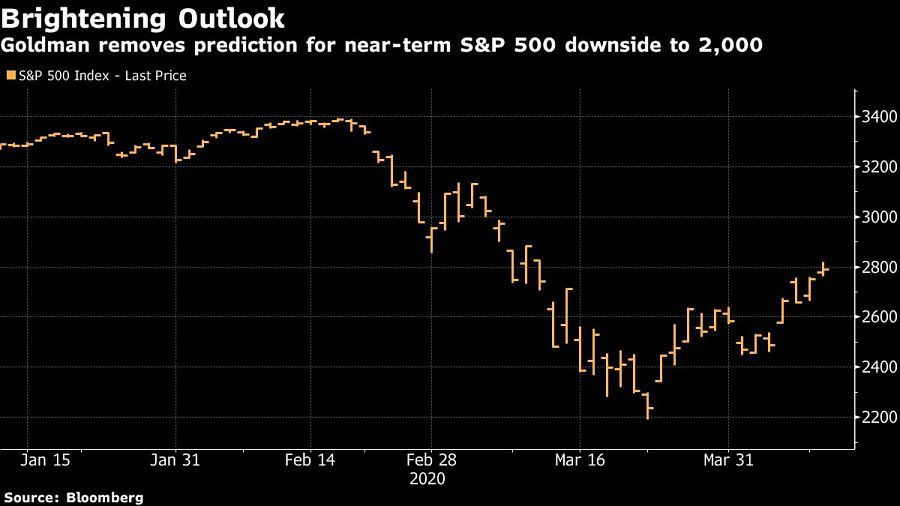

Goldman says U.S. stocks have probably bottomed

The unprecedented support from policymakers and a flattening viral curve have 'dramatically' cut risks to both markets and the economy, strategists say

U.S. stocks are unlikely to make fresh lows thanks to the “do whatever it takes” approach of policymakers, according to Goldman Sachs Group Inc.

A combination of unprecedented policy support and a flattening viral curve has “dramatically” cut risks to both markets and the American economy, strategists including David Kostin wrote in a note Monday. If the U.S. doesn’t have a second surge in infections after the economy reopens, equity markets are unlikely to make new lows, they said.

“The Fed and Congress have precluded the prospect of a complete economic collapse,” the strategists wrote. “These policy actions mean our previous near-term downside of 2,000 is no longer likely” for the S&P 500 Index.

The U.S. benchmark closed last Thursday around the 2,790 level, having hit a three-year low of 2,237 on March 23.

Goldman cited policy measures including rate cuts, the Federal Reserve’s Commercial Paper Funding Facility and fiscal stimulus such as the $2 trillion Cares Act among the “numerous and increasingly powerful” actions that have spurred equity investors to take a risk-on view.

Meanwhile, the strategists expect investors to look through first-quarter results from the upcoming earnings season, and focus instead on the outlook for 2021, according to the note.

“Despite the likely steady stream of weak earnings reports, 1Q earnings season will not represent a major negative catalyst for equity market performance,” they wrote. “Our year-end S&P 500 target remains 3,000.”

[More: Fed’s rescue efforts leave advisers hopeful — and confused]

Learn more about reprints and licensing for this article.