JPMorgan says $200 billion could exit stocks this quarter

NYSE-electronic-market-screen

NYSE-electronic-market-screen

Sovereign wealth funds and pension funds are likely to rebalance their portfolios after the equity market's big run-up

Pension and sovereign wealth funds are set to offload about $200 billion of equities as they rebalance their portfolios, posing a risk for global shares, according to JPMorgan Chase & Co.

This would be the most negative quarterly adjustment since the pandemic hit, strategists led by Nikolaos Panigirtzoglou said Tuesday. The overall figure stems from calculations spanning U.S. defined-benefit pension portfolios, Japan’s Government Pension Investment Fund and Norway’s oil fund.

“This negative rebalancing flow becomes even more problematic given this month’s sharp decline in equity market depth,” the analysts wrote in a note.

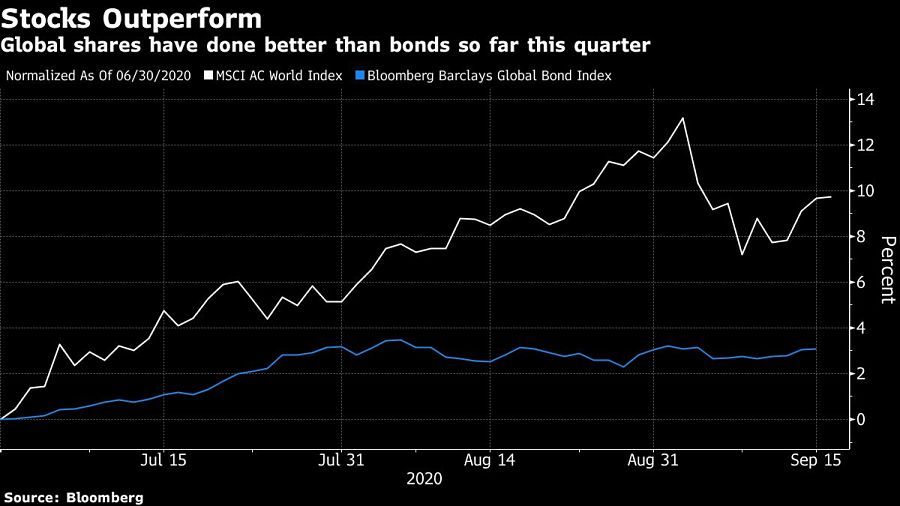

Institutions tend to adjust portfolios each quarter to maintain their target asset allocation. A gauge of global stocks has climbed about 10% since the end of June, exceeding returns from fixed income and pointing to the need for some funds to adjust their investment mix back to preferred limits.

The revision is one of many risks facing the equity market after a powerful rally from lows in March stalled this month. Others include stretched valuations for some segments, a choppy economic recovery, potential volatility around the U.S. election and reliance on central bank support of financial markets.

Still, the JPMorgan strategists are sanguine overall on the outlook for stocks.

“For the medium to long term, we still see plenty of upside given still low overall equity positioning,” they said. “A retreat in equity and risk markets over the coming weeks would likely represent a buying opportunity.”

Learn more about reprints and licensing for this article.