Senior Republican on Senate Banking Committee presses Finra on CARDS

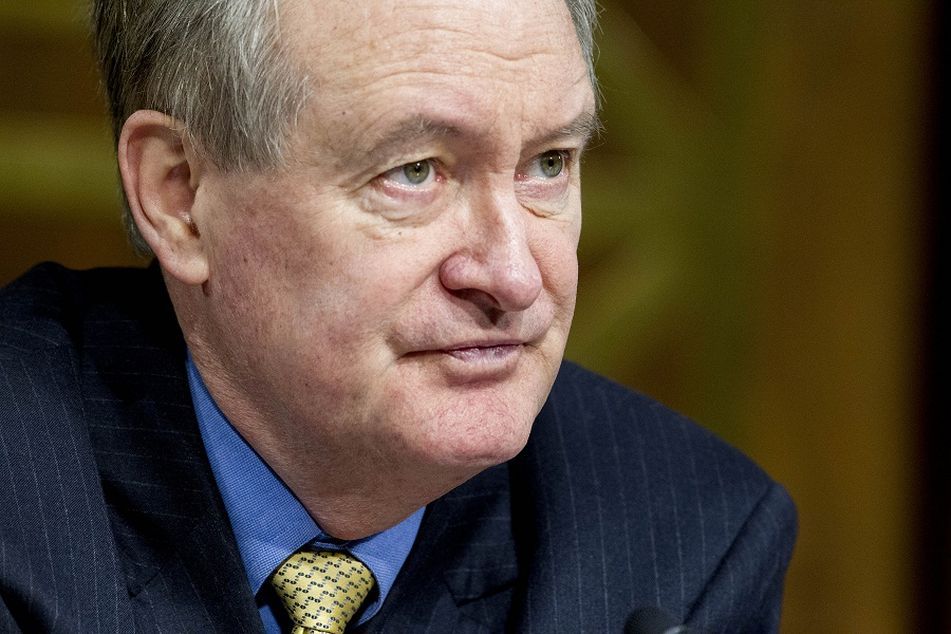

Sen. Michael Crapo, R-Idaho

Sen. Michael Crapo, R-Idaho

Crapo tells Finra chief Ketchum system could jeopardize investor privacy, be used for government surveillance.

A senior Republican on the Senate Banking Committee has added his voice to the chorus of those unhappy with Finra’s controversial plan for a brokerage data-collection system, claiming it could jeopardize investor privacy and be used for government surveillance.

“This big data proposal raises a number of concerns about investor privacy, data security, duplication of regulatory data collection and the role of Finra,” Sen. Michael Crapo, R-Idaho, the second-ranking Republican on the banking panel, wrote in letter Tuesday to Finra chairman and chief executive Richard Ketchum.

Mr. Crapo’s letter adds to the resistance facing the Comprehensive Automated Risk Data System, a mechanism that would collect reams of customer account data from clearing firms and brokerages every month.

Finra, the industry-funded broker-dealer regulator, argues that the system would enable it to detect dangerous industry and harmful sales practices more quickly. Finra declined to comment on Mr. Crapo’s letter.

The regulator introduced CARDS as a concept release in December 2013. It released a proposal to implement the system last September. After industry pushback, it modified the proposal so that CARDS would not collect information that could identify individual investors.

But Mr. Crapo said CARDS still puts investor privacy at risk.

“Simply removing personally identifiable information, while helpful, is not sufficient to resolve privacy concerns in a database of this scope and size,” Mr. Crapo wrote. “The CARDS database could become a tool of government surveillance.”

He included in the letter a list of nine questions he wanted Finra to answer about the need for CARDS, Finra’s authority to implement it and details about how it would work.

Finra received similar opposition to CARDS from Rep. Scott Garrett, R-N.J., last fall. Mr. Garrett is a subcommittee chair on the House Financial Services Committee.

In his letter, Mr. Crapo cited a survey sponsored by the Securities Industry and Financial Markets Association that claimed most investors said the costs of CARDS would outweigh the benefits.

Learn more about reprints and licensing for this article.