Displaying 10200 results

Congressional sit-in disrupted by failed attempt to override veto of anti-DOL fiduciary rule bill

Attempt to override the presidential veto of an anti-DOL fiduciary rule bill was used to interrupt a protest demanding action on gun-control legislation.

LPL, Cambridge and others in ‘serious’ talks to buy Foothill Securities

The adviser-owned independent broker-dealer is in “serious discussions” to be acquired by a larger firm, with LPL, Cambridge, and others as potential suitors.

Adviser’s Consultant: Outsourcing many compliance duties best move for CCOs

Unless firm can spend $200,000-plus a year, don't keep most compliance functions in-house.

DOL’s rule on state retirement plans arrives at OMB

The regulation, which offers states a route to avoid liability under ERISA, took its final step toward finalization.

Advisers asking DOL for clarification on fiduciary rule’s impact on compensation

Labor Department's Tim Hauser discusses fiduciary rule's impact on compensation.

Raymond James agrees to $5.95 million settlement with Vermont over alleged compliance failures

Vermont's regulator found supervisory failures under an EB-5 program helping to develop the state's ski resort

Adviser, insurance groups step up spending on political campaigns

Some have a board mandate to shell out more, while others have been encouraged by seeing their donations enhance their lobbying efforts.

MoneyGuidePro creator releases DOL fiduciary-focused software

Firms that use the tool will have a way to gauge if clients are invested to their best interests.

SEC ‘temporary’ principal trading rule to expire

Official says few firms are using it, although SIFMA has been a proponent of keeping it alive.

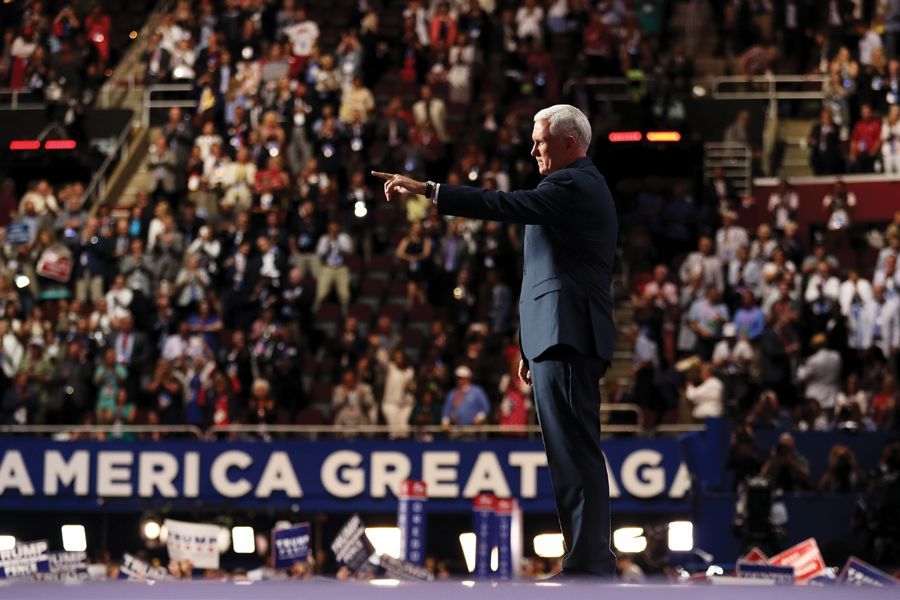

Republican convention speakers back tax and financial reforms

The future of tax reform and other adviser-related interests are getting attention at the Republican party convention. (More: 10 sectors to watch when Hillary Clinton or Donald Trump become president)

Under new fiduciary rule, DOL has reason to pay attention to reverse churning

Another reminder of the need to become well-versed on the fiduciary rule's conditions for rollover advice.

Why the DOL fiduciary rule will lead to more ETF innovation

Asset managers must expand the depth and breadth of their offerings to become more relevant and differentiated.

American Century employees sue for excessive 401(k) fees

Plaintiffs allege the asset management firm populated the retirement plan with proprietary investments for its own gain.

Dismissal of small 401(k) plan excessive-fee lawsuit ‘highly atypical’

The case, which involved a $9 million plan, was voluntarily dismissed by plaintiffs in an unusual turn of events.

Transamerica settles 401(k) excessive-fee lawsuit with its employees for $3.8 million

The retirement plan provider joins a list of other financial firms that have settled excessive-fee lawsuits with their own employees.

Finra proposes rules to restrict political contributions by brokers

Regulator is following up on similar rules the SEC put in place for investment advisers.

Former Eagles player defrauds football coaches, others out of $6 million

SEC complaint alleges Merrill Robertson Jr. and partner promised 20% and took client funds

Franklin Templeton sued by employees for self-dealing in 401(k) plan

The asset management firm joins the likes of American Century Investments and New York Life, which were also sued by employees for using proprietary funds in their 401(k) plans.

New York Life sued by employees claiming excessive 401(k) fees

Employees are suing for alleged self-dealing and fees charged by a company-affiliated index fund, which plaintiffs claim enriched New York Life at the expense of employees' retirement savings.

House overwhelmingly approves expanding accredited-investor pool

Lawmakers sent a strong signal this week to financial regulators that more investors should qualify to buy unregistered securities.