More companies try to lure workers with benefits

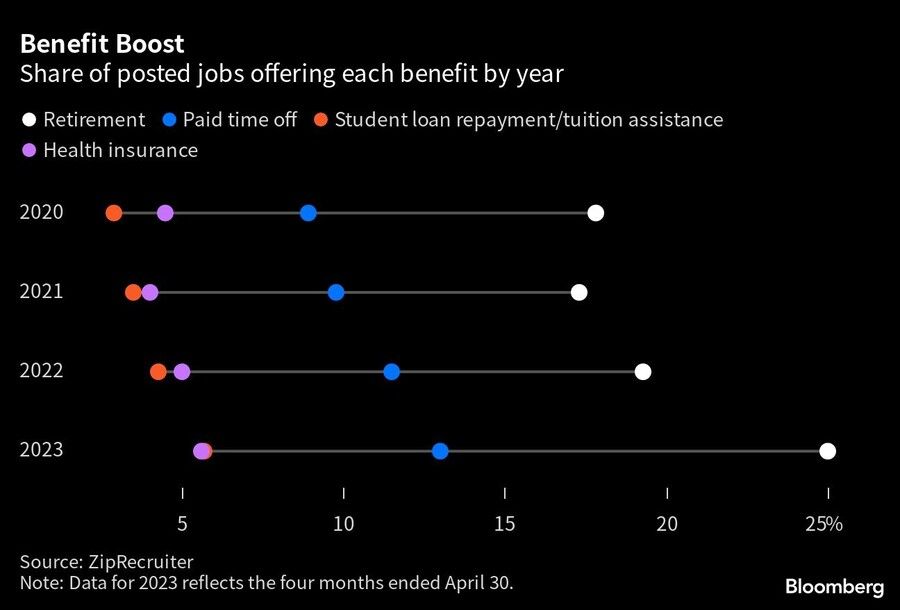

Mentions of employee benefits in job postings on a recruiting website have soared to the highest rates on record, with one in four jobs now offering retirement plans.

Over a year of rapid wage growth has U.S. companies turning to enhanced benefits to attract and retain workers.

Mentions of employee benefits in job postings on ZipRecruiter soared to the highest rates on record, according to an analysis by the jobs site. A greater share of positions offered benefits like health insurance, paid time off and paid parental leave than in prior years.

One in four jobs now offer retirement benefits, and a growing number are offering student loan repayment and tuition assistance.

“Customers tell ZipRecruiter that they are trying to end out-of-cycle wage increases and cap the size of regular increases to keep costs under control,” said Julia Pollak, chief economist at the jobs website. Against a backdrop of low unemployment and high employee turnover, “many are therefore expanding their benefits offerings.”

Despite some recent cooling in the labor market, many companies are still struggling to fill positions and limit attrition given the enduring mismatch between the supply and demand for workers.

While businesses have been raising wages quite aggressively to do that, it’s unclear how much pricing power firms will have in the months ahead if the economy continues to lose momentum.

Government data also point to a recent increase in benefit offerings. The employment cost index, a broad measure of labor costs, accelerated in the first three months of the year in part due to a pickup in benefits. Benefit costs at companies in the three months ended in March rose 1.1% from the prior quarter, an acceleration from the prior period.

GETTING CREATIVE

Wells Fargo & Co. economist Shannon Seery said she’s been hearing in client conversations that firms are “trying to get creative” to avoid hiking wages at the pace they have been.

Even with labor demand slowing, there’s still a shortage of workers, and “providing better benefits may be a solution firms explore,” she said.

Pollak specifically flagged the challenges of recruiting and retaining talent for in-person roles in hospitality, manufacturing, and tourism ahead of the summer season.

Cooling wage pressures would certainly be welcomed by Fed officials, particularly Chair Jerome Powell, who has voiced concerns about their inflationary impact. Benefits, however, still come at a cost for firms — even if it’s smaller than wages.

While the Fed is likely more focused on wages, especially in the near-term, “the benefits angle does have weight and is important — particularly if we see that get sticky even as wages starts to decline,” Seery said.

[More: Wide gaps exist between retirement plans, employee needs: Transamerica]

Why companies that maximize human capital see higher stock prices

Learn more about reprints and licensing for this article.