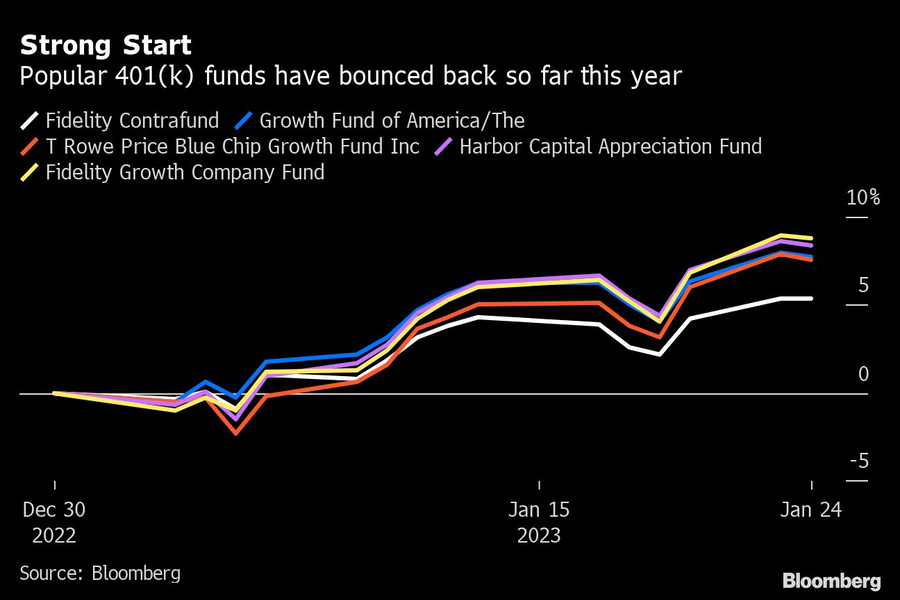

Popular 401(k) funds off to strong start in 2023

After tanking in 2022, some of the biggest actively managed funds in 401(k)s are outperforming thanks to a comeback in tech stocks.

Checking your 401(k) account balance is a little less painful these days.

Popular active equity funds in 401(k)s tanked last year because of their heavy focus on the big technology companies that got battered by surging inflation and steep interest rate hikes. Those same stocks have given them a boost so far in 2023.

Fidelity Contrafund (FCNTX), Growth Fund of America (AGTHX), T. Rowe Price Blue Chip Growth (TRBCX), Harbor Capital Appreciation (HNACX) and Fidelity Growth Company (FDGRX) are up anywhere from 5.4% to 8.8% through Tuesday’s close. By comparison, the S&P 500 is up 4.6%.

Of course, that strong start doesn’t come close to making investors whole. Those five funds were all down at least 33% in 2022, and overcoming that loss would take stupendous results. Someone with $1,000 in a fund that lost 30% would need a gain of about 43% on the remaining money to get back to that initial $1,000.

A look at what’s fueling the gains is reminiscent of bubblier times. At Fidelity Contrafund, three of its top 10 holdings as of Dec. 31 are tech companies that are up double-digits this year, with Meta Platforms Inc. (5.5% of assets) gaining 19%, Amazon.com Inc. (5% of assets) up 15% and Alphabet Inc. (about 4.2% of assets) up about 11%.

Investor hopes that declining inflation will cause the Federal Reserve to pause or even reverse rate hikes are helping boost the same growth stocks that led last year’s decline. The rally wavered on Wednesday after Microsoft Corp. (MSFT) warned of a slowdown in sales, but the Nasdaq managed to erase most of the day’s losses by 2:30 p.m.

At T. Rowe Price Blue Chip Growth Fund, concentrated positions in some big tech stocks are juicing returns, with Amazon and Alphabet at 6.8% of assets each as of Dec. 31. Nvidia Corp., the fund’s eighth-largest holding at 2.8% of assets, is up 32%. Rounding out the fund’s top 10 is software company ServiceNow Inc., with a gain of 14% for the year.

‘IN the Office’ with Steve Scanlon, head of individual retirement at Equitable

Learn more about reprints and licensing for this article.