The challenge of keeping clients away from shiny new investing trends

A firsthand example of how hard it can be for investors to ignore something that looks exciting.

Over the last decade, we’ve heard a lot about “alternative” investments. From hedge funds to startups, investors often wonder if they need something different in their portfolio.

Plus, it looks like easy money. A billion-dollar startup? A zero-risk hedge fund? Sign me up. Who wouldn’t want a piece of that action?

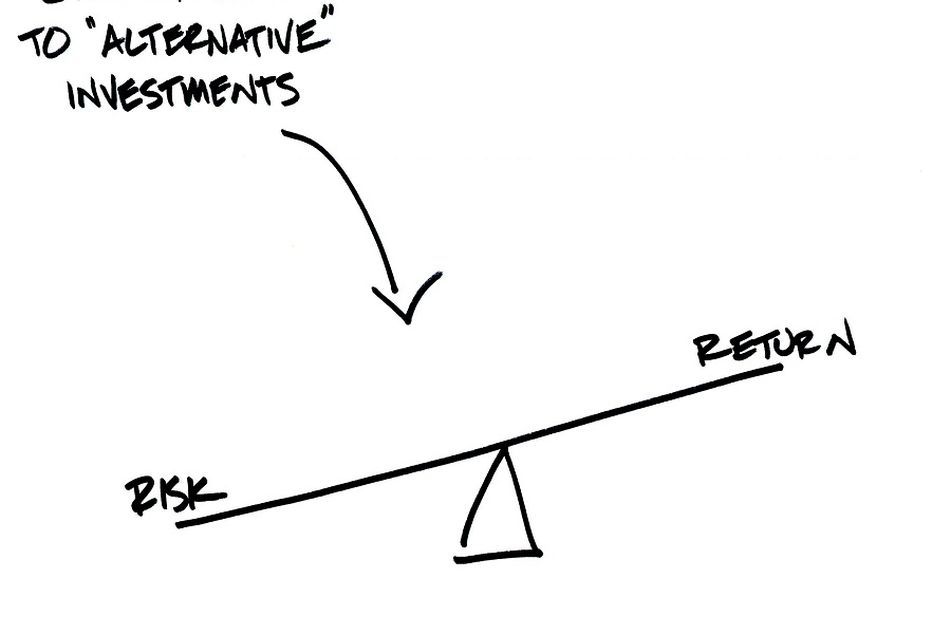

But if we have an immutable law in finance, it’s that risk and reward are related. In other words, if you expect a big reward, understand that greater risk is required.

It’s just part of the deal, but sometimes we’ll hear people say otherwise. So if someone is running around saying, “I’ve figured out how to deliver huge returns with zero risk,” run, don’t walk, to get away.

A few years ago, I saw firsthand how hard it can be for investors to ignore something that looks exciting. I submitted a proposal to a large family trust. It was a well-designed, low-cost plan. In theory, it was everything they said they wanted. But I later heard they decided to go with another option.

(More from Carl: Remind clients: You’re there to help them avoid costly mistakes)

Curious, I followed up with my contact and asked what I’d missed. He replied, “They liked your proposal, but it was boring.” The low costs and easy-to-understand strategy made them think it wouldn’t work. Huh.

Puzzled, I waited a couple of weeks and sent an updated proposal. It was the original plan, but I adjusted the numbers a bit and changed how I described the plan. It was now a proprietary system, and I’m pretty sure I used the phrase “black box.”

This reply was a bit different from the first one: “You should come talk to us.” I then explained what I’d done. No surprise, I haven’t heard from them since.

Alternative investments may make sense for different investors. But we can’t break the connection between risk and reward. We owe it to clients to help them better understand this relationship so they can make the best financial decisions.

Carl Richards is a certified financial planner and director of investor education for the BAM Alliance. He’s also the author of the weekly “Sketch Guy” column at the New York Times. He published his second book, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money (Portfolio) this year. You can email Carl here, and learn more about him and his work at BehaviorGap.com.

Learn more about reprints and licensing for this article.