Richest investors balking at fees

Capgemini survey shows a third of wealthy clients worldwide are uncomfortable with costs

Even before this year’s market crash, the wealth management industry’s richest clients were frustrated about fees.

A third of those with more than $1 million of investible assets were uncomfortable with them in 2019, according to Capgemini’s World Wealth Report 2020. Such discomfort will likely rise in today’s volatile markets.

The survey of more than 2,500 individuals found that about one in five plans to switch their primary wealth management firm in the next year, with high fees the top reason.

Their main concerns were about transparency, performance and value received. They also said they preferred fee structures to be performance- and service-based instead of asset-based.

It’s the latest sign of the pressure the industry is under as clients balk at costs and digital competitors emerge. The majority of investors weren’t satisfied by the quality of personalized information they receive, and about three-quarters of those surveyed said they would consider offerings from nontraditional providers like the big tech firms.

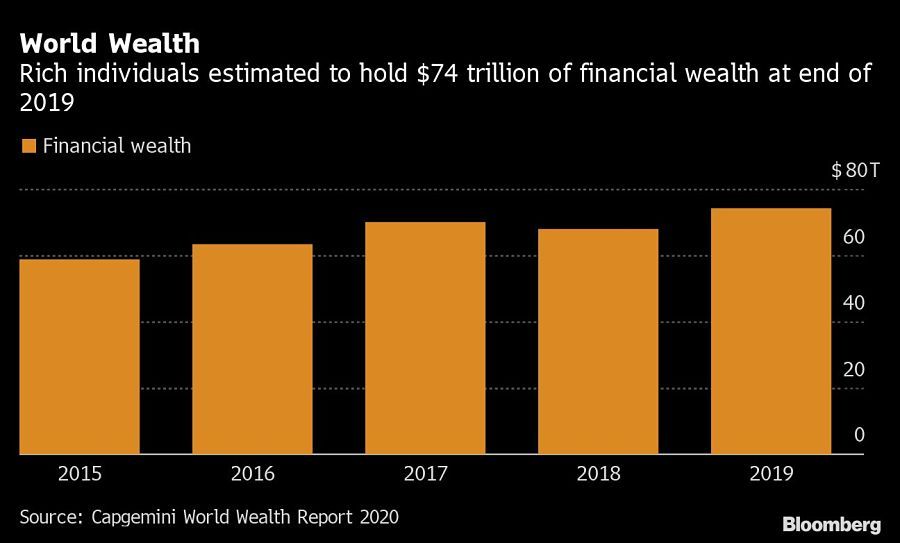

The discontent comes even as the rich get richer: The report estimates that the net worth of wealthy individuals climbed to $74 trillion at the end of 2019, up 8.7% from 2018 and $46 trillion in December 2012. The population of millionaires reached almost 20 million, including 183,400 with a net worth above $30 million, versus 18 million in 2018 and just 12 million in 2012.

For the first time since 2012, the Asia-Pacific region didn’t lead wealth growth last year — it was North America. The U.S. alone had 5.9 million millionaires at the end of 2019, up from 5.3 million in 2018 and more than any other country. Japan followed, with 3.4 million millionaires, followed by Germany, China and France.

The wealthy favored equities in the first two months of 2020. They allocated 30% of their assets to stocks, compared with 17% to fixed income, 15% to real estate, 13% to alternative investments and 25% in cash.

The survey did flag some promising growth areas for wealth managers. Those under 40 were far more likely to be willing to pay for value-added services such as real estate investment advice and tax planning. Sustainable investing is another bright spot, especially for the richest investors.

Learn more about reprints and licensing for this article.