Many clients carrying ‘money trauma’ into their future

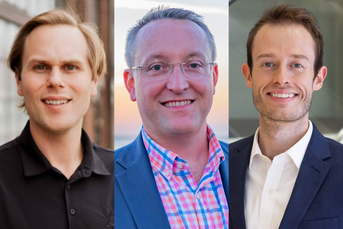

Sean Lovison of Purpose Built Financial Services and Catherine Vallega of Green Bee Advisory

Sean Lovison of Purpose Built Financial Services and Catherine Vallega of Green Bee Advisory

Report finds 79% of Americans have created a budget and are aggregating accounts in wake of inflation.

While economic and financial conditions continue to put considerable pressure on their day-to-day finances, Americans are desperately looking for alternative resources to cling to that will help with their long-term financial goals and retirement savings.

That “clinging” seems to be helping, as inflation is causing many to take positive financial planning steps. A study released Friday by Empower shows that 79% of American workers have created a budget to help manage inflation. Fifty-six percent sought out a financial planner, while 35% plan to increase their contributions to their retirement savings accounts.

Additionally, two-thirds have no plans to sell assets or investments and 69% don’t plan to reduce their contributions to retirement savings.

When all is said and done and when inflationary pressures are behind us, many will likely still be putting savings aside to ensure they’re in a better position and can leave a legacy.

“People that have made positive steps due to inflation will continue doing those steps,” said Sean Lovison, financial planner and founder of Purpose Built Financial Services. “It’s like the legacy of any other great recession, or the Great Depression, where people that are immediately affected by it kind of carry that money trauma through their entire lives.”

One approach that is helping Americans save money and battle inflation is account aggregation. “Account aggregation, or the linking of accounts in one place, provides individuals with a comprehensive view of their financial situation,” the report said. “A consolidated view can help people make more informed financial decisions.”

Empower also said workplace savers using professionally managed strategies — target-date funds or managed accounts — are saving 27% more and are more engaged with their retirement plans than users of target-date funds. The use of professionally managed strategies is highest among younger generations.

Young generations also see the value in linking accounts; Empower said aggregators are more concentrated among Gen Xers, followed by millennials. Fifty-eight percent of working Americans say they’re very or somewhat likely to link their accounts in the next 12 months.

Catherine Valega, founder of Green Bee Advisory, said aggregation is a process she implements at her firm.

“Everything in your financial life, we aggregate it, and we have a financial portal for every client,” Valega said. “They access it, I access it. Once we populate that portal with their loans and their mortgage and whatever else, then we can have the conversation around, ‘What are we going to focus on?’”

The study says workplace savers who have linked three or more accounts save 30% more than those not linking accounts. Among the 30%, 72% also take advantage of financial wellness tools.

“The more you can see your whole picture together, the better off your long-term decisions are going to be,” Valega said.

Her strategy with her clients is having conversations that can “maximize every penny we can get into that 401(k),” she added.

Results from the study also found that workplace savers value online resources, personalization, and unbiased advice. Ninety-three percent of workers want financial and retirement tools available on their 401(k) provider’s website while 88% seek help to create a personalized financial plan based on their needs.

Valega mentioned another tool that can help both women and men who aren’t able to save.

“There is something called a spousal IRA. If I don’t have my own income, but my spouse does, the spouse can make spousal IRA contributions. It works in either direction and it’s a tiny little tool. Every penny helps,” she said.

The top three factors standing in the way of saving more, the study said, were the need to make ends meet, inflation and paying back debt. More than half of respondents said they wished they had started saving for retirement earlier, while only 11% feel they are saving enough.

Valega encourages her clients to put as much money into their retirement plan as early as possible.

“You want to prioritize retirement savings,” she said. “That should just be in every worker’s mind is retirement savings. Most people are confused on the amount that they can save and the amount that they should save.”

“We do a big disservice in this country by not teaching people about personal finance,” Valega added. “A lot of people aren’t getting that education on the importance of it, so they don’t take advantage of their retirement plan.”

Schwab bond strategist says Fed on hold till 2024

Learn more about reprints and licensing for this article.