Time to worry: The government’s becoming an increasing ‘spender’

It's that time of year again when, as the Beatles state, “There's one for you, nineteen for me 'cause I'm the taxman.”

The following is an investment strategy column by Jeffrey D. Saut, managing director at Raymond James & Associates Inc.

“Let me tell you how it will be there’s one for you, nineteen for me ‘cause I’m the taxman, yeah, I’m the taxman. Should five per cent appear too small be thankful I don’t take it all ‘cause I’m the taxman, yeah I’m the taxman.”—The Beatles

Well, it’s that time of year again when, as the Beatles state, “There’s one for you, nineteen for me ‘cause I’m the taxman.” For the record, mandatory tax withholding began in 1943 and as one of the crafters of that event said – I wish we had never allowed the government to automatically withhold the tax from peoples’ paychecks because by doing so folks just don’t realize how much they are actually paying! To be sure, taxes are going up, especially on the alleged “rich.” Now as I understand it, “the rich” is defined as anyone making more than $200,000 per year, or $250,000 for a couple. While that certainly sounds like a lot of money, I challenge you to examine a family of six, four of which are kids in private colleges, combined with a mortgage payment/two car payments/ state and city income taxes/etc., and see how much money is left over at the end of the day. Still, “tax the rich” plays well politically despite the fact the top 1% of wage earners pay roughly 29% of the total taxes, while the top 5% pay a bit more than 47%. Shockingly, that leaves only 53% of the tax load for the remaining 95% of wage earners. As philosopher, economist, and journalist Henry Hazlitt wrote:

“When people who earn more than the average have their ‘surplus,’ or the greater part of it, seized from them in taxes; and when people who earn less than the average have the deficiency, or the greater part of it, turned over to them in hand outs and doles, the production of all must sharply decline. For the energetic, and able, lose their incentive to produce more than the average; and, the slothful and unskilled lose their incentive to improve their condition.”

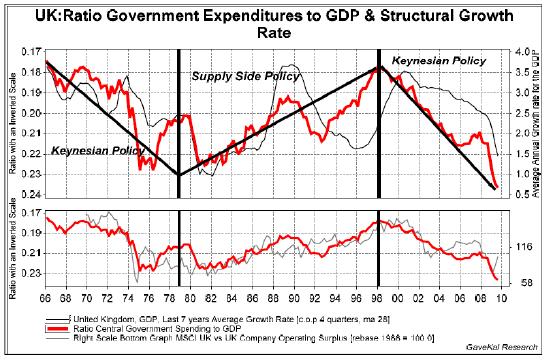

Ladies and gentlemen, we don’t have a tax shortfall problem; we have a government spending problem. As the Washington Times writes, “For the first time since the Great Depression Americans took more aid from their government than they paid in taxes.” Manifestly, our government is becoming an increasing “spender” in the economy and that should worry you. Indeed, a recent study from the sharp-sighted folks at the GaveKal organization shows what occurred in the United Kingdom when the government became an increased “spend” in that economy. By examining the nearby chart:

“(Where) the top red line represents the ratio between central government expenditures and GDP (on an inverted scale), and the grey line on the bottom panel represents the ratio between the value of the UK stock market and the operating surplus for UK companies as reported by the national accounts (a PE ratio of sorts), something emerges quite clearly. A rise in government spending (the red line declining) leads, over time, to a decline in the structural growth rate of the economy and to lower PEs.”

More importantly, although I consider myself fortunate to have forgotten most of the economics I leaned at university, the current $12.2 trillion national debt, plus the other commitments and contingencies that bring the total to $13.5 trillion, is alarming. Let me size that for you, if you spent $1 million per day since the founding of Rome (~2700 years ago), as of today you would have accumulated “only” $1 trillion in debt. Now take that $13.5 trillion debt figure, and add the ~$42.9 trillion in unfunded obligations figure (Social Security, Medicare/Medicaid, etc.), and you have a $56.4 trillion “debt hole;” and, that hole is only getting deeper! As Ray DeVoe writes:

“In conclusion, Columnist Thomas Friedman had an article in the New York Times titled ‘Never Heard that before’ that I found rather disturbing. He was attending the World Economic Forum in Davos and had discussions with many of those attending. As he wrote ‘I heard a phrase being bandied about by non-Americans – about the United States – that I can say I have never heard before: political instability’.”

Nevertheless, while the bond market seems to be reflecting some of these concerns (read: higher rates), the equity markets are not sensing the degree of fiscal tightening that is going to be needed as last week the S&P 500 (SPX/1178.10) tacked on another 0.99%. That “weekly win” left the SPX’s three-week skein at +2.4% and us with “egg” on our face once again. Obviously, we have been wrong-footed (on a short-term basis) for the fourth time since our “bottom call” of March 2, 2009, having turned cautious, but not bearish, three weeks ago with the SPX in the 1150 – 1160 zone. That “cautionary counsel” was driven by numerous indicators we have come to trust over the years. Yet, those indicators have been trumped by the near-term upside momentum. Fortunately, while trading accounts are not fully engaged, investment accounts are. That strategy is based on the simple thesis that booming corporate profits are fostering an economic recovery, which is leading to an inventory rebuild and a capital expenditure cycle. In turn, said sequence should promote a hiring cycle, and then, a pickup in consumption. We think, in the intermediate-term, such a sequence should bolster stocks into mid-summer, even though we remain cautious as the second quarter begins.

In any case, despite our near-term caution, the aforementioned “virtuous cycle” should persist until the markets begin to discount the 2010 mid-term elections next November. Through our lens, those elections may well serve as a referendum on the liberals’ versus conservatives’ agendas. If the liberals prevail, it could spell a pretty tough year for stocks in 2011. If, however, there is a conservative backlash (read: no tax increases combined with spending cuts), it could provide the footing for a decent 2010 year-end rally. Meanwhile, our “call” for the return of inflation is playing with crude oil and copper breaking out to 20-months price highs. To put it simply, the U.S. has only three options: sovereign default (unimaginable); severe economic contraction (unlikely); or currency debasement, which has been the preferred political strategy for decades. Inasmuch, we choose door number three and have/are positioning accounts for inflation. Further, our long-standing recommendation of “buying” Japan is finally bearing fruit with many Japanese centric closed-end funds and ETFs tagging fresh reaction highs last week as Japan’s new export orders hit a six-year high. We also think technology stocks should continue to outperform. Most tech companies don’t have significant retiree healthcare obligations, nor do they have a lot of debt on their balance sheets. Verily, tech companies tend to be cash rich because they retain their earnings. Some such names from Raymond James’ research universe, all of which are Strong Buy-rated, include: Radiant Systems (RADS); CA Inc. (CA); Micron Technology (MU); Nuance Communications (NUAN); Harris Corporation (HRS); NVIDIA Corporation (NVDA); and Sybase (SY).

The call for this week: For 13 months we have heard the bears growl that this is just a rally in an ongoing bear market with a double-dip recession surely in the cards. Meanwhile, we have clung to our belief in the aforementioned “virtuous cycle.” Plainly, the data suggests the growth in factory orders, shipments, production, payrolls, and capital spending are likely to stay perky in the months ahead. That is the way profit recoveries work and why the stock market continues to rise. Accordingly, while we have been too cautious for the past three weeks, we have never abandoned our belief the equity markets would trade higher in the intermediate to longer term. Still, there are some “cracks” beginning to appear. For example, last week Warren Buffett’s Berkshire Hathaway issued bonds that commanded a lower yield than those offered by the U.S. government. Also of interest was Social Security’s revelation that it will show a deficit this year rather than in the projected deficit year of 2017. Those topics, however, are for a future billet doux.

For more investment strategies by Mr. Saut, go to raymondjames.com/inv_strat.htm.

Learn more about reprints and licensing for this article.