Investing in courtroom outcomes is forecast to be a $24 billion industry in 5 years

The litigation funding investment market js set for strong gains according to a new report.

Retail investors are expected to join institutions in a growing investment market which provides funding for legal disputes.

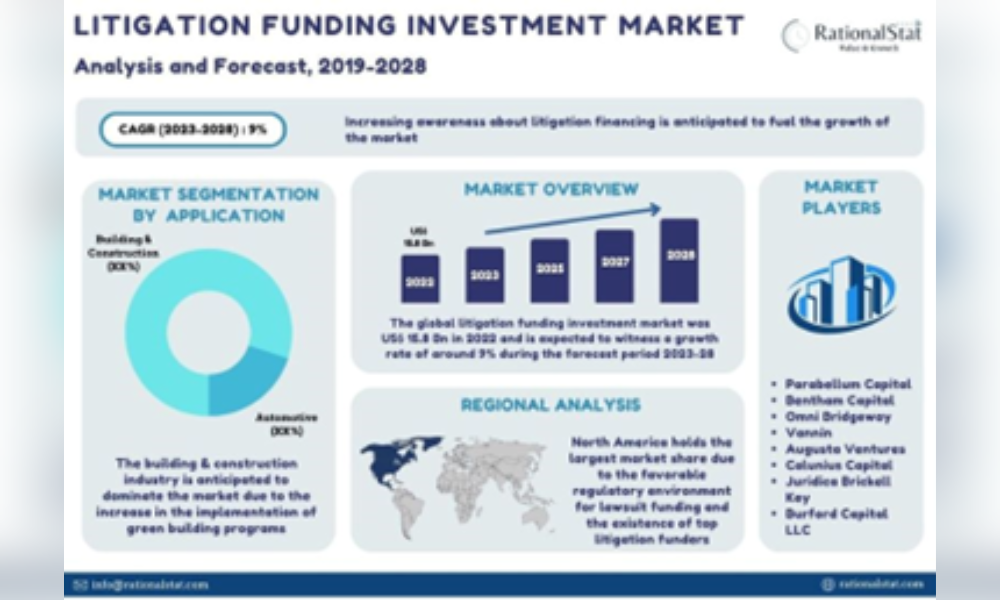

The global litigation funding investment market is estimated at around $16 billion in 2022, but forecast to grow by 9% for 2023-2028, becoming a $24 billion market in five years’ time as the growth of the global legal services market intensifies.

The forecast from RationalStat highlights how increasingly complex legal cases is driving demand for litigation funding as traditional sources of financing such as banks and venture capital firms become harder to secure.

Surging legal fees are also boosting demand for litigation funding while “investors and companies alike are becoming more and more interested in litigation financing, which is also creating new investment opportunities, thus helping the market to grow significantly,” the report states.

The market is expected to see considerable growth in demand from the media and entertainment sector due to rising cases of trademark and copyright infringement although the construction sector will continue to dominate due to a rise in the implementation of green building programs.

NORTH AMERICAN LEADS

North America has the largest market share for litigation funding investment due to its favourable regulatory environment and the presence of some of the largest funders.

While institutional investors have typically been the main participants in the market, retail investors are gaining opportunities too. An Indian fintech firm LegalPay launched an interim finance healthcare-focused fund for retail investors in 2022, enabling them to participate in asset-backed legal and debt financing asset classes through fractional ownership.

Learn more about reprints and licensing for this article.