Robo-advisers not the end-all in financial technology

Other digital platforms that advisers should also have on their radar screens handle functions other than investing.

As robo-advisers have taken the financial advice business by storm, other digital platforms not focused solely on investing are poised to disrupt the industry.

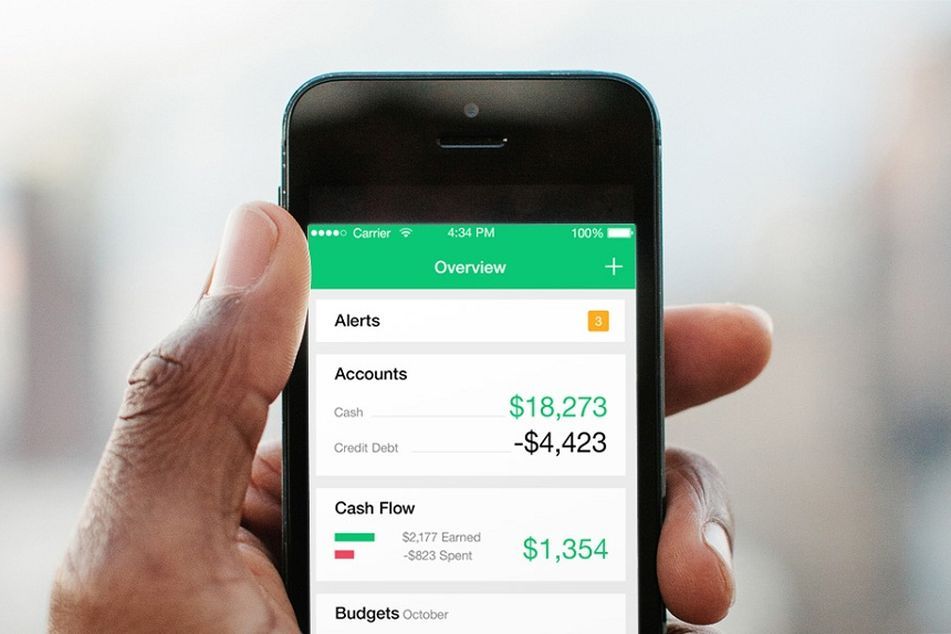

Many financial industry watchers say companies that offer apps that keep track of consumers’ personal finances such as Mint.com, HelloWallet, FlexScore and You Need A Budget (YNAB), are having as much impact as robo-advisers. And the best personal financial management websites and apps are ready to push past the traditional retirement-focused track to potentially achieve mass-market reach, according to Hearts and Wallets’ Inside Advice 2015: Early Career Millennials report.

The study broke down 40 financial advice platforms into two categories: incumbents and new entrants. Researchers designated four buckets that the technologies could fall into — planning, which creates a vision for client’s money; support action, which ensures that the client is following the plan; aggregating and monitoring, which pulls in information from various client accounts; and investing, in which robo-advisers specialize.

“There has always been planning and investing, so innovation is occurring across all four, but to address the new needs — support action, as well as aggregation and monitoring — each of these new entrants is doing something a little differently,” said Laura Varas, principal at Hearts and Wallets. “They are not appealing to the same people.”

TAKING NOTICE

Traditional financial services firms are starting to take notice.

Data aggregation has been gaining momentum, between Envestnet acquiring Yodlee and Quovo making waves with big-name investors. That movement is indicative of a stronger focus on using data from various sources to create a comprehensive financial plan for each client.

Ms. Varas said that many of the new entrants has more thoughtful approaches than retirement-centric platforms.

Researchers scored each of the online platforms across 120 factors. They noted whether or not each service tries to help clients with emergency funds, creates financial plans or budgets or identifies if a client has or needs life insurance.

Ms. Varas said her firm gauged whether each digital platform centered on one, two or all three of the “promises” for an investor: financial wellness, smart investing (algorithm-driven platforms) and retirement advice.

Hearts and Wallets found that 70% of the platforms it researched, across both incumbents and startups, were geared toward retirement advice, 10% on smart investing and 20% on financial wellness. However, only 11% of new entrants were focused on retirement planning, 56% on smart investing and 33% on financial wellness.

ATTRACTIVE TO MILLENNIALS

This shift toward financial wellness and smart investing tends to be more inviting to millennials, the study said. Millennials don’t feel like they are a priority for advisers, but using digital platforms helps them get the financial answers they’re looking for.

“You are going to have clients who are older and less tech-savvy, and therefore they don’t have as much desire to go online,” said Andy Wang, co-owner of Runnymede Capital Management in Morristown, N.J. “But the big difference is younger clients … are going to be demanding the ability to see more information in real-time.”

Many investment and wealth management companies have picked up on this.

Last summer, Morningstar acquired HelloWallet, another account aggregation firm with a mission to contribute to the financial wellness of people saving for retirement. It is geared toward consumers.

Wealth Access, on the other hand, is a personal financial management platform that uses similar techniques to promote financial wellness, but it is targeted to advisers.

REAL-TIME DATA

David Benskin, chief executive of Wealth Access, said the company is often compared to Mint.com, and that consumers often expect to view real-time financial data immediately. Advisors can use digital platforms to review such client information and make timely personalized recommendations.

“People have an expectation they can access their entire balance sheet from any time and device, and it has to be very easy to use and understand,” Mr. Benskin said.

The software from Wealth Access is also more focused on how well users are doing financially based on all their accounts, as well as their spending and savings habits.

“It tends to be more lifestyle- or goals-based today,” he added. “I think a decade or so ago it was, did you beat the S&P 500?”

DeDe Jones, managing director of Innovative Financial, said that her firm has been using Mint.com as part of the planning process for three years because it enables advisers to take just about everything into consideration.

“It expands awareness for the client of what is going on,” she said.

Ms. Jones said that it is integral to her practice, and she expects to adopt many other digital platforms and seek out other types of client financial information, but she knows that taking such a comprehensive approach can add more work for the adviser.

“When we shift our practice from investments to more detailed and inclusive planning, it becomes more labor-intensive, so people need to be prepared for that” she said. “But at the same time, it’s more rewarding.”

Learn more about reprints and licensing for this article.