Vanguard, State Street resist the new ETF craze

Two of the industry's biggest players are taking a wait-and-see attitude on active nontransparent ETFs

One of Wall Street’s hottest innovations is being hailed as the potential key to luring trillions of actively managed dollars to the booming market for exchange-traded funds. Yet two of the industry’s biggest players want no part of it for now.

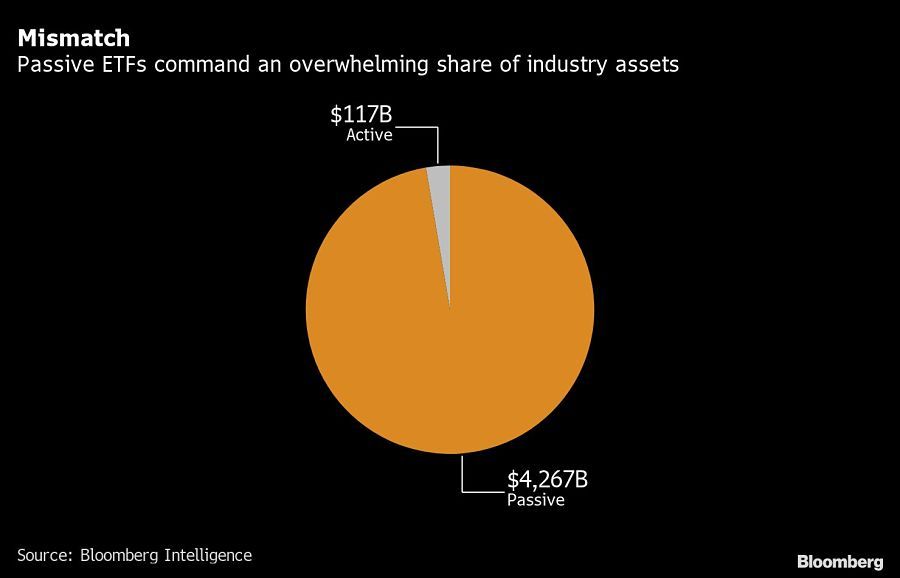

Vanguard Group and State Street Corp. say they’re in wait-and-see mode as active, nontransparent funds take their crucial first steps in the $4.3 trillion U.S. arena for ETFs.

These products come with many of the benefits of traditional ETFs but drastically reduced disclosure requirements. That makes so-called ANTs a likely conduit to bring stock-picking strategies to the exchange-traded universe.

The market’s largest player, BlackRock Inc., has already filed to use the structure after the funds debuted in April. JPMorgan Chase & Co. — which also plans its own ANTs — estimates nontransparent ETFs could ultimately command more than $7 trillion in assets.

Vanguard, No. 2 in ETFs, is in no rush to wade into untested waters, according to its head of ETF product management.

“This is an opportunity for us to learn from what others are doing,” Rich Powers said in an interview. “Investors make their way to great active strategies, regardless of whether it’s first to market.”

SLOW START

So far, it seems they have yet to flock to ANTs.

After being in the making for almost a decade, six nontransparent ETFs have launched to date from three issuers: American Century Investments, Legg Mason Inc. and Fidelity Investments. Five follow large-cap equities and one tracks mid-cap stocks.

Collectively, they have attracted almost $240 million in assets, with the $133 million American Century Focused Dynamic Growth ETF leading the pack. Performance is mixed: Half of the new products are handily beating their benchmarks, two are lagging, and one is neck and neck.

| Fund | Ticker | AUM |

|---|---|---|

| American Century Focused Dynamic Growth ETF | FDG | $133M |

| American Century Focused Large Cap Value ETF | FLG | $76M |

| ClearBridge Focus Value ETF | CFCV | $2.6M |

| Fidelity New Millennium ETF | FMIL | $3.9M |

| Fidelity Blue Chip Growth ETF | FBCG | $18M |

| Fidelity Blue Chip Value ETF | FBCV | $4.9M |

In the eyes of State Street’s Rory Tobin, there are two big hurdles to attracting investors to this new type of fund. First, the sheer dominance of passive strategies, which account for more than 95% of all U.S. ETF assets. Second, the relative cost of the ANTs.

“You’ve got your investment proposition, you’ve got your ETF mechanics, and then there’s the economics,” said Tobin, global head of State Street’s SPDR ETF business. “How do investors feel about the price point at which these are being positioned?”

The average expense ratio for the new nontransparent funds is 0.52%. By comparison, the world’s largest ETF — State Street’s SPDR S&P 500 ETF Trust (SPY) — has a fee of less than 0.1%.

FIRST MOVERS

For some market watchers, the question of demand runs even deeper than cost. Ben Johnson at Morningstar Inc. reckons all the hype around the nontransparent structure has been driven by issuers rather than investors.

“What has been absent is any clear indication of demand,” said the director of global ETF research. “This is a solution in search of a problem, and the problem that ANTs solve is chiefly in my mind an asset management problem.”

Nonetheless, issuers remain optimistic. Greg Friedman, head of ETF management and strategy at Fidelity, said the company expects growth for its products over time, with large institutional investors coming on board once the funds have a track record.

American Century said it had interest from “a lot of different parties” and pointed out that it successfully launched almost at the height of this year’s market stress.

“Almost no one was launching ETFs, and almost everyone was pulling theirs back,” said Edward Rosenberg, head of ETFs at American Century.

That kind of perseverance may well pay off in the long run, since the ETF ecosystem has a track record of delivering a first-mover advantage.

SPY, for instance, has accumulated $273 billion in assets since its launch in 1993. BlackRock’s iShares Core S&P 500 ETF (IVV) is far cheaper with a fee of 0.03%. But it remains a distant second, having gathered $195 billion since its launch in 2000.

A spokesman for Legg Mason didn’t immediately respond to a request for comment.

MUTUAL BENEFITS

The new funds reveal their holdings just once a quarter, as opposed to the daily disclosures provided by regular ETFs.

That’s an alluring prospect for mutual fund managers confronting the ongoing march of cheaper, easier-to-access passive products. They can adopt similar structures while shielding their secret sauce from front-running or replication by rivals.

But lingering questions about how the structure will hold up during times of market stress are keeping asset allocators such as ETrade Financial’s Mike Loewengart at bay.

The share price of a traditional ETF normally stays in lockstep with the value of their underlying holdings thanks to specialized traders known as authorized participants, who step in to capitalize on any price discrepancies and keep the two moving in tandem. With an ETF that conceals its holdings, that process looks a bit different.

Most ANTs launched so far use the so-called ActiveShares model from Precidian Investments. The structure publishes an indicative value every second to help traders make a price and enlists an agency broker — known as an authorized participant representative — to confidentially buy and sell securities for the APs.

Alternative methodologies from Fidelity, T. Rowe Price Group Inc., Natixis SA and Blue Tractor Group have also been approved.

“It hasn’t really been tested yet,” said Loewengart, the managing director of investment strategy at ETrade. “They need to become more seasoned.”

[More: ‘Nontransparent’ ETFs coming soon, but do advisers care?]

Learn more about reprints and licensing for this article.