Sponsored Content from BNY Mellon's Pershing

3 Questions to Ask to Power Up Your People Strategy

In 2020, many firms chose a steady-as-she-goes approach to compensation and staffing levels – but may face a major retention challenge as the “great resignation” wave engulfs America.

2020 redefined the term “challenging,” as a global pandemic, political clashes, social reckonings, natural disasters and financial turbulence converged to test us both personally and professionally. In the midst of such rapid change, it was awe-inspiring to witness the creativity and resilience of Pershing’s advisory firm clients, who reinvented their businesses on the fly while maintaining a laser-like client focus.

Now, as 2021 enters its closing months, firms are facing a different but no less formidable challenge: the potential flight of top talent in a trend dubbed the “Great Resignation.” How seriously should we take this trend? A recent Harvard Business Review article ( Who is Driving the Great Resignation? ) cited U.S. Bureau of Labor Statistics showing that 4 million Americans quit their jobs in July 2021 following several previous months of abnormally high resignations. And this might only be the beginning: A Gallup analysis posted in July found that 48% of the U.S. working population was actively job searching or watching for opportunities.

This surge of ready-to-leap employees should be of particular interest to advisory firms, when you consider the results of the newly released 2021 InvestmentNews Adviser Compensation & Staffing Study which analyzes staffing, development and rewards approaches across hundreds of advisory firms during 2020. This research, which Pershing sponsors, is marking its 30th anniversary, so it has chronicled plenty of industry ups and downs.

Given the historic year, I was unsure what to expect when reading the results: Would firms adapt their human capital approach to respond to business pressures? Would they make epic changes to address a transformed workplace? As it turned out, the study reveals an industry that has doubled down on its existing compensation and staffing strategies, despite being buoyed up by a highly resilient market. In 2020, the industry achieved yet another year of growing assets under management (AUM), revenue, profits and valuations. (Check out our 2021 InvestmentNews Pricing & Profitability Study for full details).

One striking finding is that compensation levels remained largely flat (or even declined) for the average firm, sustaining a trend that’s been holding for the past few years. We might have expected some kind of uptick in compensation, considering the myriad of new demands placed on advisors and other employees during 2020. Whether this trend reflects static market pay scales or a maturing advisory industry, we know that employees feel the effects of pay stagnancy as they consider their post-pandemic career plans.

With compensation flat despite business growth, you might guess that firms would feel a capacity pinch and ramp up their advisor recruitment. But, again, firms followed their own path. Two-thirds of firms reported that they possess enough capacity to grow the business more before they add more advisors. Compensation is important, but we know attracting and retaining talent is much bigger – so how do you?

How to turn around talent turnover

When you consider these study findings in light of the Great Resignation wave, it’s clear that firms are approaching a crossroads with their human capital approach, particularly with the heightened tension of navigating return-to-office mandates and other initiatives. Employees at every level are eyeing new opportunities, even as they take a hard look at their current situations – to assess what it might mean to stay right where they are, contributing their best work. This means that firms have a brief opportunity to be proactive – to adapt processes for building employees’ skills, providing clear avenues for advancement, and cultivating ways for them to drive and benefit firm growth in the years ahead.

As you consider such strategies, here are three questions that your advisors and other employees may be asking themselves right now: How would you respond?

1. Where am I heading in this firm?

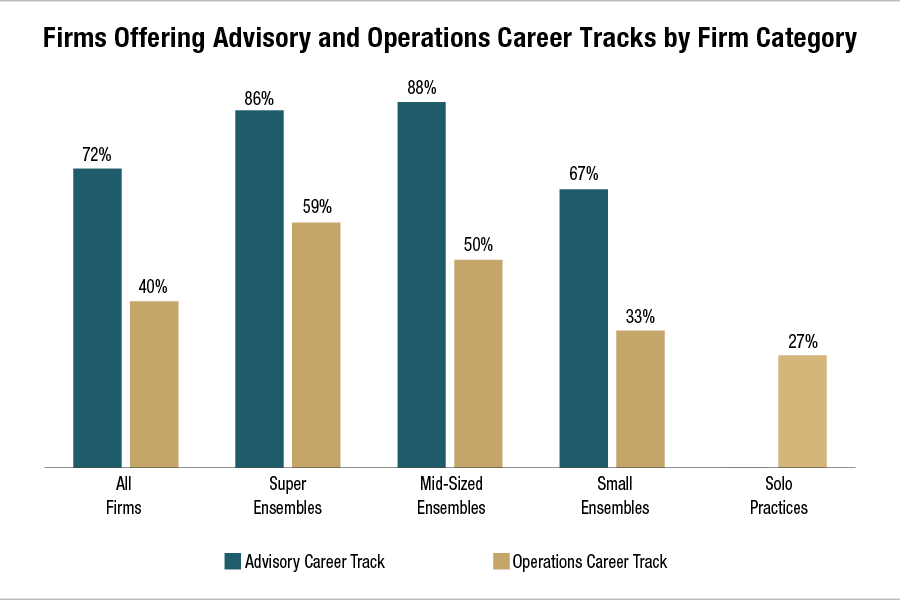

In times of uncertainty, employees need a sense of what’s ahead for them if they remain on the team. Firms traditionally have provided career tracks for their advisory talent; this remained the rule in 2020 as nearly three-quarters of firms reported having such tracks for their advisory teams. However, non-advisory employees may have far less clarity about their evolving roles in the firm. As illustrated below, about 40% of firms, on average, provided career paths for their operations and administrative support functions. Considering the increasing impact these non-advisory team members have on business success – driving technology adoption, innovation and efficiency, among other things – firms may want to create relevant career tracks that illuminate a path forward and demonstrate genuine commitment to these employees’ futures.

To be meaningful, career tracks must be accompanied by relevant training and development opportunities. Development plans vary based on position, but typically involve a combination of structured and on-the-job training. The firm may decide to invest in outside resources to handle nuanced training requirements. For example, more than 68% of participating firms rely on third-party leadership coaching and education to help them develop their future leaders. In any case, formal performance feedback plays a vital role in assessing an individual’s progress along their professional continuum. More than 85% of the firms in the study conduct formal performance evaluations, which gives firm leaders a platform for reaffirming their commitment to the professional growth of each advisor and staff member and investing in relevant and exciting training opportunities.

2. How will the firm reward me for my contributions?

In light of the flat-lined compensation described above, firms may want to revisit their approaches to salary, bonuses and other forms of compensation. The study provides an excellent source of benchmarking data, but other factors such as office geography and performance priorities play an important role in an effective calculus. It should go without saying that the pandemic has made where people work just as important as the money they make for their efforts. Clearly, elevating compensation for top talent should be on every firm’s radar screen, but equal attention must be paid to negotiating where individuals will perform their work. A little flexibility on the firm’s part may spell the difference between a key player departing or staying on the team and feeling even greater loyalty.

3. What’s in it for me in the long run?

This final question is asked by employees in every era, but it has particular resonance right now as employer-employee social contract is being rewritten in real time. And it’s a question that’s best answered in a context broader than just compensation levels. The time is ripe for aligning employees even more closely with a firm’s success and growth by making business development an imperative across the firm. Traditionally, a firm’s owners have been the key drivers of business development, but this approach is not sustainable in light of the industry’s changing demographics. Driving growth can be part of everyone’s mission, but business development savvy does not come naturally to many people. Cultivating such skills is key, but less than a third of firms in the study said they put professionals through a formal business development training program. Firms that choose to invest in making business development a core part of their culture have the opportunity to engage every employee in driving growth – and keeping eyes focused on the future.

A final word

As the Great Resignation phenomenon ripples across the U.S. workforce, every firm will pursue its own strategy for securing talent through a combination of rewards, development and engagement. No matter your path, the 2021 InvestmentNews Adviser Compensation & Staffing Study will provide extensive benchmarking data to shape your approach.

Pershing is proud to be celebrating three decades of this important study, and we remain confident that – by sharing ideas and innovations, engaging and rewarding talent, and maintaining keen focus on investor needs – the best years of the advisory industry lie ahead.

About the author

Christina Townsend is a Managing Director and Co-Head of Relationship Management Wealth Solutions at BNY Mellon | Pershing. She, and her team, work collaboratively across the enterprise to develop, implement and support the strategy and solutions available to wealth managers, registered investment advisors, multi-family offices and trust companies. She has a team of dedicated relationship management experts working with prospects and clients to optimize their businesses. Christina is a member of the Wealth Solutions Executive Committee.

Prior to her current role, she led the Managed Investments product and transition teams and served on the Managed Investments Executive Committee. She was responsible for the product strategy, roadmap and implementing client’s managed account solutions.

Christina joined Pershing in 2000. She started her career in the corporate intern program and then spent a number of years supporting business process improvement efforts for the firm. She managed a team that was responsible for delivering large-scale technology and new client conversion projects.

She is the North America Co-Chair of BNY Mellon’s Women’s Initiative Network and is a member of the BNY Mellon WIN Executive Council.

Christina earned a Bachelor of Science degree in Economics from Bates College. She completed the Securities Industry Institute® program, sponsored by Securities Industry and Financial Markets Association (SIFMA), at the Wharton School of the University of Pennsylvania.

Connect with Christina Townsend on LinkedIn

Learn more about reprints and licensing for this article.

This content is made possible by BNY Mellon's Pershing; it is not written by and does not necessarily reflect the views of InvestmentNews' editorial staff.