Yale, MIT and NYU targeted in excessive-fee lawsuits concerning retirement plans

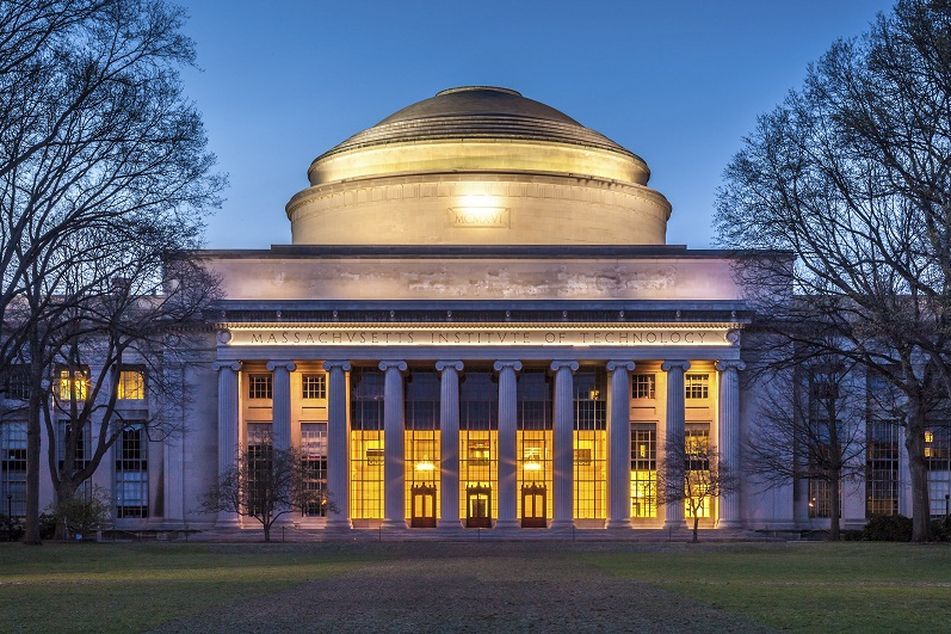

Massachusetts Institute of Technology

Massachusetts Institute of Technology

The suits against NYU and Yale are especially significant because they're the first regarding university 403(b) plans.

A trio of renowned universities — Yale University, New York University and the Massachusetts Institute of Technology — were sued on Tuesday over allegations that their defined-contribution plans charged employees excessive plan fees, leading them to overpay by millions of dollars in retirement savings.

The lawsuits continue what’s become an accelerating trend over the past decade in the retirement industry — that of plan participants bringing claims against employers for alleged fiduciary breach under the Employee Retirement Income Security Act of 1974, due to offering high-cost investments and record-keeping and administration services.

However, because the NYU and Yale plans are 403(b) plans — 401(k)-type plans for public educational institutions, non-profit employers and church organizations — the lawsuits represent ground-breaking territory for this sort of litigation.

“These cases are the first cases involving university 403(b) plans,” according to Jerry Schlichter, managing partner at St. Louis-based law firm Schlichter, Bogard & Denton, which is representing plaintiffs in the three cases.

Mr. Schlichter’s case against Novant Health, a nonprofit hospital system, was the only other suit he’s brought against a 403(b) plan. The case settled last year for $32 million.

The $900 billion 403(b) market has been much slower to adopt basic concepts of fiduciary prudence that are broadly accepted in the 401(k) market, according to one prominent ERISA attorney, who requested anonymity because of business with the universities named in the suits.

“It doesn’t surprise me at all that the tort bar is discovering 403(b) plans,” the attorney said. “The only thing that surprised me is that it’s taken so long.”

The MIT suit, filed in a Massachusetts district court, concerns the university’s 401(k) plan. All three universities have plans with several billion dollars’ worth of retirement assets.

Plaintiffs in the lawsuits, who are plan participants in the plans and seek class-action status, share common allegations, including the claim that fiduciaries acted imprudently by selecting high-cost funds for the plans when lower-cost alternatives in different share classes were available.

Further, because the plans offered a wide array of investment options, there were “duplicative” strategies that diluted fiduciaries’ bargaining power to obtain lower fees and caused “decision paralysis” among participants, according to the Yale suit, filed in a Connecticut district court.

The MIT Supplemental 401(k) Plan, for example, offered more than 300 funds, while the Yale University Retirement Account Plan included more than 100, and NYU’s two 403(b) plans each had at least 70.

In July 2015, MIT eliminated hundreds of funds; the complaint alleges participants would have saved more than $8 million in fees in 2014 alone, and “many more millions since 2010,” had the lineup been revised earlier.

MIT spokeswoman Kimberly Allen said that, as a general practice, the university doesn’t comment on pending litigation.

NYU and Yale also used multiple firms to provide record-keeping services to the universities, causing participants to pay duplicative and excessive fees, according to plaintiffs.

Before Yale consolidated services with one plan provider in April 2015, Yale used both TIAA and Vanguard Group for record-keeping and administration services. The plan paid between $3.8 million and $4.3 million (approximately $200-$300 per participant per year) from 2010-14, while $35 per participant would have been more reasonable for a plan of its size, plaintiffs claim.

“NYU takes seriously the welfare of our faculty and employees — very much including a dignified retirement — and the retirement plans offered to them are chosen and administered carefully and prudently,” NYU spokesman John Beckman said. “We will litigate this case vigorously and expect to prevail.”

Further, Mr. Beckman said the named plaintiffs in this case “notably include several faculty members who recently lost unrelated court cases they brought against NYU.”

Yale spokeswoman Karen Peart said the university has not officially been served with the complaint. “We are cautious and careful in administering our plans and we will defend ourselves vigorously,” she said.

Plaintiffs in the MIT suit also claim that Fidelity Investments had and continues to have a “comprehensive role” in the plan and “extensive relationship with MIT,” which caused MIT to retain Fidelity as a record keeper for nearly 20 years and use nearly 200 Fidelity funds in the plan, to the detriment of participants.

For example, plaintiffs cite Fidelity’s donation of hundreds of thousands of dollars to MIT in past years, and Fidelity chief executive Abigail Johnson serving as a member of the MIT Board of Trustees since 2007.

Fidelity is not a named defendant in the lawsuit.

“The university as fiduciary must operate for the exclusive benefit for its employees and retirees in running the plan, and we allege they can’t take into account donations or anything else that benefits them,” said Mr. Schlichter.

Fidelity spokesman Steve Austin said it’s too early to provide comment on the suit because the firm is continuing to evaluate it.

The names of the three suits are: Tracey et al v. Massachusetts Institute of Technology et al; Vellali et al v. Yale University et al; and Sacerdote et al v. New York University.

Learn more about reprints and licensing for this article.