‘It’s about being efficient, not keeping up with the gay Joneses’

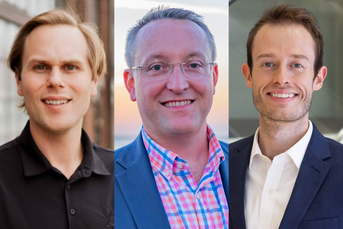

David Rae, of DRM Wealth Management.

David Rae, of DRM Wealth Management.

Advisor, who has developed a successful niche working with LGBTQ-plus clients, addresses stereotypes, homophobia, and the impact of the AIDS crisis.

Pride season may be around the corner but having a conversation with your LGBTQ-plus clients is something that should take place all-year round.

That’s the message David Rae wants advisors to take away. Rae, who’s the founder and president of DRM Wealth Management, an RIA based in West Hollywood, California. Rae explains he developed a niche working with LGBTQ clients after the firm he started at sponsored several pride events around the Los Angeles area.

“As a gay person myself, it was a natural fit to go out and try and get people at this great marketing opportunity that my firm was offering at the time,” he says. “When you’re 20-something, and you’re starting from scratch, you did as many intros as possible. We had a booth at Pride, and it was just a great way to get people to talk to.”

That ended up leading to a lot of great referrals for him, which helped him realize those in the community are people he really enjoyed working with and wanted to take on as clients. Though he notes, only 40 percent of his client base consider themselves part of the LGBTQ community.

Reflecting on his career in the industry, 20 years ago there was a lack of financial planning and advice for people in the LGBT community, Rae explains, because “there were so many different challenges financially for people in the community that just weren’t being addressed.”

By putting himself “out there” as a gay financial planner, he’s attracted quite a few people who are straight, but also those who are immigrants or people of color, “or even just women that just didn’t feel comfortable talking to maybe more conservative male advisors,” he says.

“I’ve taken on quite a few clients who maybe have a gay sibling, parent or child. So, me being LGBT and supporting some other ancillary needs are more specific rather than them being gay themselves.”

Rae admits that while things have gotten significantly better for the LGBTQ community over the years, it’s still not perfect. There’s still quite a bit of homophobia and taxation on the community.

“Even if we look at the numbers on gay marriage, there’s still tens of millions of Americans who are against gay marriage. It’s still lots of people, but it’s way less people than it was 10 or 15 years ago,” he said.

There are also some stereotypes that exist within the community, Rae says, like, “We have all this money, and we can spend all this money on vacations and things like that, but a lot of it boils down to probably not having kids,” he says. “If you’re not paying for daycare, or taking two extra bodies on your vacation, your budget can go a lot further.

“I do think some of the rules of thumb of financial planning, on budgeting and saving, and different things like that don’t come into play as often, especially for couples or gay people who don’t have children.”

In addition to that, Rae points out that the LGBTQ-plus community, up until recently, didn’t have gay marriages or weren’t having kids so they were missing some of the big things that make people reach out for financial planning.

“Without those triggers, many people in the gay community put off planning for the future,” he said. “In terms of the the AIDS crisis, there’s definitely a generation that thought they probably would never make it to retirement. I’ve talked to so many people who are like, ‘I traded in my retirement account in the 80s or 90s because I didn’t think I’d be alive.’ And here they are. So they’re playing catch up from that or they just didn’t save.”

Rae added that another challenge among LGBTQ clients is they can tend to have a higher cost of living because of where they’re choosing to live out their lifestyles, which means, spending can be an issue.

“We just need to make sure we find ways to be very efficient, and not keep up with the gay Joneses, if possible, so that we can reach our goals.”

Name: David Rae

Position: Founder and president

Company: DRM Wealth Management

Founded: 2017

AUM: $115 million

Learn more about reprints and licensing for this article.