What keeps these top securities regulators awake at night?

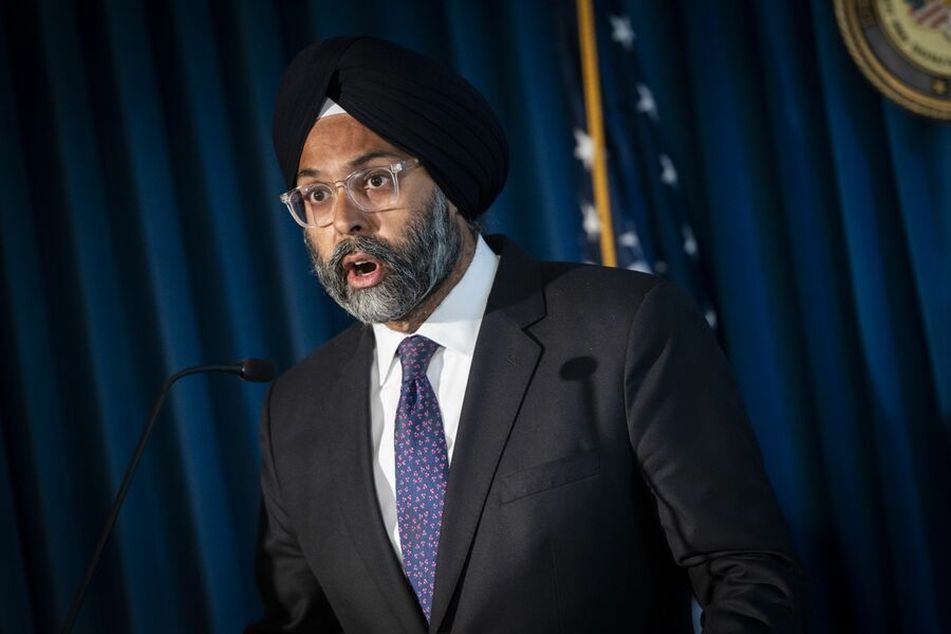

Gurbir Grewal, director of enforcement for the Securities and Exchange Commission

Gurbir Grewal, director of enforcement for the Securities and Exchange Commission

"I call it B-D/IA arbitrage," Finra's Christopher Kelly said, describing his concern about advisors flouting the boundaries between charging clients fees and commissions.

Freddy Krueger is plenty scary, but not as menacing as bad brokers and cryptocurrencies are to these securities regulators.

Financial advisors flouting the boundaries between charging clients fees and commissions, unregistered dealers of cryptocurrencies and the vast $21 trillion market of private investment funds are the stuff of long, sleepless nights for two of the securities industry’s top regulators: Christopher Kelly, senior vice president and acting head of enforcement at Finra, and Gurbir Grewal, director of the enforcement division at the Securities and Exchange Commission.

Both spoke on a panel about enforcement developments and trends Wednesday at the Financial Industry Regulatory Authority Inc.’s annual conference in Washington.

When asked an audience member at the end of the session about one or two pressing issues in the broker-dealer space that kept them up at night, Kelly responded: “One pattern that we’ve seen is a small number of brokers take advantage of the different fee structures between the broker-dealer account and the [investment advisor] account by moving securities back and forth.”

Brokers are registered with Finra and charge commissions; advisors are registered with the SEC and charge fees. It has become increasingly common over the past decade for financial advisors to wear both hats.

“I call it B-D/IA arbitrage,” Kelly said. “As you know, every year, there’s been more dually registered advisors. Last year was the first time Finra had more representatives registered as both brokers and investment advisors than just solely as brokers. There are also more firms that have affiliated investment advisors.

“And one pattern that we’ve seen is a small number of brokers take advantage of the different fee structures between the broker-dealer account and the [investment advisor] account by moving securities back and forth,” he said.

Kelly cited one Finra enforcement case where the broker was selling clients variable annuities in their brokerage accounts, charging a commission and then, within hours, moving those securities to an investment advisory account and charging a fee, a clear instance of double-dipping.

“So, he got the upfront sales charge of the broker-dealer product and continuing IA fees as it sat in the investment advisor account,” he said. “What was particularly egregious about this case was that the issuer of this variable annuity offered an investment advisor share class. Essentially, these customers were paying thousands of dollars in upfront sales charges for nothing.

“I don’t think this is something every broker is engaged in, but it is an issue you should keep on your radar,” Kelly added.

Meanwhile, the SEC’s Grewal acknowledged to an audience full of broker-dealer executives and compliance officers that cryptocurrency investments sold by non-Finra licensed firms was top of mind.

“It’s unregistered intermediaries, when you have all these functions commingled under one roof,” from acting like a broker-dealer, an exchange and a clearing firm all at once, that causes concern, he said.

Those crypto deals “don’t abide by the rule books, and they’re not subject to the examination requirements you all have to follow,” he said.

Grewal added that the tide was going out on the $21 trillion private fund industry, revealing its underlying problems. Private funds are investments that aren’t registered as an investment company under the Investment Company Act.

Private funds are opaque, Grewal said, and he cited issues around their expenses, conflicts of interest and the potential for mismarking valuations.

Don’t forget these vital things if you are buying or selling an advisory business

Learn more about reprints and licensing for this article.