[email protected]

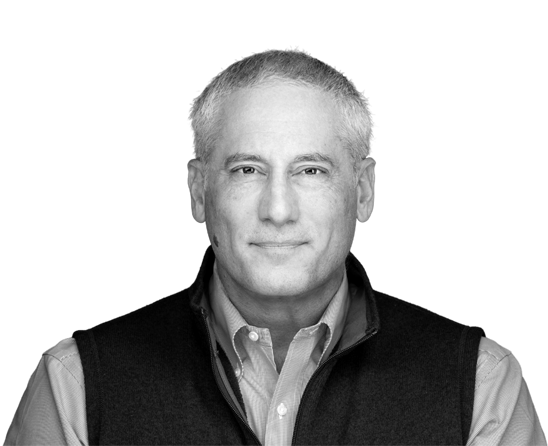

Chuck has been a financial adviser for more than 25 years. He started in the early 90s as a "cold calling cowboy" in NYC selling individual stocks. As he built his book, he always planned to go independent and did so in 1999 by opening an independent branch of Raymond James Financial. At that time, Chuck earned his CFP designation and transitioned from individual stock picking to financial planning and asset allocating using mutual funds and SMAs. Chuck's practice evolved into what is today Sovereign Financial Group Inc., an SEC registered RIA. With offices and advisors in Connecticut, New York and Pennsylvania, Sovereign is one of the fastest growing, independently owned RIAs in the North East. Chuck is also the director of Sovereign Advisor Solutions (SAS) — a division of Sovereign Financial Group Inc. SAS helps advisors transition to RIA by offering a comprehensive plug and play solution for going independent. Chuck's ties to the financial planning community run deep. He currently serves on the Board of Directors for the FPA of Connecticut and chairs their Pro Bono / Public Outreach Committee. Chuck received his degree in Finance from The University of Connecticut and completed his coursework for the CFP certification with The American College. He resides in Connecticut with his wife, two children, black lab and cats. In his spare time, he enjoys all things outdoors — on the weekends you will find him with his family hiking, camping, skiing, boating or just enjoying the trees while grilling in the backyard.