Blue wave unleashes demand for clean-energy ETFs

More than $1 billion poured into a pair of clean-energy exchange traded funds last week as the as the Democratic wins in the Georgia runoff increased the odds that President-elect Joe Biden’s energy policies will come to fruition.

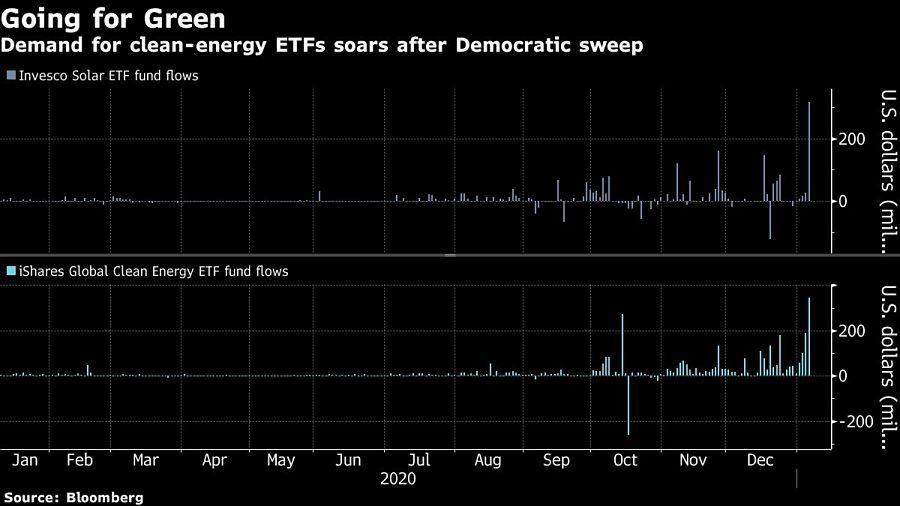

The Democratic sweep of both houses of Congress stoked a record flood of cash into renewable-energy exchange-traded funds last week.

The $6.2 billion iShares Global Clean Energy ETF (ICLN) lured a record $691 million of inflows last week, according to data compiled by Bloomberg. Meanwhile, the $4.6 billion Invesco Solar ETF (TAN) was on track to take in nearly $370 million — another all-time haul.

The flood follows a strong Democratic showing in the runoff elections in Georgia, which tipped control of the Senate to President-elect Joe Biden’s party. With Democrats at the helm of both the White House and Congress, that increases the odds that Biden’s energy policies will come to fruition — boosting the appeal of “clean” funds, according to Independent Advisor Alliance’s Chris Zaccarelli.

[More: Visit InvestmentNews’ ESG Clarity for more socially responsible investing news]

“Clearly the Democrats recapturing the Senate in conjunction with their control of the House and White House brings a lot more investment outcomes to the fore,” said Zaccarelli, the firm’s chief investment officer. “Clean energy is more likely to see positive tail winds or at least no headwinds under full Democratic control of government than under any other configuration.”

TAN and ICLN hit all-time highs last week amid record trading volumes for both funds. Call option volume also spiked to record highs amid the bullish fervor.

There are risks that those bets may be too optimistic, given how slim the Democratic hold on the Senate is, said Todd Rosenbluth, director of ETF research for CFRA Research. Additionally, it’s not clear how aggressively the Biden administration will pursue those policies as the U.S. struggles to contain the spread of the coronavirus and its economic impact.

“Right now, we’re looking at the legislative agenda as more focused on the near term in terms of stimulus before you get to any further plans for infrastructure or anything like that,” said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. “It’s not quite clear the extent to which and how aggressively that agenda will be pursued.”

Still, the appetite for clean-energy funds in the wake of the November election has been robust, with TAN and ICLN soaring 77% and 68%, respectively. That demand threatens to take the shine off of environmental, social and governance conscious ETFs after a banner year, according to Bloomberg Intelligence.

“Clean-energy exchange-traded funds could bypass the broader ESG category in natural assets in the next few months if current trends hold,” BI analysts Eric Balchunas and Athanasios Psarofagis wrote in a note. “Flows into clean-energy ETFs have breadth and depth that typically portend a grassroots frenzy of buying as investors seek to grab exposure as fast as they can.”

[LISTEN: The InvestmentNews Podcast: Bob Doll’s 2021 Prediction Special]

Learn more about reprints and licensing for this article.