Jacques Cousteau grandson floats ETF

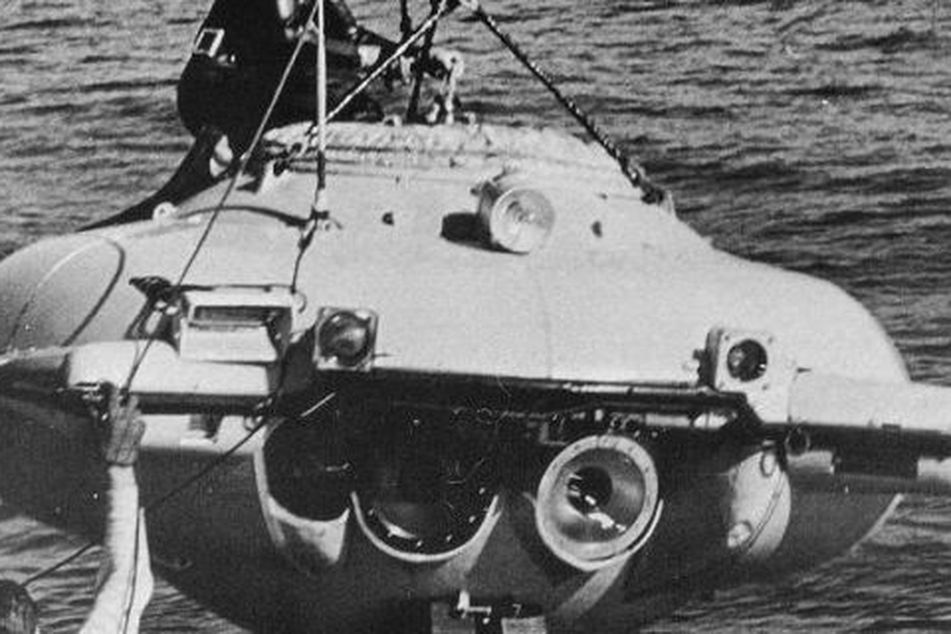

Among other things, Jacque Cousteau devised the first diving saucer

Among other things, Jacque Cousteau devised the first diving saucer

Professional portfolio managers will oversee fund developed by scion of undersea star

Jacques Cousteau’s grandson is the newest member of the exchange-traded-fund world. Philippe Cousteau, the grandson of the famed conservationist, has teamed up with ETF provider AdvisorShares Investments LLC to launch an actively managed socially conscious ETF.

Mr. Cousteau won’t have anything to do with managing the newly minted AdvisorShares Global Echo ETF Ticker:(GIVE). Forty basis points of the ETF’s 1.7% expense ratio, however, will go directly toward funding the Global Echo Foundation. Mr. Cousteau co-founded the group to provide resources for supporting women and children, microlending and environmental sustainability. AdvisorShares will donate an extra 25 basis points of its management fee to the foundation, as well.

Noah Hamman, chief executive of AdvisorShares, said the goal is to keep shareholders up-to-date on how the donations are being used so they can see the impact they are making. “We want to make the charitable part as transparent as the ETF,” he said.

Management of the assets will be left up to four socially conscious institutional money managers. The ETF will allocate among fixed-income, equities and long/short strategies to target an absolute return and a low correlation with the S&P 500.

Community Capital Management Inc. will handle the U.S. fixed-income portion of the fund. Baldwin Brothers Inc. and Reynders McVeigh Capital Management LLC will oversee the equity portions, and First Affirmative Financial Network LLC will use an alternative strategy.

Jacques Cousteau, an oceanographer, gained fame in the 1960s with “The Undersea World of Jacques Cousteau,” a documentary series about the adventures of a research vessel called The Calypso. He died in 1997.

Learn more about reprints and licensing for this article.