Displaying 10200 results

Advisers should get behind a bill to strengthen senior financial protection

Push by advisers could help tug this needed legislation out of the doldrums and on to the president's desk.

Boston RIA hit with $48 million arbitration award

Clients accused Lee Weiss of recommending an unsuitable investment in a Polish tobacco company.

Finra alleges former broker put clients in risky ETFs to hedge against financial doom

Richard William Lunn Martin improperly recommended non-traditional ETFs while warning of economic collapse, Finra said

SEC fines WFG Advisors $100,000 for overcharging clients in alternative investments

The wealth manager overbilled for investments in REITs and BDCs

The greatest risk to RIAs that’s not in their portfolios

Here are some of the most critical and potentially damaging misconceptions held by compliance professionals.

White vows to forge ahead on fiduciary duty, third-party exams despite diminished SEC

Chairwoman Mary Jo White and commissioner Kara Stein laid out regulations the agency will tackle, despite missing two of its five members.

Shift of SEC resources to RIA oversight not likely to stop push for third-party exams

A move by the Securities and Exchange Commission to beef up oversight of investment advisers probably will not stop the agency's effort to establish third-party exams for the sector.

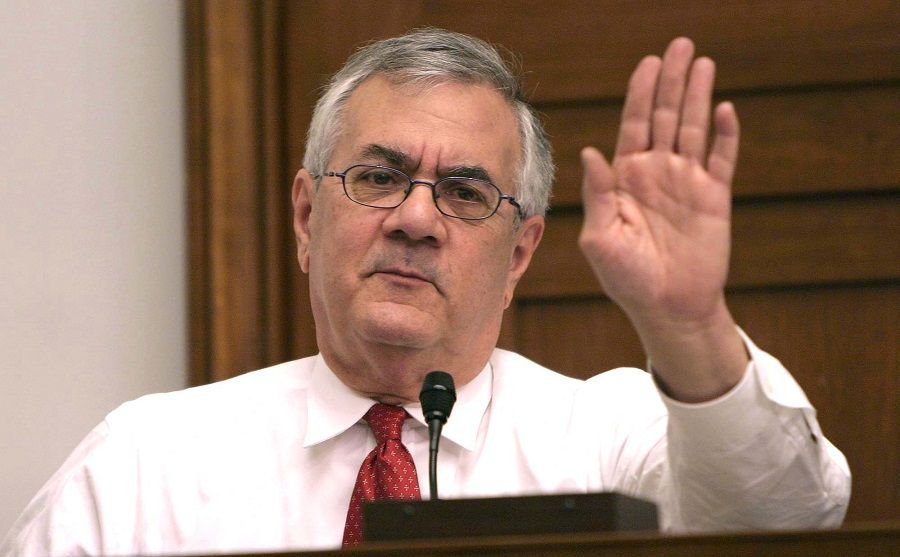

Dodd-Frank architect Barney Frank blasts decision to overturn MetLife SIFI status

The former House Financial Services committee chair criticized the ruling and said it could ultimately lead other institutions to try to overturn their SIFI status.

With anti-DOL fiduciary rule lawsuits, industry organizations’ actions speak louder than words

How can those suing to quash the DOL rule, like SIFMA CEO Ken Bentsen Jr., claim to also support its premise?

SEC plans to propose fiduciary rule next April

Another item of interest to financial advisers, third-party exams, is also on the docket for next spring.

SEC going after advisers for reverse churning

Breakfast with Benjamin The commission is specifically looking at why some clients are in advisory accounts versus brokerage accounts.

Finra fines Lincoln Financial broker-dealer $650,000 for failing to protect client data

Records of thousands of clients were exposed to foreign hackers, regulator claims.

DOL fiduciary rule places risk management software center stage

Tech vendors are getting the spotlight thanks to the new regulation and market volatility.

Litigation schedule set for suits against DOL fiduciary rule

The plaintiffs and Labor Department are seeking summary judgment for the cases in a Dallas federal court, with a decision possible in October.

Merrill Lynch to pay $415M to settle SEC charges it misused customer cash

In responses to charges it misused customer cash, the wirehouse agreed to the payment and to admit wrongdoing in violations of the customer protection rule.

Jackson National’s new variable annuity hints at annuities’ future post-DOL fiduciary rule

The firm is developing its first fee-based variable annuity, which many experts say is the future of the product line in the qualified market.

Bank of America Merrill Lynch to trim mutual fund offerings

The firm hopes to make it easier for clients and advisers to understand sales charge reductions and waivers.

MetLife is second major insurer to exit the brokerage business, in the sale of adviser unit to MassMutual

MetLife is the second major insurer to exit the brokerage business, in the sale of its adviser unit to MassMutual. Mergers may be on the rise due to the Labor Department's proposed fiduciary rule.

John Oliver and Congress square off over DOL fiduciary rule

Rule advocates say it would save investors $17 billion a year. House Republicans call it 'Obamacare for financial planning.'

TIAA’s Roger Ferguson breaks with rivals to support Obama fiduciary rule

Former Fed vice chairman says he doesn't support litigation over the controversial regulation.