One year on, iShares’ Core series clawing back market share for BlackRock

One year on, iShares' Core series is clawing back market share for BlackRock as price cuts, rebranding helps firm recover from case of “Vanguarditis.”

One year ago this week, BlackRock Inc.’s iShares launched a new series of exchange-traded funds aimed at buy-and-hold investors to fight its declining market share. It’s working.

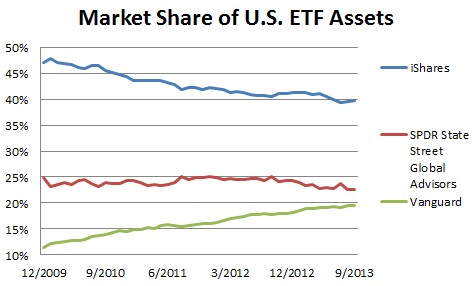

BlackRock launched its Core series, a group of 10 low-cost building-block ETFs that can be used to build the base allocation of a portfolio, in October 2012 after watching its ETF market share fall to about 40%, from nearly half in 2009.

The main cause for the erosion was the fact that iShares, the largest ETF company, with $623 billion in ETF assets, was unable to compete with the low-cost ETF options at rival Vanguard Group Inc. AllianceBernstein LP even went so far as writing to clients that BlackRock was suffering from a case of “Vanguarditis.”

That apparent sickness turned into a cure for investors, though, as the fading market share led BlackRock officials to realize that the firm could do more to serve classic buy-and-hold investors. Thus the launch of the Core series.

“We pay attention to what competitors are doing, but I wouldn’t say it drives our behavior,” said Sue Thompson, head of the registered investment adviser group at BlackRock. “It’s our clients that drive our decisions.”

The Core series included price cuts on, and the re-branding of, six existing ETFs, such as the $45 billion iShares Core S&P 500 ETF (IVV), and the introduction of four new low-cost ETFs, such as the $2.5 billion iShares Core MSCI Emerging Markets ETF (IEMG). The moves are not complete, as iShares plans to launch target risk allocation managed portfolios of the Core ETFs in an ETF-of-ETFs structure.

The idea behind Core was to make it easier for advisers and retail investors to choose ETFs for their portfolios, Ms. Thompson said.

“The way we think about it is, the simpler we can make things, the better,” Ms. Thompson said. “The average person doesn’t need a small-cap Brazilian hedged ETF. They need something simple.”

(Don’t miss: iShares takes next step to woo retail investors, fend off Vanguard)

iShares’ new commitment to simplicity — and low costs — has struck a chord with investors.

“It was a good sign they’re moving in the direction we want to see them moving,” said Derek Tharp, a financial planner at Mote Wealth Management LLC. “The Core series fits our personal investment approach. We like to see more competition in that area.”

The 10 Core ETFs have had $9 billion in inflows for the year through Sept. 30, nearly one-third of the $30 billion in total net inflows into iShares ETFs over that time. The Core series has also helped iShares ETFs break into model portfolios at the warehouses, particularly the long-term strategic models, which iShares was largely left out of before.

“The Core series has to be viewed as a success,” said Michael Rawson, an analyst at Morningstar Inc. “They had the same funds before, but they weren’t competitive. Now they’re able to compete in that space.”

The expense ratio of the iShares Core S&P 500 ETF was reduced to 0.07%, from 0.09%, as part of its re-branding as Core. The price cut helped bridge the gap between it and the $12 billion Vanguard S&P 500 ETF (VOO), which charges 0.05%.

Through the end of September, the two ETFs were neck and neck with inflows, each taking in around $3.7 billion. Over the comparable time period last year, Vanguard’s S&P 500 ETF had a $1.1 billion inflow lead over the iShares ETF.

To help expand the Core ETFs, BlackRock also doubled down on its distribution partnership with Fidelity Investments in March. Fidelity customers can now trade 65 iShares ETFs commission-free at Fidelity, including the entire Core series, up from 30.

Overall, the introduction of the Core series has helped stabilize iShares’ ETF business, Mr. Rawson said.

From 2009 to September 2012, iShares’ ETFs shed about 0.2% of market share a month. Since the introduction of the Core series in October 2012, its market share has essentially been flat, falling only 0.05% a month, according to Morningstar.

Still, iShares faces an uphill battle in winning over some buy-and-hold advisers who have been using Vanguard ETFs for years.

“The Core products are great, but quite frankly, I don’t feel they are a better long-term option than other products already available,” said James Osborne, president of Denver, Colo.-based financial planning firm Bason Asset Management, who uses primarily Vanguard ETFs.

BlackRock spokeswoman Christine Hudacko said the primary goal of the Core series is to capture the increasing number of buy-and-hold investors discovering ETFs.

That doesn’t mean BlackRock is ready to concede to Vanguard.

“If you have scale and a broad product set, you’re in a better position to form a really important part of an RIA’s portfolio,” Ms. Thompson said. “Low-cost core ETFs put you in an even better position.”

Learn more about reprints and licensing for this article.