Alts are rockin’ the house!

Demand for income, inflation protection, enhanced returns and volatility dampening has created a ‘Goldilocks moment’ for alternative investments.

While the biggest bands of the 1960s were The Beatles and The Rolling Stones, the decade also saw the emergence of so-called “alternative” acts like The Velvet Underground and Iggy Pop & The Stooges offering different takes on rock ‘n’ roll. The 1970s saw alternative sounds crystallize into new genres, and college radio stations in the 1980s created a larger market for them, paving the way for Nirvana’s 1991 album “Nevermind” to finally push alternative music to a mainstream audience.

Thirty years later, the financial services industry seems ready for its own version of alternatives to push into the mainstream. Just as alternative music attracted fans looking for something different from popular radio hits, alternative investments give wealth management firms a way to stand out from the crowd in a world of increasingly commoditized investing, said Doug Fritz, co-founder and CEO of consulting firm F2 Strategy.

“[Alternatives] can be different and unique and provide something to a prospect that they can’t get anywhere else,” Fritz said. “It’s like the Kirkland brand of vodka — maybe it’s Grey Goose. No one can tell. But if I don’t have my own handmade vodka crafted with baby tears, no one is going to work with me.”

Demand for income, inflation protection, enhanced returns and volatility dampening has created what research from Cerulli Associates calls a “Goldilocks moment” for alternative investments. Financial advisers are allocating an average of 14.5% of portfolio assets to alternative investments and plan to increase the portion to 17.5% in two years, according to a survey conducted by Cerulli and Blue Vault Partners, an alternative investments researcher.

While the numbers should be taken with a grain of salt, with actual growth probably being closer to single digits industrywide, the data still indicate an asset class hitting its stride, said Daniil Shapiro, director of product development at Cerulli.

“Our polling across both this and our broader adviser survey shows that advisers are planning to increase alternative investment allocations,” Shapiro said. “And this is certainly carried through via adviser assets that are invested in these exposures.”

Challenges still exist for many advisers, but the demand has led to a proliferation in the number and types of products available.

And companies looking to solve the problems for advisers have attracted significant investments. CAIS and iCapital, two digital marketplaces that are like the Amoeba Music and Tower Records of alternative investments, are valued, respectively, at $1.1 billion and $6 billion.

Independent advisers are seeing an influx of marketing materials from new platforms offering access to alternatives, said Jeffery Nauta, principal and chief compliance officer of Henrickson Nauta Wealth Advisors, a hybrid RIA based in Belmont, Michigan.

“A day or two doesn’t go by that I don’t receive an email on an investment offering from one of those platforms. A lot of these platforms have some type of tech, but some are just quasi-placement agents,” he said in an email. “Along with that, we’re seeing pitches to increase allocations to alternatives along with opportunities for education on various alternatives.”

But just as alternative music never totally took over the airwaves, some advisers are less bullish on adding alternative investments to portfolios.

“The more a product sponsor has to spend on marketing, the crappier the product is,” said Rene Bruer, co-CEO of Smith Bruer Advisors, a fee-only RIA operating out of Tallahassee, Florida and Colorado Springs, Colorado. Bruer has received invitations to weekend getaways hosted by alternative asset managers but sticks to traditional strategies from Dimensional Fund Advisors.

“The good products over time stand on their own,” he said. “They’ve been around for decades upon decades, stood the test of time and it works.”

Because while drinking at clubs and tickets to concerts — sometimes for music that people haven’t even heard of — may have diminished some music fans’ life savings, it never came close to toppling the global economy as derivatives linked to mortgage-backed securities did in 2008.

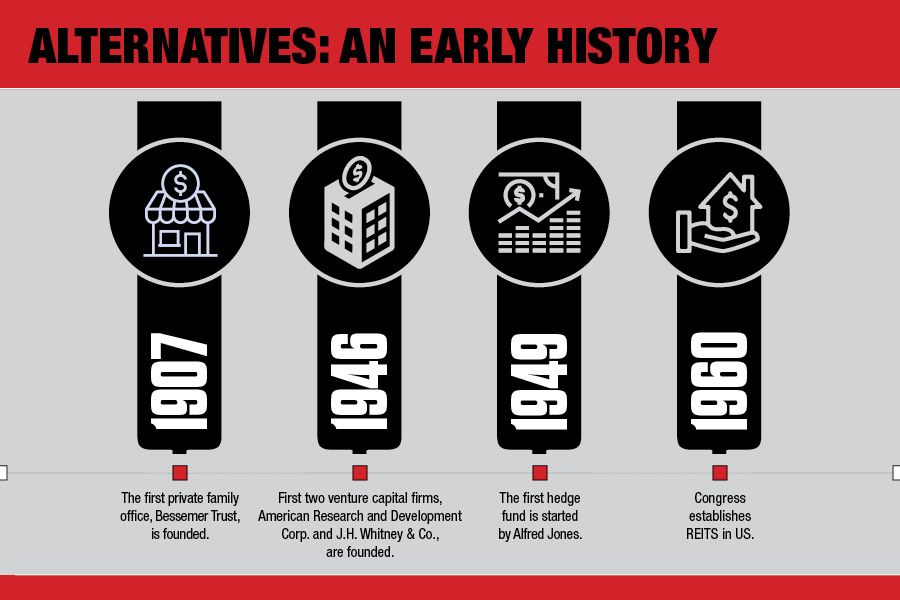

IN THE BEGINNING

“Alternative investments” is a broad term that generally refers to any investment that isn’t cash, stocks or bonds. While the term is relatively modern, private-capital-type investments can be traced back to the industrial revolution, according to Preqin, a company that provides data and analytics on alternatives. Venture capital investments in private markets rose to prominence following World War II, the first hedge fund launched in 1949 and boomed in the 1970s, and leveraged buyouts and private equity became staples in the 1980s.

Growth, however, was primarily driven by institutional investors such as pension funds and endowments, as well as some advisers serving ultra-high-net-worth clients. Now, new types of products are opening market segments that were traditionally closed to individual clients, and technology is making it easier than ever for advisers to access them.

“The money is definitely getting behind this technology because private equity firms are seeing that although pension funds and other corporate investment structures are all but maxed out in the asset class, the private market of accredited investors is ripe for the picking,” said Eric Roberge, founder of Beyond Your Hammock, a fee-only financial planning firm in Boston. “Now platforms like CAIS are trying to connect with the adviser crowd to gain access to these accredited investors and the pitch isn’t all that bad. Instead of the typical highly illiquid, high-minimum funds, they are pitching $50K minimums with quarterly liquidity options.”

The assets are following. In 2018, alternative assets accounted for 12% of the global market, double what it was 15 years earlier, according to CAIS. Preqin expects assets in alternatives to reach $17.2 trillion in 2025, up from $11.8 trillion in 2021.

SEARCH FOR SAFETY

Alternatives are looking especially attractive in 2022 as the Federal Reserve combats historic inflation. Between a volatile stock market and low-risk bonds dropping in price, advisers are looking for a safe haven as the traditional 60/40 portfolio underperforms from both ends.

EP Wealth Advisors, an RIA out of Torrance, California, has long offered liquid alternatives to clients but is starting to add strategies like private credit and private real estate, said Adam Phillips, partner and managing director of portfolio strategy at the firm. This was done as an acknowledgment that what worked in the past won’t necessarily work in the future, and today’s unique market requires advisers to be creative in how they allocate money, he said.

“We are trying to take a more proactive approach as allocators,” Phillips said. “We see weakness in the market driven by a number of factors. … We’re not abandoning traditional investments, but we see long-term value in these types of investments that have been available to us in the past. If they are additive to portfolios, let’s take a look.”

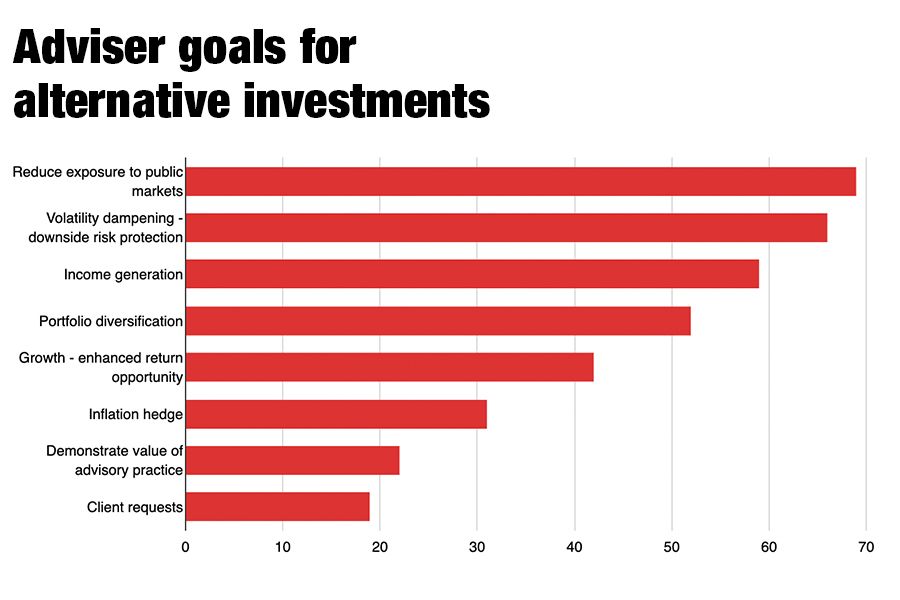

Reducing exposure to public markets is the top reason advisers allocate to alternatives, with 69% of those surveyed by Cerulli and Blue Vault citing this as a goal. Two-thirds of advisers named dampening volatility or offering downside protection as a goal, while 59% cited income generation.

Less than a third said they use alternatives to hedge against inflation, and only 19% said the allocation was in response to a client request.

“The fit of alts will vary exposure by exposure and client by client, hence wouldn’t paint this with one brush,” Cerulli’s Shapiro said in an email. “A key takeaway here is that the demand (and likely brand sale) is coming from the advisors, not their clients.”

SEARCH FOR DEMAND

A survey by F2 Strategy, however, found that some wealth managers are pulling back on their use of alternatives because client demand just wasn’t there. Many advisers aren’t experienced in offering alternative investments, and the knowledge gap is even larger between advisers and clients.

The products themselves also remain cumbersome for many wealth managers. Support and administration of the assets are difficult because of the quality, format and usefulness of data, according to a survey by F2 Strategy. There are also liquidity constraints and additional fees involved.

“Once you start experiencing the challenges there, you realize that there are additional costs and additional considerations. You need to invest in additional resources,” said Joe Price, F2’s senior manager of consulting services. “I didn’t get the read that the advisers are pulling away or wouldn’t use alternative investments, but [rather] decelerating and being more thoughtful with how they approach it.”

“The juice isn’t worth the squeeze,” Fritz said, adding that his survey found 47% of advisers currently using alternatives expect to decrease allocations in the coming years.

Henrickson Nauta Wealth Advisors is one such firm. Though it has allocated 20% to 40% to alternatives for most clients over more than 20 years, the firm is rebalancing this year to sell well-performing alternatives to purchase equities, Nauta said.

Another significant downside is the lack of consistency in how alternative products report pricing. A significant allocation to alternatives can mean an incomplete picture of a client’s assets, which in turn can impact how a firm collects fees.

“Because they aren’t pricing daily, they tend to understate volatility,” Phillips said. “It’s important to educate advisers because we don’t want them pitching something because it’s the easy answer.”

SOME STEER CLEAR

This opaqueness is enough for advisers like Bruer to steer clear of alternatives entirely. The accounting standards on products like private equity are “haphazard at best,” he said, and he knows other advisers whose clients got burned when a product failed to deliver.

Pulling from his background in the military, Bruer tells clients that the road to a good financial outcome is a narrow path with minefields of bad investments on both sides.

“The minute you get off [the path], you’re going to get blown away because there are so many products out there being pushed,” he said.

Bruer is also skeptical of claims about downside protection, citing a lack of long-term data on the viability of some types of alternatives compared to more traditional portfolio models. Without that, advisers are just reverting to market timing, a behavior most encourage their own clients to avoid.

“Clearly a lot of money is being made by marketing and selling these products whose outcomes we don’t know,” Bruer said. “If you’re not doing financial planning and a firm is strictly pitching products, then you’ve got to have that next, sexier thing to talk about.”

Nauta, a self-proclaimed proponent of alternatives, agrees that much of the increased adoption of alternatives reflects the return-chasing nature of financial services. While many of the products being advertised are traditional hedge funds and private equity funds from big-name sponsors with long track records, they won’t create new opportunities for investors or provide the desired diversification, he said.

“Either because you’re receiving watered-down products, asset classes highly correlated with equities, or a combination of both,” Nauta said. “I think there will be a number of clients and advisers that will be surprised and frustrated by the actual realities of owning alternatives.”

After guiding his firm through introducing alternatives to clients, Phillips recommends advisers new to the space to take a serious and methodical approach to due diligence. It can take months to understand a strategy well enough to have the conviction necessary to put an alternative product into a client portfolio, he said.

“A lot of them sound really interesting but what advisers need to understand is you need to look beyond the marketing materials,” Phillips said. “Even though we have approved them, they’re not right for all clients.”

When Nirvana and some of its contemporaries were wildly successful, major music labels quickly invested in hundreds of bands hoping to find the next big alternative hit. The once revolutionary sound quickly became commodified and oversaturated on the airwaves as more traditional pop music made a return alongside the swelling popularity of hip-hop.

While investing trends aren’t nearly as ephemeral as music tastes, advisers need to be wary of untested strategies from managers new to the space, Phillips said. Even if they’ve successfully gathered assets in a short time, alternatives can’t be a crutch to lean on or a distraction for clients when traditional markets are bad.

“I think you need to be careful,” he said. “Alternatives are so personal and unique to clients’ circumstances and their willingness and ability to take on risk, not just with the investment but also liquidity. There is some danger to making these available to clients.”

Learn more about reprints and licensing for this article.