Increase in liquidity should lift stocks and bonds: JPMorgan

Accommodative central bank policies should provide a boost to equities markets worldwide, analysts say

Extremely loose monetary policy will be required for a long time to support growing debt levels worldwide, buoying liquidity along with global equity and bond prices, according to JPMorgan Chase & Co.

“More debt, more liquidity, more asset reflation,” was the conclusion of strategists including Nikolaos Panigirtzoglou, who forecast a $16 trillion increase in worldwide debt this year that would push the combination of private and public sector borrowing to a record high of $200 trillion by year-end.

That will lead to higher savings rates, very accommodative central bank policies and more cash in the system — the bulk of which may find its way into the global stock market, they wrote in a note Friday.

“Elevated cash holdings create a strong background support for non-cash assets such as bonds and equities,” the strategists wrote. Given the current low level of bond yields, “most of this liquidity will eventually be deployed into equities as the need for precautionary savings subsides over time.”

The increase in global liquidity during the coronavirus crisis has happened at a much swifter pace that during the 2008 downturn, according to JPMorgan. Total money creation could exceed $15 trillion or more by the middle of next year as quantitative easing continues at a stronger-than-normal level, the strategists wrote.

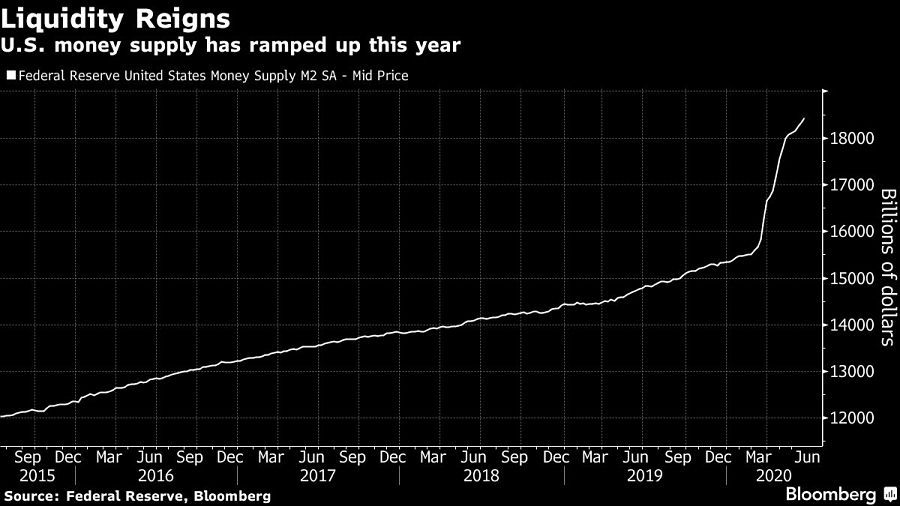

In the U.S., M2 money supply has risen $3 trillion so far this year to $18.4 trillion, according to Federal Reserve data compiled by Bloomberg.

[More: Stock rally is sending investors back into hedge funds]

Learn more about reprints and licensing for this article.