Acquisition and Succession: Shift Your Focus from Retirement to Growth

Your work may be more than just your livelihood…

Your work may be more than just your livelihood – it’s your life. The thought of eventual retirement or succession is simply an easy subject to avoid.

In fact, a recent SEI survey shows only 17% of advisors have a formal, signed succession plan in place and just 45% have a business continuity plan (1).

Succession planning is not an end-game strategy for your business. If anything, it is about building a bigger, stronger business that one day can work for you. With a good plan, the right people, and enough time, every business can survive its founder’s retirement and many can even prosper.

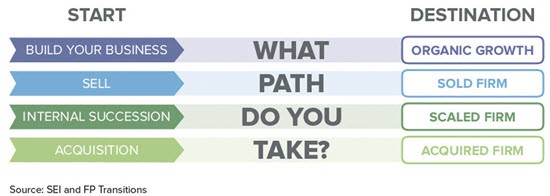

Your journey begins with the courage to envision your future. Call it what you will — transition, succession, exit or replacement planning — the long-term planning process for your business is a journey that begins with the courage to envision your future. Taking the initiative now to think about a succession path will enable you to realize and preserve the value of what you’ve built and to recruit next-generation talent to grow your business.

Whether your goal is to retire with an income plan, build a legacy, merge with or acquire a complementary firm, you’ll need a formal succession plan. Work with a team of industry professionals to understand your options and implement a detailed plan. Your plan should engage all your stakeholders, including your family, legal and tax counsel, partners and next-generation advisors — so that it fits your lifestyle, your time frame and your business.

For more details, download the new white paper from SEI and FP Transitions, Acquisition & Succession: Shift Your Focus from Retirement to Growth, or contact SEI at 888-734-2679. seic.com/advisors.

(1) SEI/FP Transitions Advisor Poll on Succession Planning, April 2014, N=771

Information provided by SEI Investments Management Corporation, a wholly owned subsidiary of SEI Investments Company.

This information should not be relied upon by the reader as research or investment advice and is intended for educational purposes only.

FP Transitions is not affiliated with SEI or its subsidiaries.

Learn more about reprints and licensing for this article.