Work-life balance is harder for women in the pandemic

According to a new InvestmentNews Research survey, women were twice as likely to be working longer hours than a year ago

Eight months into the pandemic’s disruption of work and family life, research shows women advisers are more likely to be working extended hours from home.

According to a new InvestmentNews Research survey, 38% of all advisers are working longer hours than they were a year ago, and about a third are spending more time on household work and childcare. On average, those who say they are putting in more time are spending 12 additional hours per week on the job and nine more on household responsibilities.

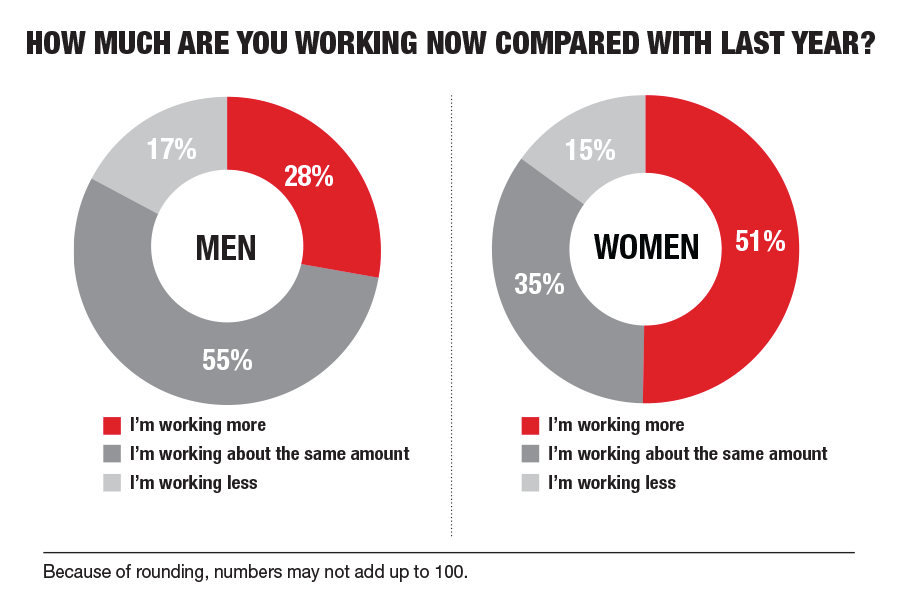

The survey of advisers and related professionals found women were almost twice as likely to be stepping up their work hours. Fifty-one percent of women reported working longer hours, compared with 28% of men. That may be because women were more likely to be entirely remote, with 48% of women and 30% of men working from home all the time.

It’s the new normal, but an old story.

Research has repeatedly shown that women in partnerships tend to take on more household and childcare responsibilities than men. The combination of remote work and remote learning is adding to the burden like never before.

Women, working mothers in particular, are burning out from the double whammy of longer work hours and added caregiving responsibilities, according to the 2020 Women in the Workplace study by LeanIn.org and McKinsey & Co. The study found that, as a result, one in four women were considering cutting back on work or leaving the workforce entirely.

“Working from home has blurred the line between work and home, and many employees now feel ‘always on’ — available to their employer 24/7,” LeanIn founder Sheryl Sandberg wrote, adding that failure of companies to address employee burnout could be “setting gender diversity back years.”

The InvestmentNews Research survey echoes those findings. Only 19% of women said they were very satisfied with their current work-life balance, compared with 35% of men. Asked how confident they would be about maintaining their mental health through another year of the current environment, 38% of women said they were very confident, compared with 55% of men.

While advisers generally found their firms supportive, others pointed to ways employers could help reduce the pressure of life in 2020.

“The firm is in focused growth mode,” one wrote. “They are trying to support the staff and grow aggressively at the same time. Easing off the growth goals would help.”

Long-term flexibility may also help struggling employees. Among advisers working entirely from home, 40% said their firms could support them better by making remote work a permanent option. That was the most common suggestion survey respondents had for their firms.

Firms should also combat the perception remote employees are less committed or productive. But as one survey respondent noted, working from home isn’t always a choice — especially now.

“I believe it’s the only choice I can make to keep my child safe,” the respondent wrote. “I certainly feel pressure to have a plan to return to the office soon.”

For more information on IN’s research offerings, contact: [email protected].

Learn more about reprints and licensing for this article.