ETF that paid people to invest has started to charge

The exchange-traded fund industry's fee war may be running out of steam

The wave of cost-cutting that has been sweeping the more than $6 trillion global market for exchange-traded funds for the past two years may finally have reached its limit.

In the space of a few weeks, the first and only fund that paid people to invest has switched to a new owner and started to charge, while one of the few “zero-fee” ETFs has been shut down completely.

The two products were unrelated, but the twin events look like confirmation of what many in the industry have long believed: The fee war could only go so far. Now they’re preparing for what they hope will be a new era that places more value on strategy and returns than on price point.

“ETFs have come to a new stage of development where the fee war is only part of the story,” said Linda Zhang, chief executive officer of Purview Investments in New York. “The next phase of the story is who is able to provide better performing products, net of fee.”

If that happens it’ll be a sea change for the passive industry.

Faced with an increasingly competitive landscape — at last count there were roughly 2,200 ETFs in the U.S. alone — issuers have been slashing expense ratios amid the desperate fight to lure assets.

While it left plenty of experts wondering how they were making money and fretting potential hidden costs, for investors it should have been a dream come true.

Alongside cuts to trading commissions it meant even the smallest among them could buy an ETF through their favorite broker for peanuts then pay nothing for its annual management fee. Yet it seems not many took advantage.

Salt Financial made headlines last year by releasing the Salt Low TruBeta U.S. Market ETF (LSLT) which would temporarily pay investors, with holders receiving 50 cents for every $1,000 — until it grew to $100 million or April 2020 when a $2.90 management fee could kick in.

The ETF never managed to raise more than about $12 million, and the issuer announced last month that the fund — along with another Salt product, the Salt High TruBeta U.S. Market ETF (SLT) — would be acquired by Pacer Advisors. It started charging the $2.90 fee in May, and is currently down about 10% this year.

“Even though it worked in the sense that it raised assets, it didn’t raise them enough for us to feel that being in the retail business made sense,” said Alfred Eskandar, co-founder and president of Salt Financial, which still supplies the indexes for LSLT and SLT. “People are starting to see through that, they’re realizing it’s about quality, it’s about the uniqueness of the strategy, it’s about performance.”

The market turmoil caused by the coronavirus may have accelerated that trend, as traders navigate the extreme volatility and seek out investments that can thrive in what could be a new economic era.

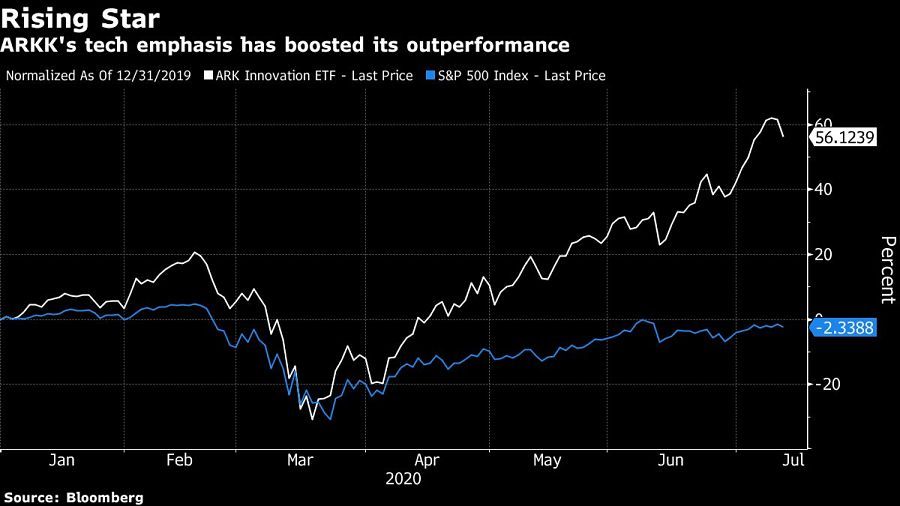

Michael Venuto, chief investment officer of Toroso Investments, points to the outperformance of some thematic funds and actively managed offerings, like the Ark Innovation ETF (ARKK), as the latest craze occupying investor attention.

“The fee war for beta is pretty much over,” he said. “We’ve seen a lot of people that are done with the fee war and are now interested in, ‘What can I buy that will do better than the market?’”

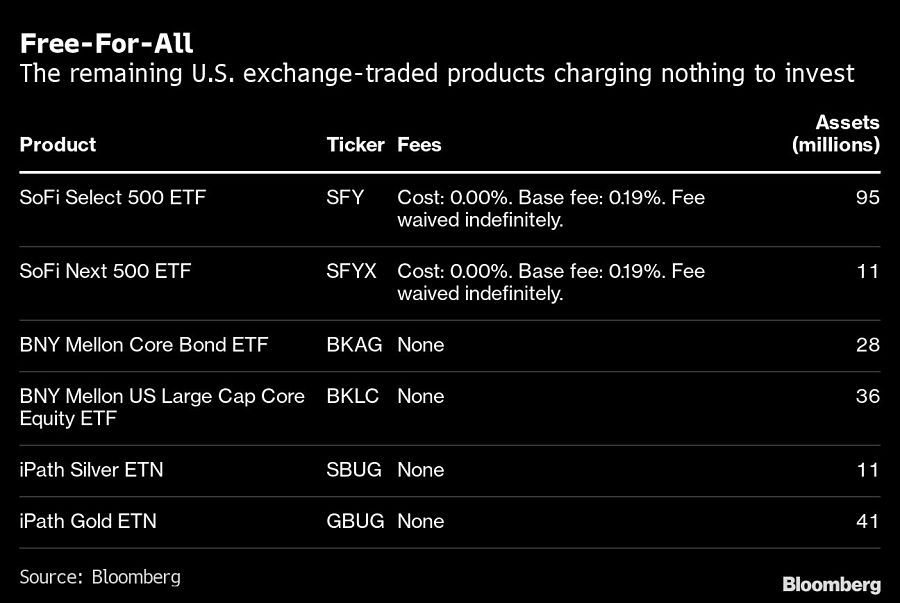

That’s not to say Venuto thinks zero-fee is dead. Last year, he helped Social Finance Inc., an online lender known as SoFi, unveil two funds without fees, the SoFi Select 500 ETF (SFY) and the SoFi Next 500 ETF (SFYX).

SFY currently has $95 million in assets and SFYX has $11 million. Venuto says the tactic was more for the benefit of SoFi’s existing investors than to attract new ones, and will continue indefinitely for the two products.

In Australia, there’s a different picture: The Pinnacle aShares Dynamic Cash Fund Managed Fund (Z3RO) was a money-market-like fund aiming to pay above the official interest rate without management fees. The fund was suspended last month with A$4 million ($2.7 million) in assets, less than a year after its launch.

In a statement to the Australian stock exchange, Pinnacle Fund Services Ltd. said it considers it unlikely the fund “will reach sufficient scale to be economically viable.”

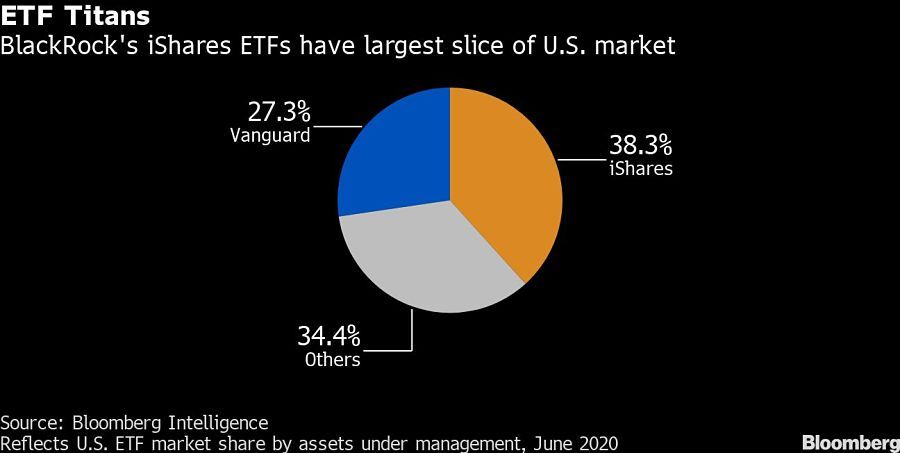

If zero-fee funds did disappear, it wouldn’t necessarily signal a rich new era of profits for ETF issuers. Industry competition remains fierce, especially between giant asset managers like BlackRock Inc. and Vanguard Group, the two largest players.

Just last month, BlackRock lowered the cost on its biggest ETF, the iShares Core S&P 500 ETF (IVV), to match a Vanguard Group rival.

For Ben Johnson, co-head of passive strategy at Morningstar Inc., it’s like rival gas stations on the same strip, each trying to undercut the other on an identical product.

“At some point, you can’t go any lower,” Johnson said. “When you draw near to that zero bound, the incremental gain to the end investors doesn’t mean a whole heck of a lot.”

Learn more about reprints and licensing for this article.