Federal Reserve pivots toward jumbo hikes after being slammed as too slow

The Fed quickly became more concerned that the surge in food and energy prices caused by the war in Ukraine would entrench inflation — and expectations — at unacceptably high levels.

Federal Reserve officials, rattled by persistent inflation and criticism that they’re behind the curve, have pivoted toward an even more aggressive plan of interest-rate hikes than they signaled earlier this month to ensure price increases cool.

In the days after the March 15-16 Federal Open Market Committee meeting, Chair Jerome Powell and his colleagues shifted from a long-standing preference for slow and gradual interest-rate increases to front-loading policy with a half-point hike on the table in May and more to come.

The war in Ukraine initially made them cautious, with officials backing a quarter-point increase this month as they raised rates from near zero. But investors took the hike in stride and the Fed quickly became more concerned that the surge in food and energy prices caused by the war would entrench inflation — and expectations — at unacceptably high levels.

In speech after speech since they raised rates, officials stress that they want the central bank’s lead role in cooling price pressures to occupy a much more prominent part in the national conversation.

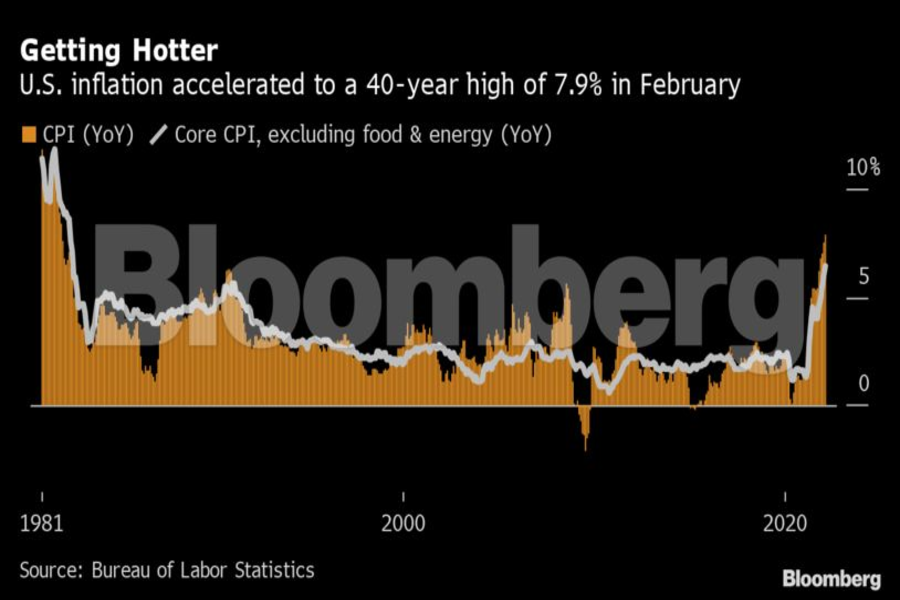

“Inflation, inflation, inflation is the top of everyone’s mind,” San Francisco Fed President Mary Daly told the Bloomberg Equality Summit on March 23, adding that “I have everything on the table right now,” including a half-point hike in May, to cool the hottest price pressures in 40 years.

Daly’s comments followed those of Chair Jerome Powell who in a March 21 speech said the policy committee needed to move “expeditiously,” a more aggressive tone than his post-meeting press conference a few days earlier.

The suddenness of the shift — the latest escalation from the Fed since it began signaling tighter policy toward the end of last year — leaves the impression that officials are scrambling to catch up, said Derek Tang, an economist at LH Meyer in Washington.

“They bet their name on inflation coming down in the second half,” he said. But with Ukraine raising food and energy prices and China supply chains further crimped by virus lockdowns, “it looks less and less likely that is going to happen.”

That assessment seems to have pushed the center of gravity on the Federal Open Market Committee toward a half-point hike in May, with investors leaning into that bet in interest-rate futures markets and pricing around 2.1% percentage points of more tightening for the year as a whole — the equivalent of about eight quarter-point hikes over six remaining meetings this year.

Some on Wall Street expect the Fed to go even faster: Citigroup Inc. economists have penciled in four straight half-point hikes, followed by two quarter-point moves.

WHAT BLOOMBERG ECONOMICS SAYS…

“Fedspeak since the March FOMC meeting has confirmed one thing: The FOMC would have hiked interest rates by 50bps in March had Russia not invaded Ukraine. The war has immediately exacerbated inflation, but the dampening effect on U.S. growth or the labor market has yet to show.” — Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger (economists)

Minneapolis Fed President Neel Kashkari, one of the last doves, penned a clarifying mea culpa on March 18 explaining how his views on both inflation and interest rates had evolved.

Loretta Mester, the Cleveland Fed President who is a voting member of the Federal Open Market Committee this year, suggested Feb. 24 that she would wait until midyear to determine whether the rate path needed to speed up. A month later, she said she found it “appealing” to front-load some of the rate increases “earlier rather than later.”

“When things turn out different than you anticipated, you admit your forecast was wrong and adapt,” said former Fed Vice Chair Donald Kohn, who’s now a senior fellow at the Brookings Institution. “You might argue that the forecast was unusually wrong, and the adaptation has had to be unusually quick and large.”

In fairness to his former colleagues, Kohn also pointed out that there’s nothing in the experience of recent policy making or forecasting to compare with the shock of the Covid-19 pandemic.

In past cycles, Fed officials had reasonable confidence in their forecasts and that the economy would behave as it had done in the past. Now, they say they are beyond both their goals for maximum employment and stable prices. That’s put their forecast on trial: If the evidence makes a strong case that it is wrong, they must adjust policy.

Cracking the code on inflation

Learn more about reprints and licensing for this article.