Displaying 157 results

JPMorgan Funds’ David Kelly: The forces of stability and chaos

In theory, it's quite simple.

Advisers: How to talk to clients about elder care

Elder Care issues can create one of the most stressful situations of your clients' lives.

BlackRock’s Bob Doll: Markets remain vulnerable to corrective forces

Last week was a difficult one for equity markets as ratings downgrades on European sovereign bonds raised fears of credit contagion.

Raymond James’ Jeffrey D. Saut: Crisis = danger + opportunity

Friday was a multi-swinging session, which is exactly what you want for a bottoming phase in the equity markets.

Build America Bonds: Are taxable munis here to stay?

As the market for taxable munis expands, many advisors and investors are rethinking their approach to municipal bonds.

BlackRock’s Bob Doll: An element of uncertainty in the markets

Equities rallied for the first part of last week, reaching new highs for the current cycle on Thursday, before falling sharply on Friday on news that US regulators are suing Goldman Sachs over alleged fraud in connection with its collateralized debt obligation business.

Pimco’s El-Erian: Greece on the verge of becoming ‘global phenomenon’

What is less well understood at this stage is that the externalities, negative and positive, are not limited to Europe.

Bill Gross: It’s now time for Greece to restructure

Greece needs to reduce the nation's debt through a restructuring and impose deep spending cuts to exit its fiscal crisis, according to Pacific Investment Management Co.'s Bill Gross.

Time to worry: The government’s becoming an increasing ‘spender’

It's that time of year again when, as the Beatles state, “There's one for you, nineteen for me 'cause I'm the taxman.”

Raymond James’ Jeffrey D. Saut: ‘We are for ‘flation’

Herb Stein was Chairman of President Nixon's Council of Economic Advisors between 1972 and 1974.

BlackRock’s Bob Doll: Don’t expect to see a ‘double-dip’ recession

Surprisingly strong corporate earnings helped equity markets stage another rally last week.

BlackRock’s Bob Doll: Stocks may have gotten ahead of themselves

The following is a weekly investment commentary by Bob Doll, vice chairman and chief equity strategist for fundamental equities at BlackRock Inc.

Peter Schiff: The Fed is inflating the ‘biggest bubble of them all’

During the 1990s, inflationary Federal Reserve policy fueled a tech stock bubble. When that bubble burst, the Fed inflated a larger one in real estate. Now that the real estate bubble has burst, the Fed is inflating the biggest bubble of them all -- a government bubble.

Are Build America Bonds in your future?

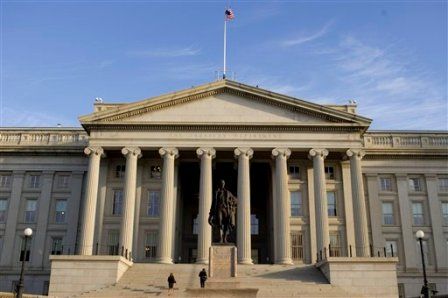

Build America Bonds were introduced in April 2009 to create jobs and to help municipalities offset borrowing costs with a 35 percent direct subsidy from the U.S. Treasury.

Raymond James’ Saut: Don’t wait for May to go away

An old stock market “saw” states, “Sell in May and go away,” emphasizing that the worst part of the year for stock performance is the months between May and November.

How to play the health-care reform

The following is an investment strategy column by Jeffrey D. Saut, managing director at Raymond James & Associates Inc.

JPMorgan’s David Kelly: The investment implications of health care reform

This morning, after almost a year of heated debate, the President has achieved his goal of a major reform to the health care system.

J.P. Morgan Funds’ David Kelly: Do nothing, at least on the stance of monetary policy

On Tuesday the Federal Reserve's Open Market Committee holds its second meeting of the year to consider the direction of monetary policy.

Peter Schiff: ‘Very good reason’ to believe home prices will collapse

The latest housing initiative announced today by the Obama Administration draws the U.S. government and, by proxy, all taxpaying Americans, further into the inescapable quagmire of a devastated real estate market.

BlackRock’s Bob Doll: The cyclical bull market has further to run

Equity markets notched positive returns again last week, as the Dow Jones Industrial Average climbed 0.6% to 10,625, the S&P 500 Index advanced 1.0% to 1,150 and the Nasdaq Composite rose 1.8% to 2,368.