Displaying 18 results

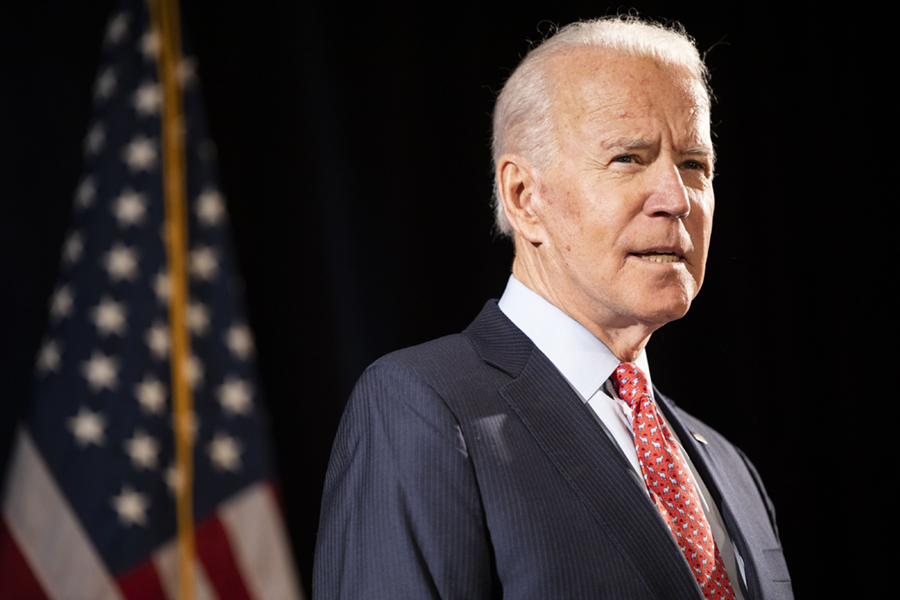

Biden takes another $7.4B step in fight to tame student debt

The latest move covers almost 280,000 borrowers in the SAVE, income-driven replacement, and public service loan forgiveness programs.

Biden’s budget targets backdoor Roths and $10M retirement accounts

The proposed budget seeks to increase taxes for corporations and the wealthy.

Biden administration cancels $1.2B of federal student loans

The move wipes out loans for those who borrowed less than $12,000 for their higher education.

Biden selects Martin O’Malley for Social Security commissioner

The agency is responsible for distributing Social Security to more than 70 million beneficiaries and commands a $1 trillion budget.

Biden unveils new student debt forgiveness plan

After being shot down by the Supreme Court, the administration has unveiled a revamped plan that could benefit more than 800,000 borrowers.

Not investing in ESG doesn’t make you anti-ESG

As the environmental, social and governance space evolves, we're learning that the value from an investment perspective is not always best, even if it's always good.

Economic realities dampen pace of RIA acquisitions

This is the first time since 2014 that first-quarter deal volume has declined from the same quarter a year earlier, according to data from DeVoe & Co.

Inflation, no longer deemed transitory, puts advisers in scramble mode

The Biden administration is now saying upward pressure on prices could be the new reality, which has advisers getting more creative.

Promises of student debt forgiveness put advisers in uncharted territory

The moving target of potential debt forgiveness, coupled with an extended payment moratorium, has advisers reading the political tea leaves for direction.

How Biden’s billionaire tax would hit the wealthy

Under Biden's plan, wealthy individuals would owe taxes on the unrealized gains of their assets, in addition to realized gains, a change that would upend long-standing tax principles.

Advisers place little faith in Biden’s ‘billionaire tax’

The proposal, which goes after households worth at least $100 million, enters unprecedented territory by trying to tax unrealized gains.

Biden to propose 20% tax aimed at billionaires

The tax, dubbed the Billionaire Minimum Income Tax by the White House, would hit both the income and unrealized gains of U.S. households worth more than $100 million.

Biden’s digital assets directive fails to provide clarity for advisers

Advisers will have to wait a while longer before they get answers on issues such as custody, as regulators sort out crypto oversight.

Biden aims for coordinated approach to overseeing crypto

The White House executive order is the first attempt at coordinating the government's strategy, although it falls short of providing a clear direction on regulation.

SEC bogs down on climate rule, handing White House fresh setback

At issue is how much environmental data companies can be forced to disclose before regulators put themselves in legal jeopardy.

RIAs see M&A momentum gaining steam in ’22

As firms chase scale with bigger and bigger deals, RIA sellers are enjoying the ride of record-level valuations.

Hedging inflation requires tiptoeing through TIPS

Treasury inflation-protected securities have become the hottest ticket in 2021 as messages about 'transitory' inflation clash with reality.

Biden tax proposal draws ire from financial advisers

The idea of hiking taxes on capital gains from the current top rate of 23.8% is viewed by some as a trial balloon to test levels of support and resistance. The top tax rate would apply to those with annual incomes of at least $1 million, which is about 500,000 American taxpayers.