Forget a rate hike – Peter Schiff expects more quantitative easing from the Federal Reserve

Euro Pacific Capital CEO and chief strategist says economy is not recovering and central bank will only hike rates when 'market forces its hand.'

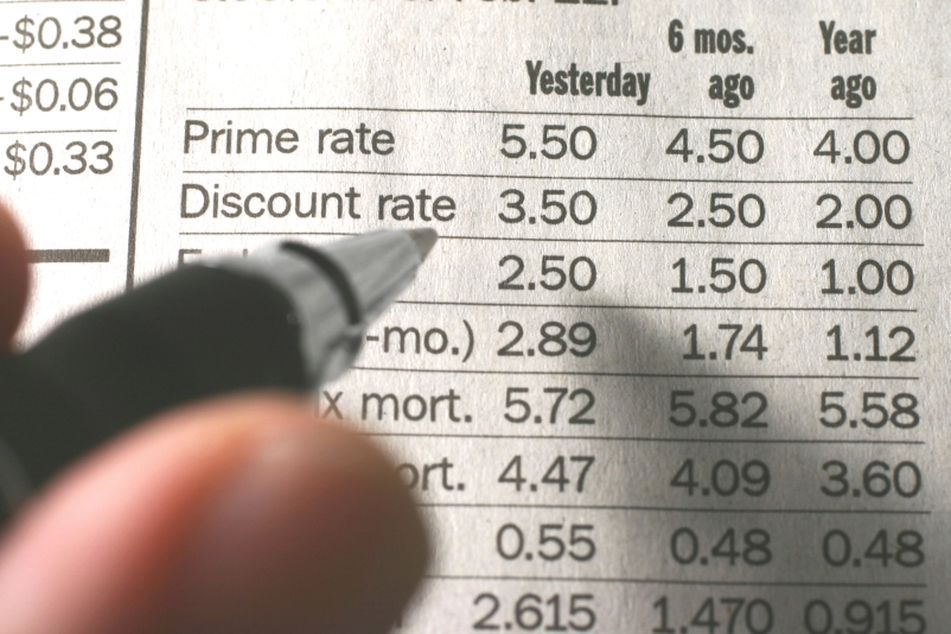

Never mind fretting over higher interest rates, because the Federal Reserve’s next move will be another round of quantitative easing, according to Peter Schiff, chief executive and global strategist at Euro Pacific Capital.

“This is not a recovery, it’s a bubble, and I think the Fed is fearful of pricking it,” Mr. Schiff said Wednesday in Las Vegas at the SkyBridge Capital SALT conference.

“The Fed can’t raise rates, so they just keep talking about it, and it doesn’t matter what the data says, we’re going to get QE4,” he added, referring to a fourth round of quantitative easing. “When the Fed does raise rates, it will be because the market forces its hand and then we will have a worse situation to deal with.”

(More: New York Fed President Dudley says economy is strong enough to handle rate hike this year)

Mr. Schiff was one of five panelists for a session aimed at providing macroeconomic forecasts.

While the panel included an eclectic mix that included a former prime minister of Greece and a former assistant to President Barack Obama for economic policy, Mr. Schiff presented the bleakest outlook for the United States by challenging policies employed at home and abroad.

U.S. LIKE GREECE

On Greece, a country teetering on the brink of default and leaning toward leaving the eurozone, Mr. Schiff said, “The U.S. has a lot more in common with Greece than is generally perceived.”

George Papandreou, the prime minister of Greece from 2009 to 2011, said of all the deficits that Greece faced, “the worst deficit was a credibility deficit.”

“The Greek and the European governments have to get off their high horses,” he added in a reference to continuing political gamesmanship.

“Right now we’re suffocating the private sector and the middle class,” he said. “This is not only a Greek issue, but it’s an issue inside the euroddzone.”

(More: Gross says 35-year bull market in stocks and bonds coming to an end)

Mr. Schiff’s insistence that, instead of another round of QE, the U.S. economy needs to grind through the pain and fallout from higher interest rates, butted up against the logic of Gene Sperling, who worked on economic policy under Presidents Bill Clinton and Obama.

Mr. Sperling was challenged by moderator Steve Forbes, chairman of Forbes Media, about why the U.S. economy isn’t doing better six years into a recovery.

“Two terrible things happened with the financial crisis,” Mr. Sperling said. “One was the financial crisis, and the other was the deleveraging and the cleaning up of balance sheets.”

He added the he believes the $800 billion stimulus package was helpful, but that it was hurt by the contracting economies at the state and local levels.

EL-ERIAN TRIES TO STEER CLEAR

Mohamed El-Erian, chief economic advisor at Allianz SE and chairman of Mr. Obama’s global development council, joked that he wanted to stay out of the debate between Mr. Schiff and Mr. Sperling about the politics of the Fed’s monetary policy, but apparently couldn’t resist.

“Up to 2008, we fell in love with the wrong markets — credit and financing — because we believed they could grow,” he said. “We have not yet had the handoff to real growth.”

Asked about the impact of economic policies on small business growth, Mr. El-Erian said he is “less worried about the startups. I worry more about the existing businesses that see uncertainty in Washington.

“We need corporate tax reform to clean up a tax system that is too high because the exemptions are too high,” he said. “We seem to still have this notion that governments are in control, but I wonder whether we’re living in a new world where government don’t control as much.”

Mr. Schiff believes the government is definitely in control of the current market cycle, but he sees things getting more dire before they get better.

WORSE THAN 2008

“Not only is the next financial crisis going to be worse than 2008, it’s going to be worse than what 2008 would have been like if the Fed hadn’t bailed out the markets,” he said. “Right now the economy is sicker than it was before the financial crisis, because this hasn’t really been a recovery — it’s been a gigantic bubble.”

He shunned suggestions that the Fed will raise rates this year.

(More: Why the Fed won’t raise rates this year)

“The Fed has been bluffing that it’s going to raise rates, but now we’re getting April data that’s worse than the March data, and they can’t blame that on the weather,” he said. “The government won’t let the market heal itself, but the day of reckoning is coming.”

Learn more about reprints and licensing for this article.