Flood of Bitcoin ETF filings but cooling demand for funds

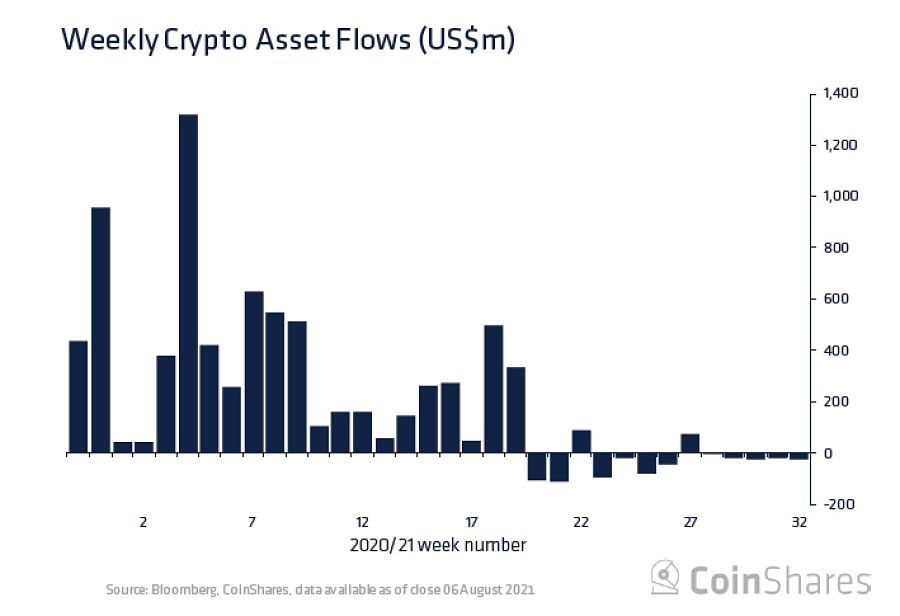

Digital asset investment products from Grayscale, Bitwise, 21Shares and others saw outflows for the fifth straight week, the longest such streak since January 2018.

Securities and Exchange Commission Chairman Gary Gensler ignited a fresh wave of optimism among Bitcoin exchange-traded fund advocates this month — but it’s unclear whether investors share that enthusiasm.

Digital asset investment products from Grayscale, Bitwise, 21Shares and others saw outflows for the fifth straight week, the longest such streak since January 2018, according to data compiled by CoinShares. The outflows total roughly $93 million over that stretch. Much of it reflects money being yanked away from Bitcoin products, according to the digital asset manager.

The cooling appetite stands in contrast to the growing pile of cryptocurrency ETF filings, with at least 18 applications landing with the SEC this year. That tally grew by three in the past two weeks after Gensler signaled that regulators may be more open to a Bitcoin ETF if it was based around futures rather than the cryptocurrency itself. However, even if the SEC finally green-lights the fund structure, it’s not a sure bet that a Bitcoin ETF would be met with huge demand, according to Meltem Demirors of CoinShares.

“There’s so many venues for people to buy and sell Bitcoin, to get exposure to Bitcoin in tax-managed accounts,” said Demirors, chief strategy officer at CoinShares. “We’re not really sure what the demand will look like because the maturation of crypto in the U.S. is already quite high.”

After setting an all-time high of nearly $65,000 in April, Bitcoin resumed its volatile price swings. The world’s largest cryptocurrency dropped below $30,000 in June as environmental and regulatory concerns hammered sentiment. Bitcoin has since rebounded to more than $46,000, even as the Senate passed an infrastructure bill that would allow for broad oversight of virtual currencies.

However, fund flows have yet to match the rebound. Bitcoin funds and futures are on track for a third straight month of outflows, the longest streak in data going back to 2014, according to Bloomberg Intelligence. The bulk of that decline is due to decreasing open interest in Bitcoin futures, meaning traders let their contracts roll off without renewing.

The outflows might even be bigger, if not for the fact that the $30 billion Grayscale Bitcoin Trust (GBTC) — the largest crypto fund — doesn’t allow for share redemptions. That’s after shares of the trust ballooned by the hundreds of millions earlier this year amid the crypto craze. As a result, GBTC has traded at a persistent discount to its underlying Bitcoin since March.

Still, in the eyes of Bloomberg Intelligence’s James Seyffart, it’s just a matter of time before investors flood back into crypto funds.

“I think there’s still demand for Bitcoin products that people can access on the traditional financial system rails, if you will,” Seyffart said. “Flows tend to follow performance in areas and products like this, so with the recent weeks of performance for Bitcoin, I wouldn’t be surprised to see those flow numbers potentially turn around.”

[More: MassMutual indie broker-dealer to sell Bitcoin fund]

Being an only in the financial industry has been challenging

Learn more about reprints and licensing for this article.