Displaying 30 results

Leading through innovation – with Tom Ruggie of Destiny Wealth Partners

Uncover the key initiatives behind Destiny Wealth Partners’ success and how it became one of the fastest growing fee-only RIAs.

Alts platform CAIS secures another partnership

The leading alternative investments provider is helping Captrust, the $800B wealth juggernaut, provide a better experience for advisors.

There’s a gender gap in emerging tech investment

Fintech platform’s poll shows men more likely than women to dive into crypto, blockchain, and alternative assets.

Shaking up the 60/40 portfolio

The importance of diversification, like your health, only reveals itself in bad times, advisor says.

Firms and advisors need an alt-friendly tech solution

As alternative investments grow in popularity, firms and advisors will need tech that enables them to provide better service to clients exposed to such assets.

Advisors reassess their alt stakes after loading up

Use of alternative investments skyrocketed when stocks and bonds tanked in 2022, but advisors are still standing behind those positions as stocks rally.

AlTi’s upper-high-net-worth ambitions get $450M boost

The global wealth and alternatives manager is getting strategic investments from Allianz X and Constellation Wealth Capital.

KKR sees ‘trillions’ of retail investor dollars moving to alts

'Mass affluent individual investors historically have not had an easy way to access these types of products and strategies,' senior KKR executive says.

Advisors not done with alternatives despite bull run

The run-up in stocks raises the question of whether advisors should start reducing their stakes in those illiquid alternatives that once provided them safe harbor.

Finra smacks Philly broker with Wells notice

"It's not a good day for Austin Dutton," says one attorney.

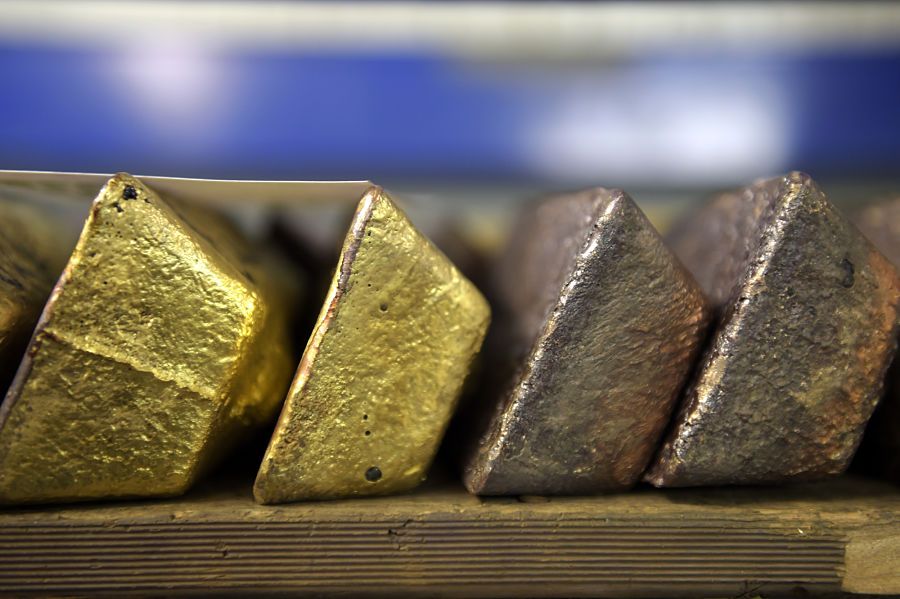

Gold prices set to soar amid stock volatility

Investors turn to gold for its relative safety in volatile markets. The new coronavirus outbreak is fueling sales

BlackRock to co-manage high-yielding alternative income fund

YieldStreet Prism Fund gives individual investors direct access to BlackRock's institutional expertise

Wealthy investors steer billions toward new Trump tax break

Over the last month, there was a jump in the assets flowing into funds that employ the opportunity zone tax incentive

Time is running out on opportunity zones — but there’s limited choice

2026 marks the end of full tax benefits for investors in Opportunity Zones. Find out more about this investment tool, the history behind it, and key aspects to consider.

Alternatives by the numbers

While individual investors' allocations to alternative investments average less than 10%, interest in alts is rising.

RIAs take a soft approach to cross-selling

Planners use multiple means to show clients they have more to offer than the basics.

Risk parity: The real culprit behind the market’s madness

Stocks have been murdered, and China seems to have been caught red-handed. But some financial luminaries are pointing to a surprising defendant: the risk-parity strategy pioneered by hedge fund manager Ray Dalio. Who's guilty?

When looking to preserve clients’ capital, consider alternatives

The potential benefits — and pitfalls — of using alternatives to diversify a portfolio focused on capital preservation.

Long/short equity, event-driven liquid alt funds top stocks in first half

Flows turn mixed but overall universe expected to grow by 5% this year to about $495 billion.

Which is the easier question: How do you feel about liquid alts or how to regulate them?

It's easy to vilify liquid alts; it's much harder to draft the kind of regulation that allows an investor to make an informed decision about the risk-return profile of their investments.

- 1

- 2