Recruiting slowed in the first half while M&A soared

Volatile markets may be holding recruiting activity back from its breakneck pre-pandemic pace but mergers and acquisitions have more than rebounded from the 2020 low.

Adviser recruiting activity appears to be slowing down as firms increasingly grow their head count and assets through deal-making, according to an analysis of the most recent industry data.

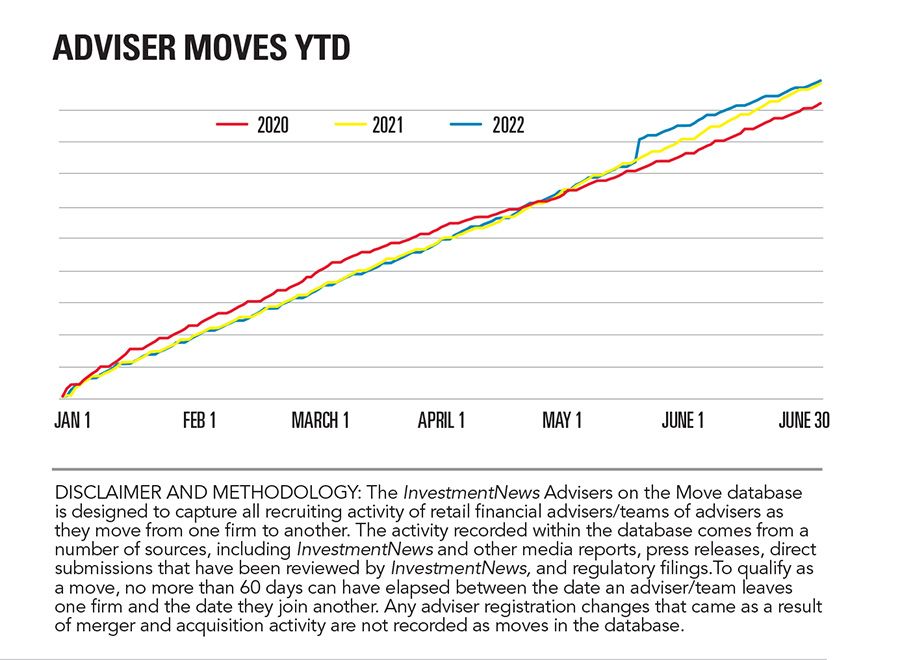

Total moves of advisers between firms were up only 1% during the first half of the year compared to the same period a year earlier, according to the InvestmentNews Advisers on the Move Database. The data include advisers who transition between firms, excluding those that result from a merger or acquisition.

Q2 Top Net Gains

| Q2 Top Net Gains | Advisers Gained | YTD |

|---|---|---|

| LPL Financial LLC | 728 | 895 |

| Fidelity Brokerage Services LLC | 113 | 257 |

| Ameriprise Financial Services, LLC | 77 | 102 |

| Cetera Advisor Networks LLC | 73 | 67 |

| GWFS Equities, Inc. | 64 | 100 |

| Morgan Stanley | 50 | 89 |

| Raymond James Financial Services, Inc. | 41 | 89 |

| Raymond James & Associates, Inc. | 37 | 63 |

| Citigroup Global Markets Inc. | 25 | 70 |

| Commonwealth Financial Network | 21 | 39 |

Still, the lift over the first two quarters came in large part from a June deal that brought CUNA Brokerage Services’ brokerage and advisory assets to LPL Financial, resulting in more than 500 advisers moving their registrations to the independent broker-dealer. LPL did not outright buy the brokerage, which had $36 billion under management.

Q2 Top Net Losses

| Q2 Channel Net Changes | Adviser Moves | YTD |

|---|---|---|

| Independent Broker-Dealer | 840 | 1,092 |

| RIA | 270 | 614 |

| Discounter | 114 | 300 |

| Institutional | 18 | -3 |

| Regional Broker-Dealer | -29 | 50 |

| Insurance Broker-Dealer | -156 | -422 |

| Wirehouse | -418 | -965 |

| Bank | -639 | -666 |

Even including those transitions, first-half moves of experienced advisers were down 7% from the first half of 2019.

Volatile markets, which can be a difficult time to transition assets, may be holding recruiting activity back from its breakneck pre-pandemic pace. But mergers and acquisitions have more than rebounded from the 2020 low.

M&A in wealth management grew by 39% year over year in the first half, according to the latest quarterly report from Echelon Partners. The bank and wealth management consultancy projects 2022 to be another record-breaking year following the highest volume in any second quarter since it began tracking data.

In other words, if this year has been slow for individual advisers and teams on the move, entire firms are changing hands more than ever.

In the second quarter, 840 advisers on net moved to independent broker-dealers, 270 to registered investment advisers, 114 to discount brokerages and 18 to the institutional channel. Meanwhile, a net 639 advisers moved from banks, 418 from wirehouses, 156 from insurance broker-dealers and 29 from regional broker-dealers.

Q2 Channel Net Changes

| Q2 Top Net Losses | Advisers Lost | YTD |

|---|---|---|

| CUNA Brokerage Services, Inc. | 583 | 596 |

| Merrill Lynch, Pierce, Fenner & Smith Incorporated | 275 | 584 |

| Wells Fargo Clearing Services, LLC | 139 | 380 |

| Edward Jones | 96 | 188 |

| First Financial Equity Corporation | 78 | 100 |

| UBS Financial Services Inc. | 54 | 90 |

| Equitable Advisors, LLC | 47 | 93 |

| Securities America, Inc. | 44 | 73 |

| NYLIFE Securities LLC | 31 | 78 |

| Northwestern Mutual Investment Services, LLC | 29 | 66 |

Learn more about reprints and licensing for this article.