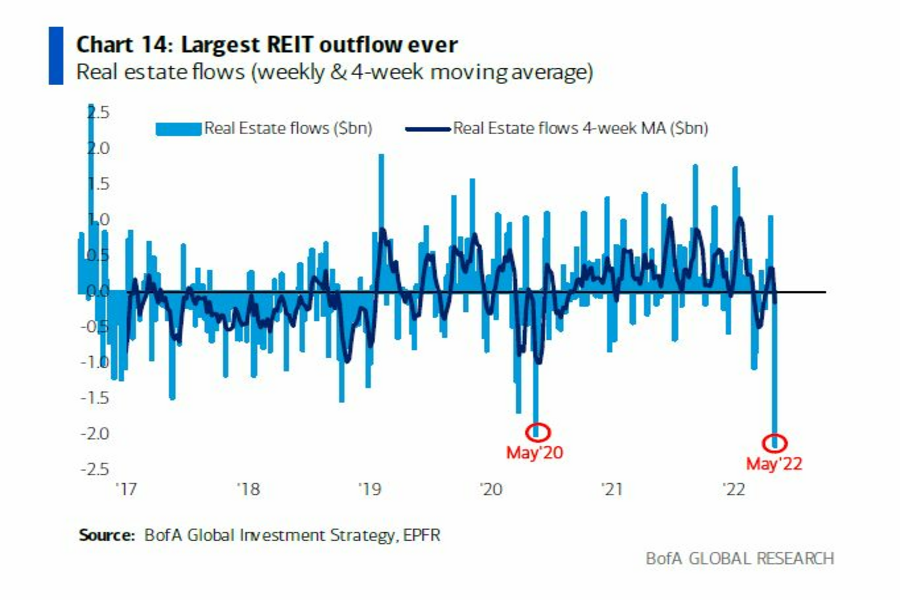

Every asset class saw outflows in the week prior to the Federal Reserve’s meeting, with real estate posting its biggest outflow on record — $2.2 billion — and investors piling into safe havens like U.S. Treasuries, BofA said, citing EPFR Global data through Wednesday.

The Nasdaq 100 Index tumbled 5.1% on Thursday, the most since September 2020, slumping along with most bond markets and unwinding the prior day’s post-Federal Reserve bounce. The wild two days for markets leaves the tech-heavy gauge down 21% for the year amid concerns about inflation, aggressive rate hikes and an economic slowdown.

European stocks and U.S. futures fell on Friday morning in London, signaling the selloff may continue.

“Paralysis rather than panic best describes investor positioning,” Hartnett wrote, saying the market is grappling with how to price in inflation and slowing growth.

“‘Recession shock’ was priced-in too quickly; this is a problem as stronger-than-expected economic data in the first half is causing the market to price-in longer/bigger inflation/rates shock,” he wrote.

Still, Hartnett noted that the average entry point for $1.1 trillion in inflows to the S&P 500 since January 2021 was 4,274 index points, meaning that investors are “under water but only somewhat” for now, with the gauge at around 4,147 points.

Learn more about reprints and licensing for this article.