Displaying 167 results

Vanguard limits access to the safest money market funds

The asset management giant closed Treasury money funds to new investors in an attempt to keep yields positive

Oil bulls keep piling into beaten-down ETFs

But those bets haven't paid off to date because efforts to stabilize the crude oil market have fallen short

BlackRock investors flee long-term funds

During the first quarter, the asset manager saw about $19 billion in withdrawals from its mutual funds and ETFs, but $52 billion in inflows for its cash management business

Fed’s ability to buy ETFs may ensure it never needs to

The Fed's signal alone was enough to loosen the cash crunch that had been squeezing global credit markets

Cash is king as investors flee bond funds, active equities in March

Outflows from fixed-income funds hit a record $240 billion last month, says Morningstar

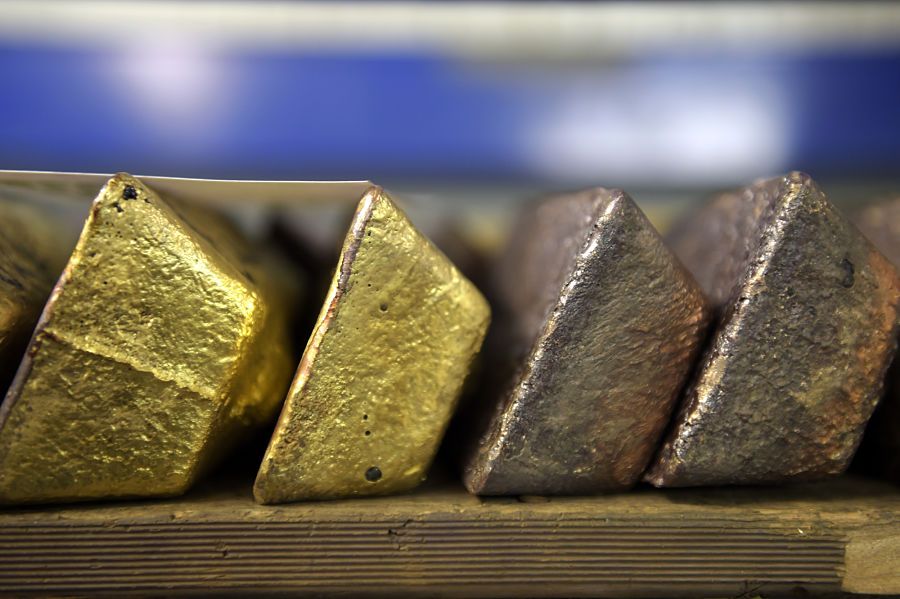

Gold digs in near seven-year high as ETFs swell again

The precious metal is being supported by predictions of the deepest global recession in generations and expectations of prolonged stimulus efforts

ETF investors go all-in on stimulus with $17 billion stock bet

The health care sector leads equity ETF flows with almost $3 billion added

State Street delays shaking up world’s biggest ETF

The asset manager is postponing rebalances on the SPDR S&P 500 ETF and almost 60 other funds

Near-retirees drain TDFs at a rapid clip

People within 15 years of retirement emptied target-date funds of a net $9.4 billion in March, according to Morningstar

There’s a work-from-home ETF coming

Direxion's new fund will invest in industries such as cloud technologies, remote communications and cybersecurity

American Century puts nontransparent ETFs on the map

The asset manager launches the first two such funds; says it expects the active strategies to shine amid the crisis

ETFs shutting down at the fastest pace since 2017

During the first quarter, 72 exchange-traded funds with $1.4 billion in assets closed their doors

Big ETF inflows in Q1 worry bulls looking for signs of bottom

Exchange-traded funds took in $66.3 billion during the first quarter, about $8 billion more than they attracted during the same period last year

Fed’s move into corporate bonds calms ETF dislocations

The central bank's pledge to buy investment-grade credit and certain ETFs sparked a rally in higher-rated debt

New ETF offerings dried up amid March volatility

But April may be livelier, with American Century announcing that the first active nontransparent ETFs will begin trading Thursday

BlackRock waives ETF fees for New York Federal Reserve

The new fee structure addresses how the asset manager will handle conflicts of interest inherent in its arrangement with the Fed

‘Illiquidity doom loop’ threatens European bond ETFs, analyst says

The gap between some funds' price and the value of their assets could lead to problems

JPMorgan sees shorts behind $9 billion influx into S&P ETF

The inflows into SPY came as the S&P 500 Index plunged amid fears about the economic fallout from the coronavirus

SEC extends Form ADV deadline for advisory firms affected by COVID-19

Registered investment advisers will have 45 extra days to file ADVs, brochure updates

Fixed-income ETFs caught in bond market’s liquidity trap

The cash prices of some of the most actively traded bond funds are at a steep discount to the value of their underlying assets