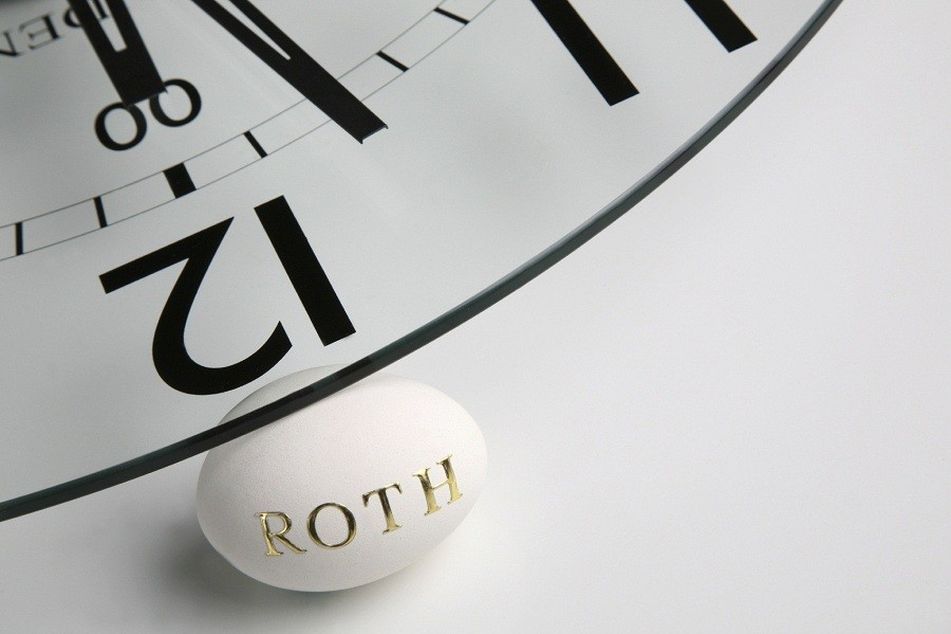

Are Roth conversions after 70½ advisable? 5 factors to consider

Future tax rates and when the money will be needed are among the things advisers should take into account.

The biggest benefit of a Roth conversion of an individual retirement account is the tax-free compounding over time. Those who are over age 70½ obviously have less time to make the upfront tax cost of a Roth conversion worth the benefit, given their shorter life expectancy.

Advisers working with older clients should still address the prospect of a Roth conversion, but first consider these five factors:

1. When will the funds be needed? If the plan is to tap into the Roth funds sooner rather than later, it might not be worth it to pay the upfront tax bill. If funds are needed, it’s also more likely that the client may be in a lower tax bracket, resulting in a lower tax on any traditional IRA distributions.

If the funds won’t be needed in the foreseeable future, it could pay to do the Roth conversion. This lets the tax-free accumulation begin since Roth IRAs have no lifetime required minimum distributions. The Roth funds grow tax-free and eliminate uncertainty about the effect that future higher taxes could have on the traditional IRA RMDs.

After death, the inherited Roth IRA can be passed on to a spouse, who can do a spousal rollover and continue to avoid RMDs, adding more years of tax-free accumulation. If the beneficiary is a child or grandchild, the inherited Roth IRA could be stretched over many decades depending on the age of the beneficiary. In that case, there would be RMDs on the inherited Roth IRA but those RMDs would likely be tax-free.

2. Future tax rates. If the client is concerned about higher tax rates in the future, it might pay to pay the tax at lower rates now and then never again. On the other hand, if you project relatively low tax rates, then a conversion may not be warranted. Remember too that a Roth conversion is not an all-or-nothing choice. Partial conversions may be a way to hedge.

3. Beneficiary’s projected tax rates. Look at the tax rates of the beneficiaries. If they might be in a higher tax bracket, a conversion now can be a good estate planning move so that the beneficiaries can inherit tax-free retirement savings. Of course, the client has to have the funds to pay the conversion tax without worrying about needing those funds for themselves.

If the beneficiaries will be in a lower tax bracket, then it’s probably best not to convert and let them pay the taxes at their lower rates when they inherit. In addition, if there are multiple beneficiaries, their combined taxes will be lowered since each beneficiary uses up their lower brackets. Again, this is not an all-or-nothing decision when it comes to the beneficiaries either. Partial conversions can be done, leaving the Roth funds to a beneficiary who may be in a higher tax bracket and traditional IRA funds to beneficiaries in a lower bracket.

(More: Post-tax-time IRA checkup)

4. Qualified charitable distributions. QCDs are only available to IRA owners (or IRA beneficiaries) who are 70 ½ years old or older. The funds to be donated are transferred directly from the IRA to the charity. The amount transferred is excluded from income and counts toward the RMD. For IRA owners who will take advantage of this to reduce or even eliminate the tax on their RMDs, a Roth conversion might not be necessary, unless it is done in addition to the RMD amount mainly to benefit beneficiaries as an estate planning move. The tax paid on the Roth conversion would be like a gift to beneficiaries.

(More: Why aren’t clients using QCDs? Help them!)

5. Medical bills. Roth conversions probably should be avoided if heavy unreimbursed medical bills are projected. Even under the new tax law, these expenses are still deductible as itemized deductions, if they exceed 7.5% of adjusted gross income (10% for 2019). RMD income can be partially offset by these medical deductions. Roth conversions will increase adjusted gross income and decrease the amount deductible for medical expenses. In addition, when there are significant ongoing medical bills, money may be tight, and paying a tax to do a Roth conversion would not be recommended.

(More: New tax law provides opportunity for tax-rate arbitrage on Roth IRAs)

Ed Slott, a certified public accountant, created the IRA Leadership Program and Ed Slott’s Elite IRA Advisor Group. He can be reached at irahelp.com.

Learn more about reprints and licensing for this article.