The latest in financial adviser fintech — May 2020

We look at the big news, announcements and underlying trends and developments in the world of technology solutions for financial advisers and wealth management!

This month’s edition kicks off with the news that FTV Capital (the PE firm that invested heavily in rapidly rising Riskalyze) has taken a majority stake in Docupace, which historically was a “document management” system for advisory firms that had expanded into front-office new-client onboarding but now – with FTV’s capital – aims to expand into the messier (but more desperately needed) opportunities for back-office business process automation (for what remains a very paperwork-intensive industry even with the shift to digitally e-signed forms).

From there, the latest highlights also include a number of other interesting adviser technology announcements, including:

- Pulse360 launches new note-taking solutions allowing advisers to capture client notes digitally in a client meeting and immediately thereafter queue templated follow-up messages to clients.

- Hidden Levers expands into financial planning software with a stress-test-based approach to modeling retirement projections.

- Edmond Walters launches new Apprise financial planning software platform for ultra-high-net-worth clientele.

- SmartAsset’s SmartAdvisor launches an extension of its lead generation service that will queue up a “Live Connection” to a prospect directly by telephone.

- XY Planning Network launches a new compliance archiving solution for websites, emails, and a wider range of “next generation” social media platforms like Instagram and Facebook Groups.

Read the analysis about these announcements in this month’s column, and a discussion of more trends in adviser technology, including eMoney partnering with Allianz to expand its capabilities to illustrate annuities in a decumulation plan, Orion launching a marketing automation tool to offer prospects Advizr’s financial planning modules, Schwab striking a deal for API-based direct feeds to account aggregators that should set an industry template for reducing how often links break, and serial AdvisorTech entrepreneur Steve Lockshin announcing his latest venture, an estate planning solution dubbed “Vanilla.”

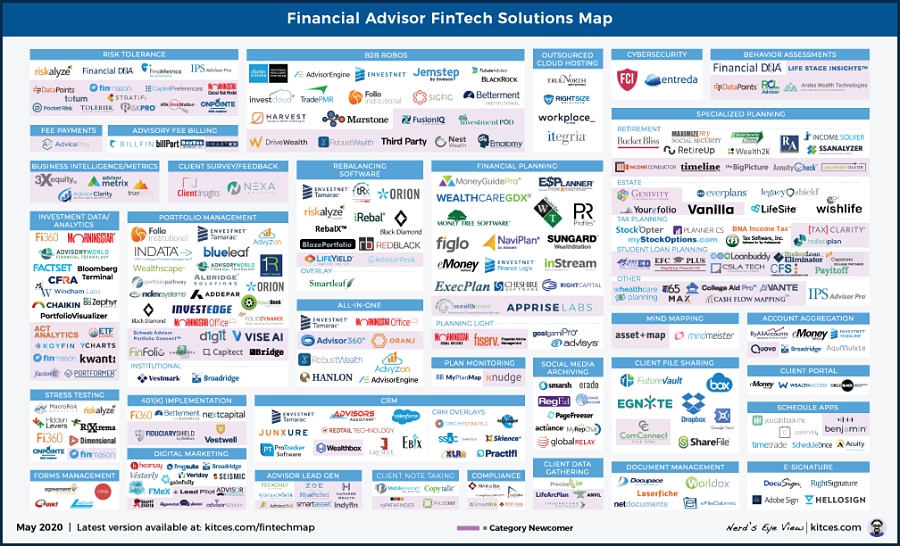

And be certain to read to the end, where we have provided an update to our popular new “Financial Advisor FinTech Solutions Map” as well!

I hope you’re continuing to find this column on financial adviser technology to be helpful! Please share your comments at the end and let me know what you think!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to [email protected]!

FTV Capital buys majority stake in Docupace to expand front-office document storage to back-office process automation. In the 2000s, the rise of the internet and the accessibility of cloud storage led a drive for advisory firms to “go paperless,” converting new paperwork and existing client files into digital systems and spawning the rise of various “online document management” solutions like Worldox, LaserFiche, NetDocuments, and Docupace. Soon, though, it became clear that managing files virtually wasn’t just a matter of handling internal documents, but also shared documents with clients, leading to the rise of various “client vault” solutions, and offerings like Citrix Sharefile to facilitate the (secure) email transfer of those documents between the adviser and client. In turn, as document transfers between advisers and clients became more common, demand increased for the ability to not just sign and scan paper documents for subsequent electronic transfer, but to be able to e-sign documents and handle the entire onboarding workflow digitally (a process that early robo-advisers, in particular, excelled at), spawning the birth of innumerable “robo-adviser-for-advisers” solutions that promised to facilitate digital onboarding processes (e.g., Jemstep, AdvisorEngine and FutureAdvisor) and the rise of various (electronic) “forms management” solutions like LaserApp and AgreementExpress. But the reality is that in the current environment, secure digital storage, file transfers and e-signatures are quickly becoming commoditized as workflows become standardized and the cost of online storage space becomes ever cheaper. Leading to the next shift of document management from front-office and digital onboarding to back-office business process automation … which, in an industry still dominated by legal agreements and authorizations requiring signatures, entails a non-trivial amount of paperwork tied to ongoing back-office functions (from IRA withdrawals and wire requests to existing clients creating new accounts or requesting new transfers). In this context, it’s notable that FTV Capital, a PE firm known for investing in the world of AdvisorTech (including stakes in InvestCloud and Riskalyze), announced this month that it was taking a majority stake investment into document storage provider Docupace. Notably, though, the investment into Docupace doesn’t appear to just be a bet on Docupace’s core competencies around document management, client onboarding, and Docupace’s niche solution into facilitating adviser re-papering when switching broker-dealers; instead, FTV is characterizing its investment as “growth capital” and Docupace’s new CEO David Knoch (previously of broker-dealer 1st-Global, now-Avantax, which itself was a long-term Docupace user) is emphasizing Docupace’s opportunity to pursue back-office business automation. Of course, the caveat is that when it comes to back-office workflows, in particular, every enterprise operates differently, often a reflection of long-embedded processes and procedures that may be tied to legacy technology, making the processes themselves difficult to standardize and deployment painfully bespoke. On the other hand, the scope of the challenge in back-office automation in advisory firms and platforms also speaks to the depth of the opportunity, and the increasing popularity of Salesforce in large firm enterprises gives Docupace a single common CRM system to build integrations toward for the bulk of its prospective enterprises. In addition, as the RIA community continues to grow and scale, there are new opportunities for providers like Docupace to bring back-office business process automation into the “large” RIA space – which size-wise is more akin to small to midsize broker-dealer enterprises (e.g., from a few dozen to a hundred or so advisers), but also tends to be more nimble, more standardized (making it easier to automate processes), and less prone to being bound up with legacy technology and systems (if only because RIA platforms of size have only emerged more recently). And the competition to automate advisory firms – front- and now back-office – are increasingly coming from all directions, including robo-advisers-for-advisers moving from the front- to back-office, forms management and e-signature onboarding tools moving from the front-office to back-office, CRM systems expanding workflow automation to capture more of the firm’s process execution, and now document management systems like Docupace trying to expand from digital paperwork to the processes around them. Still, though, as long as the advisory industry itself remains rooted in contracts and (digital) paperwork, the opportunity remains for the wedding of traditional CRM systems and workflows to the software that powers and manages the underlying paperwork needed for execution.

Pulse360 launches note-taking software for client meetings integrated with Adviser CRM. For much of our history, financial advisers have been the quintessential ‘yellow pad’ users, for everything from sketching out financial planning strategies and investment concepts to capturing meeting notes for the client file. Of course, in the modern digital era, more and more financial planning and similar tools are capable of even more effective illustrations of financial and investment concepts, and CRM systems have evolved to capture not just the notes of a client meeting but all the firm’s activities on behalf of clients throughout the year. With the caveat that for most financial advisers, actually capturing meeting notes and getting them into the CRM system is still a common pain point, with some advisory firms leveraging paraplanners to capture essential meeting notes and client follow-up tasks, and leading to the rise of mobile dictation solutions like CopyTalk and Mobile Assistant for advisers to ‘brain dump’ all the notable aspects of a recent client meeting (or even to read their own meeting notes into the software). In this context, it’s notable that this month marked the debut of Pulse360, a new take on note-taking software for financial advisers designed to capture meeting notes (even ‘handwritten’ into a tablet using a Microsoft pen) and import them directly into adviser CRM systems (including launch integrations with Salesforce, Redtail, and Wealthbox) while maintaining a searchable index for future reference. In addition, though, Pulse360 not only captures the notes themselves but queues up the relevant follow-up actions, including sending meeting recaps to clients and queuing up subsequent tasks and workflows to execute client requests. Of course, advisory firms often already expect their CRM systems to reliably capture client meeting notes and to queue up post-meeting workflows, arguably making Pulse360 redundant. Yet in practice, given the gaps that still exist in Advisor CRM systems actually making it easy to fulfill such functions, Pulse360 joins a crop of additional “CRM add-on” solutions, including Knudge (for client to-dos), Genesis SmartWare (for cross-system workflows and triggers), and LeadPilot and Snappy Kraken (for marketing automation), all designed to fill in the gaps of what an adviser CRM ‘should’ theoretically do but in practice still doesn’t do (well or at all). And given both the ubiquity and essential compliance aspects of taking thorough and accurate notes for client meetings, Pulse360 seems well-positioned to fill in a key adviser function (as an alternative to CopyTalk or Mobile Assistant for those who prefer real-time written meeting notes to post-meeting dictation). Though in the long run, the question will be whether Pulse360 can gain substantial market share fulfilling a key function, has its features eventually copied by adviser CRM systems that step up to fulfill the need… or ends out being acquired by a CRM system that wants to quickly capture the capability before a competitor does?

Edmond Walters’ new HNW financial planning software Apprise Labs opens for business. One of the key benefits but also challenges of financial planning software is that in practice, what it does and doesn’t do is very closely aligned to the ‘typical’ financial adviser business model and what those advisers implement to get compensated for their planning. Accordingly, in the early days when the adviser model was more life-insurance-centric, financial planning software had robust capital needs analyses (to demonstrate the need for life insurance) and estate planning modules (when the estate tax exemption was only $600,000 and even a young couple with basic term insurance had an estate tax ‘problem’ and potentially needed irrevocable life insurance trust planning). As the financial adviser business model shifted more towards mutual funds and then assets under management models, financial planning software itself also shifted, becoming more and more focused on retirement (and college savings) accumulation projections. And now as the majority of baby boomers enter retirement, financial planning software is taking on an increased focus on decumulation planning. While it’s a positive that financial planning software has been able to adapt to whatever is the ‘mainstream’ business model for financial advisers (and their associated client needs), the bad news is that it means advisers who aren’t in the mainstream model serving mainstream clientele often struggle to find ‘good’ financial planning software, from tax-centric advisers struggling with tax-sensitive planning software, advisers serving Gen X and Gen Y clients struggling with the lack of debt management and budgeting tools… or advisers serving ultra-HNW clients struggling to find the tools to handle the advanced tax, estate planning, and multi-generational planning needs of such clientele. In fact, when it comes to serving ultra-HNW clients, in particular, remarkably few financial planning software solutions exist, with the market still dominated by spreadsheet-based tools like WealthTec (which may be robust for calculations but lacks the modern UI that advisers and especially affluent clients have come to expect) or advisory firms’ own home-grown spreadsheets. Accordingly, Edmond Walters – founder of eMoney Advisor, who sold the company to Fidelity for nearly $250M in 2015 and then discovered for himself the lack of ultra-HNW planning tools for people in his situation – announced this month the open release of his new financial planning software Apprise Labs, developed specifically to provide a modern planning engine and interface for ultra-HNW financial planning. In practice, Apprise is built around 3 different “studios” – single full-screen interfaces that Walters envisions advisers will use interactively with clients on large conference room TV monitors – including an Income Studio (how HNW clients will generate the cash flows to support their lifestyle), a Lifestyle Studio (evaluating the trade-offs of major HNW lifestyle decisions, including the purchase and sale of various businesses, real estate properties, etc.), and a Legacy Studio (to model and visualize advanced estate planning techniques from gifting to GRATs and ILITs). And already, Walters notes that Apprise is seeing growing interest from large enterprises… though likely not for all their advisers, the bulk of whom may still use alternatives like eMoney Advisor, RightCapital, or MoneyGuidePro, but ‘just’ the subset that works with ultra-HNW clients. In fact, MoneyGuidePro President Tony Leal is a joint owner in the Apprise venture, recognizing that MoneyGuidePro is not built to serve the ultra-HNW clientele that Apprise targets (and that the platforms are more complementary than competing), and that Apprise will likely win market share where MoneyGuidePro and similar planning tools have struggled (e.g., trust companies, multi-family offices, private banks, and wirehouses) where the primary competition is (still) a complex spreadsheet. Though in the long run, just as Walters’ innovation at eMoney Advisor was more than just planning software but also a Personal Financial Management dashboard that has become replicated by nearly every competitor, the long-term impact of Apprise may be more than just capturing financial planning market share in the underserved ultra-HNW segment, but also its approach to have large single-screen dashboards that advisers can use for interactive planning experiences?

Hidden Levers launches financial planning software with native retirement stress testing capabilities. When clients call or email expressing concerns about market volatility, often one of the first actions an adviser takes in response is to suggest “updating the plan” to put the market decline in the context of the client’s individual situation… often to show that as eye-popping as the volatility may be, it hasn’t derailed the client’s long-term plan (and/or the client still has ample time to recover given ongoing savings or relatively modest retirement withdrawals). However, the caveat of the “updated financial plan shows you’re still reasonably on track” approach is that clients may still wonder “well, what happens if the market falls further from here, and how exposed is my portfolio to a further market decline?” For which advisory firms often have no answer, as traditional financial planning software lacks the capability of dynamically illustrating how much further the market must fall for a plan adjustment to be required (and how much of an adjustment is necessary to get the plan back on track), and certainly can’t model particular investment stress testing scenarios in the client’s particular plan (e.g., what is the likely impact to the client’s plan, and the necessary spending adjustments, if it turns out the pandemic has a U-shaped recovery versus the V-shaped one the markets seem to currently be predicting?). In this context, it’s notable that Hidden Levers – one of the early players in scenario-based portfolio stress testing to evaluate how well-diversified the portfolio really is – has announced the launch of its own financial planning software, specifically built to map its portfolio stress-testing capabilities directly into the client’s retirement (or accumulation) cash flow projections. In the long run, though, it’s not clear that stress testing a financial plan will be such an ‘essential’ component (as it clearly is now in the short term) that it compels advisers to switch platforms away from more established players like MoneyGuidePro, eMoney Adviser, and RightCapital, or whether Hidden Levers will ultimately be able to build the substantial feature set necessary to compete in the holistic financial planning software category. On the other hand, for more investment-centric firms – that don’t necessarily deliver (and charge for) standalone financial plans, and where portfolio design and stress-testing tools take a more central role and Hidden Levers may already be a core component – the extension into financial planning software may be an easy and appealing incremental addition for those firms to deliver retirement projections for the portfolios they already manage (and in point of fact, Hidden Levers indicated that it built the solution largely at the request of two existing enterprise users), positioning Hidden Levers as more of a threat to Orion’s Advizr than traditional standalone planning software tools. Nonetheless, the reality is that the scenario-planning approach to “retirement stress testing” is a gap in the broader landscape of financial planning software as well… leaving the door open as to whether Hidden Levers ‘just’ becomes an appealing planning solution for investment-centric firms that want a unified view of stress testing across their portfolios, their business analytics (with Hidden Levers’ Business Intelligence solution), and clients’ financial plans, or whether its unique stress-testing-feature set is appealing enough to compete even more directly in the mainstream financial planning software category as well?

Decumulation planning with annuities pushes further into financial planning software as eMoney integrates with Allianz. From its earlier days, one of the key functions of financial planning software was to demonstrate a consumer’s financial planning ‘gap’… for which the adviser could sell a product as a solution, from conducting a Capital Needs Analysis (to demonstrate a[n adviser-sold] life insurance need) to projecting college savings (to demonstrate a need to save more into a[n adviser-sold] 529 plan), to projecting the accumulation path towards retirement (to demonstrate the client needed to contribute more to [adviser-managed] investment accounts). And as the target market for advisers has shifted increasingly towards retirees that are no longer accumulating but decumulating, so too have the capabilities of financial planning software increasingly focused on planning for retirement distributions. Except ironically, the annuity industry now sells nearly $250B of new annuity products per year, many of which are sold specifically for decumulation planning purposes … yet annuity products and their income guarantees cannot actually be illustrated in most financial planning software. Accordingly, it’s notable that this month eMoney Adviser announced a deal with Allianz Life, as eMoney puts it, to “demonstrate the value of annuities through a planning lens” and “the principle of building protection into a financial plan,” and will include real-time annuity policy data feeds directly into eMoney to show how a client’s annuity values are changing in the eMoney client dashboard. Notably, though, eMoney has emphasized that it will remain “product agnostic”, and explicitly stated that it will not show any specific annuity products offered by individual insurance companies and instead will more generically show an adviser-inputted amount of guaranteed income the annuity could produce. The “good” news of remaining product-agnostic is that eMoney Adviser appears to be avoiding the conflict of interest that MoneyGuidePro has chosen to embrace, where MGP is not only aiming to facilitate specific product illustrations and recommendations from within the planning software but, via Envestnet, has developed an Insurance/Annuity Exchange where Envestnet can participate financially (i.e., generate revenue) by making those annuity product sales happen (raising the potential of whether MoneyGuidePro could someday become ‘free’ as an annuity product distribution channel instead of traditional standalone planning software). The bad news, however, is that by failing to illustrate specific products, the adviser cannot demonstrate the actual benefits of their actual product recommendation, nor is it possible to see which specific products are actually ideal (or not) in the context of the client’s specific financial plan and needs (rather than illustrating a hypothetical level of guaranteed income that the recommended product may or may not likely be capable of actually producing). In fact, some have raised concerns that the annuity industry itself is resisting having its specific products illustrated in financial planning software, in recognition that certain companies’ products may not show well when subjected to a more rigorous holistic planning analysis. And eMoney itself appears to be emphasizing a focus on supporting ‘suitable’ product sales over fiduciary advice (that would necessitate the ability to analyze specific product recommendations), noting that Allianz and eMoney “share the same value set: improving client outcomes through holistic planning and suitable investments”. Still, though, with a recent Private Letter Ruling clearing the way for fee-based annuity products (that AUM advisers can actually bill upon for providing management services), and annuity companies actively retooling towards what may become a more appealing set of fiduciary fee-only annuity products, arguably in the future there will be more annuity products than ever for fiduciaries to consider implementing for their clients… at least if their financial planning software is ever built to actually illustrate when specific annuity products really do provide a holistic improvement to the client’s financial plan.

Envestnet expands Annuity Exchange as major IMO Financial Independence Group launches RIA solution through FIDx partnership. In the world of insurance and annuities, independent agents have long had the option to affiliate with an Independent Marketing Organization (IMO) to receive additional servicing and support (above and beyond what any individual agent may get from the insurance company directly). In fact, IMOs have become a major pillar of insurance and annuity distribution in independent channels, serving as an intermediary that allows insurance companies to have fewer larger relationships, and for IMOs to handle the ‘last mile’ of service, particularly when supporting the process of evaluating products, getting quotes, and actually completing applications and underwriting, across a wide range of agents and their clients (for which IMOs receive a commission override for their services). Yet just a few years ago, the Department of Labor’s fiduciary proposal posed an existential threat to IMOs, raising the question of whether annuities (at least in retirement accounts) would see their commissions greatly diminished or banned altogether, and be reinvented in a new fee-based format for the rapidly-growing RIA channel instead (where IMOs have historically had no relationship, as few RIAs carry any licenses or relationship to facilitate historically commission-based insurance and annuity transactions for clients). And while the DoL fiduciary rule was ultimately defeated by broker-dealers and insurance product manufacturers, it did in fact accelerate the creation of fee-based annuities (as well as the annuity carriers obtaining new Private Letter Rulings to permit RIAs to sweep their fees from such annuities without having it treated as a commission or a taxable distribution). And to facilitate the rise of a new wave of fee-based annuity distribution, Envestnet in 2019 launched a new (fee-based) Insurance/Annuity Exchange in partnership with its newly created subsidiary FIDx, offering up the technology that would allow RIAs to purchase fee-based annuities directly on behalf of their clients (and acquiring financial-planning-software provider MoneyGuidePro to further integrate its annuity offerings directly into clients’ planning projections and recommendations). Except the caveat is that while technology can increasingly expedite and even automate the paperwork and application process for new fee-based annuities, most RIAs do not have the internal team resources to manage the process or stay up to speed on the latest product developments … a role historically filled by IMOs that haven’t existed for RIAs. Accordingly, this month Financial Independence Group (FIG), one of the largest annuity IMOs that already supports 3,000+ agents, announced a new partnership with Envestnet’s FIDx to provide support for RIAs selling fee-based annuities. The new offering, to be operated through FIG’s new “RIA Insurance Solutions”, will either work with RIAs to support on the back-office execution (e.g., product research, case design, application, and issuance) or as a fully outsourced partner (one that ‘only’ supports RIAs and won’t otherwise compete with them for the client)… while leveraging the technology of and placing the annuity purchases through FIDx (which ostensibly gets a cut for its new role in the distribution process). Which on the one hand highlights that even as technology can accomplish more and more, there is still a role for value-add intermediaries as a support layer between the technology platform and the advisory firm and its clients (and Envestnet itself took a stake in mega-RIA service provider Dynasty Financial earlier this year as well). And on the other hand, it further expands Envestnet’s increasing expansion from being ‘just’ a TAMP platform (with technology that facilitates the use of its platform) into an ever-widening multi-channel platform (from third-party asset managers to fee-based annuity and insurance products, and soon debt/credit products as well) where its technology can facilitate virtually ‘any’ financial services product that advisers many need for their clients (and building relationships with the service providers necessary to support them).

SmartAsset launches Live Connection to facilitate real-time handoffs For adviser lead generation. Despite the fact that they show one of the lowest client acquisition costs and one of the highest scores in marketing efficiency in the latest Kitces Research study on financial adviser marketing, most financial advisers have been reluctant to engage in various paid online lead generation services. According to the research, the relative dissatisfaction stems from the fact that advisers place far more weighting on the “quality” of each individual lead (i.e., its likelihood to be a good fit that “closes”) than the aggregate result of marketing costs incurred and results generated; in other words, advisers would prefer to pay more for one lead that closes, than pay less for 5 leads but have to winnow down the list to get the same one that closes (even though the end result of the latter would be the same new client revenue for a lower upfront marketing cost). Especially since, for many online lead generation opportunities, a significant amount of effort is required following up on email inquiries just to turn them into a phone call or bona fide approach meeting in the first place. Of course, the reality is that advisory firms must still spend time engaging in those email outreaches and then actually meet with prospects to determine if they’re a good fit in the first place, and given that most advisory firms don’t have a formal role to help conduct initial sales calls to respond to and screen prospects, the time to attempt contact and then meet with those non-qualified prospects is still a ‘cost’. Still, though, the fact that advisory firms show a strong preference for leads with a high contact rate, and in general a fewer-but-more-high-quality-leads approach, has in recent months led to a new shift in online lead generation services for advisers, starting with the launch of IndyFin in March, which distinguishes itself in part by running its own call center to initially screen prospect inquiries before handing them off (in a more prequalified manner) to the advisory firm. And now, competitor SmartAdvisor has announced a similar solution, where instead of simply serving up the email contact information for prospects, those who reach out via the SmartAdvisor service and are interested in speaking with an adviser can be transferred as a “Live Connection” phone call, resulting in by definition a 100% contact rate, and what SmartAdvisor reports as a 20%+ close rate based on their multi-month pilot since late 2019. However, the high close rate is likely buoyed by the fact that at the moment prospects actually reach out to find an adviser (e.g., via SmartAdvisor), they are often ready at that moment to engage (if only they could actually reach an adviser at the moment)… which means most advisory firms may not be able to benefit anyway, lacking the size and depth of the team to actually be able to field inquiries that SmartAdvisor is looking to hand off in real-time with a Live Connection phone call. Still, though, a shift in online adviser lead generation appears to be underway, where the advisory firms must either outsource the initial process of responding to and screening leads (e.g., with IndyFin), or create the necessary capacity to respond quickly to prospects themselves (or even to ‘take a phone call’ at the moment when SmartAdvisor Live Connection hands it off to them), in order to maximize their ability to capitalize on prospect leads … which, ironically, is actually how the hand-off from marketing to sales has always worked?

Orion launches automated marketing solution tied to Advizr planning software. One of the biggest challenges in marketing comprehensive financial planning services is that no one wakes up in a cold sweat in the middle of the night thinking “I need to get myself a comprehensive financial plan!” At best, consumers may have a particular financial pain point or problem they wish to solve, which becomes the trigger point for the adviser to establish what eventually becomes a more comprehensive relationship. Accordingly, most advisory firms have historically opened the door with insurance, annuity, or investment-related marketing and an investment proposal to solve what is usually an ‘investment problem’, for which the adviser’s value-add is to offer more holistic financial planning advice that goes beyond the portfolio (or other product solution). But now, Orion Adviser Services – which last year acquired financial planning software provider Advizr – has announced the launch of Market*r, which allows financial advisers to create financial-planning-related marketing campaigns, that in turn pull prospects directly into a standalone financial planning module in Advizr, and then prompt the prospect to contact the adviser if/when they’re ready to go even deeper. Similar to MoneyGuidePro’s myMoneyGuide Labs, the appeal of a solution like Market*r – tied directly to financial planning software – is that not only does it better focus the client on the adviser’s financial planning value proposition (instead of a more investment-centric focus), but that by engaging with the planning software, the client-inputted data is already pre-populated and ready for the adviser to expand the advice relationship (eliminating any need for repeated/double data entry). Advisory firms can either upload their own list of prospects or ongoing leads as received or pull prospecting lists directly from third-party marketing list providers like InfoUSA, at a price of $350/month for the technology (or $600/month with Advizr’s marketing consulting support as well). Which is striking, as while the reality is that advisory firms have always paid far more for solutions that tie more directly to their ability to generate or maintain revenue… Orion is now aiming to charge $350/month for ‘just’ a marketing extension when Advizr previously charged less than $100/month for its entire financial planning solution (which Orion subsequently turned ‘free’ as included with Orion). Though in the end, when advisory firms are struggling to both differentiate and to demonstrate their value beyond just their products and investment portfolios alone and spending an average of more than $3,000 to acquire one client, if Orion’s Market*r can really help advisory firms generate even just a few new clients, it will still produce an above-average ROI to the advisory firm! With the caveat that it’s still on the shoulders of the advisory firm to figure out how to get (or decide to separately pay for) the leads that go into the Orion Market*r marketing funnel in the first place.

XY Planning Network launches XY Archive as adviser platforms increasingly blend, build and buy. In the 1980s and 1990s, the “best” adviser technology solutions were the all-in-one platforms developed by major wirehouses, which had the largest adviser base and the most resources to deploy to build their own technology, while independent firms struggled with the lack of resources to develop competing technology capabilities. Through the 2000s and 2010s, though, the rise of the internet and the interconnectivity of APIs suddenly made it possible for independent software companies to weave themselves together, allowing any advisory firm to assemble a “best-in-class” solution through the available API integrations and creating an environment in which the leading solutions can “connect to everything” and establish a user base larger than even the largest advisory firms (e.g., eMoney Advisor alone has more users than all four major wirehouses combined!). The caveat, though, is that the deepest integrations between technology solutions still take additional time and effort, such that not all “integrations” are the same, and advisers are often left struggling to try to figure out which combinations of independent software solutions will actually weave together deeply enough to efficiently operate their businesses. That in turn appears to be causing the pendulum to swing back once again, to adviser platforms – from broker-dealers to RIA support platforms – beginning to either develop their own technology tools or at least the overriding “dashboard” that the adviser uses to connect to the full suite of available tools … all prepackaged in a manner that ensures they “work” together. In fact, the latest T3 Adviser Technology Survey reveals that the highest rated broker-dealer platforms (by the advisers actually using the technology) include Commonwealth’s Adviser360, RBC Black, and LPL’s ClientWorks … all of which have employed strategies to either build (Commonwealth), buy (LPL acquiring AdvisoryWorld), or at least pull together in a prepackaged offering (RBC) a specific tech stack that brings to the table the particular solutions their advisers need. In this context, it is notable that this month XY Planning Network announced the launch of XY Archive. In and of itself, XY Archive is simply another entrant into the category of compliance archiving solutions (competing with the likes of MessageWatcher and Smarsh, though XYPN indicates it will only be available to XYPN current and former members). But from the broader perspective, XYPN developing its own technology solution (rather than just finding a partner to integrate) signals yet another adviser platform shifting away from simply offering a menu of third-party technology solutions, opting instead for a more crafted approach of specific technology vendors that the platform itself either weaves together (a la RBC Black) or builds and integrates more directly (as Commonwealth did with its Adviser360). Of course, even large adviser platforms don’t necessarily build every element of the technology stack, leading Commonwealth to partner with RightCapital for its financial planning software engine (rather than build its own) and even wirehouse Morgan Stanley to partner with Addepar for high-end portfolio performance reporting. Still, though, the emerging trend of adviser platforms choosing to build even just some of their own technology marks a significant shift from the trend of the past 20 years (where offering an ever-growing menu of independent technology options was the dominant model), turning the primary distribution channels and enterprise buyers of independent technology solutions into their competitors once again … but also opening the door for a subset of advisertech companies that are ready to pivot their own models to provide the essential engines for calculations and key functions that other enterprises can build their own layers on top of instead?

Will Schwab’s new API-based data sharing agreement set a future template for direct-feed account aggregation with no more breakages? For nearly a decade, the great appeal of account aggregation services, from ‘retail’ solutions like Intuit’s Mint.com to industry providers like eMoney Advisor, was its ability to gather together personal financial data from disparate sources into a single consolidated dashboard. The challenge, however, was that most financial services providers didn’t make that data readily available, forcing consumers instead to grant their personal login credentials to the account aggregation providers, who would then log in on the user’s behalf and ‘scrape’ the requisite data directly from the provider’s screen output. The end result of this screenscraping approach was that the data was obtained… but with significant security risks (due to the sharing of usernames and passwords), a significant server load for financial services firms (as ‘real’ users often only log in a few times a month or even a few times a year, while account aggregators may log in daily to obtain updated data), and regular frustration for the client/user themselves as updates to the client interface from the provider could cause inaccurate data (as the appropriate section to screen-scrape moved around) or a change to the provider’s login process could ‘break’ the connection altogether. And in recent years, the stakes around such data-sharing has increasingly amplified, as account aggregation has shifted from simply aggregating and showing the data to actually prompting users to do something about it, and potentially leading the client to terminate their relationship with the very firm that was providing them the data in the first place (e.g., “according to the data your bank just provided us, you could get a better interest rate on your credit card by canceling your account with them and moving to this new provider instead!”). In fact, such flare-ups have at times reached the point where some big financial services firms shut off access to the account aggregators altogether for periods of time, under the auspices of the security concerns that arise from password-sharing in order to screenscrape. However, a new approach to account aggregation is emerging, exemplified earlier this year by JP Morgan striking an agreement with Yodlee to shift away from password-based screenscraping and into a (more secure) tokenized approach where clients provide a one-time authentication for a direct data feed from their provider to the account aggregator, which then receives that data feed (properly encrypted) on an ongoing basis. And now this month, Schwab announced its version of a similar API-based token system for sharing its custodial data with Envestnet’s Yodlee, Intuit’s Mint and eMoney Advisor. The significance of the Schwab announcement in particular, as one of the largest financial institutions in the country (and the largest serving independent advisers), is that whatever deal Schwab (and JPMorgan) have signed will likely become the template used more broadly across the industry, and if Schwab has agreed it’s likely that others will soon acquiesce as well, quickly accelerating the shift from screenscraping to APIs. From the adviser and client perspective, the good news in this shift (beyond a more secure way to transfer the data itself) is that it should lead to more consistent data with fewer errors, and an end to what historically has been an especially frustrating tendency for account aggregation connections to “break” on a regular basis (as an API-based approach won’t break whenever a provider updates its client interface or login process and can be bound with uptime/stability agreements by enterprise contract). And by creating the data feed more directly, clients will also likely have greater control over what data is shared (whereas in the past, aggregators that received the client’s login credentials effectively could see “everything,” including data that wasn’t necessarily intended to be shared). However, in the end, the willingness of major financial services firms to sign on to direct API feeds also likely means they extracted some concessions of their own, potentially limiting the flow of data that “might be used against them” (e.g., will a direct readout of current credit card interest rates or bank account yields be provided if account aggregators may still use that data as a means to solicit clients away to other providers?), and/or may turn out to include outright restrictions on how the data account aggregators receive can (or cannot) be used or shared. Ultimately, time will show whether new gaps in account aggregation data (or capabilities predicated on that data) may emerge based on the new agreements … but in the near term, most advisers will likely just welcome more consistent and stable data feeds and an end to the regular need to ask clients to log in and fix their connections!

Early fintech darling Motif Investing abruptly shuts down as ETFs dominate thematic investing. One of the dominant financial services themes of the 2010s was the rise of ‘FinTech’ companies that sought to disrupt the established incumbents, most notably the emergence of “robo-advisers” like Betterment and Wealthfront seeking to disrupt human financial advisers. Beyond the robots-versus-humans battle, though, was also the rise of the next generation of online brokerage platforms – from Robinhood to Acorns to Motif Investing – all seeking to capture the next generation of investors with platforms designed to appeal to millennials and make it easier than ever to start investing. In the case of the former, their approach to millennials was simply to make it as easy as possible to open an account and start buying individual millennial-familiar stocks (e.g., “FANG” stocks like Facebook, Apple, Netflix and Google), in fractional share increments if necessary. Motif Investing took a different approach, however, opting instead to aggregate together groupings of 30 stocks into various “Motifs” – thematic groupings of stocks from certain industries or subindustries (e.g., energy or even shale gas stocks), to certain investment strategies (e.g., high-dividend stocks), to speculative themes (e.g., robotic revolution or biotech breakthroughs), or even more millennial-specific themes (e.g., online gaming). The appeal of the Motif approach was that it encouraged better diversification (at least 30 stocks in a particular theme was more diversified than buying just one high-flying stock) and the Motifs themselves were thematic concepts that investors could invest toward (e.g., robotics, biotech, or gaming) without needing to figure out exactly which stocks, in particular, were best to buy (with the Motif investing community itself creating the Motifs, along with a spate of professionally designed Motifs as well). Yet as it turns out, the approach of thematic investing was so popular that Motif wasn’t the only platform to pursue it … so did the entire domain of ETFs, which in the 10 years since Motif launched grew from $1 trillion to over $4 trillion of AUM, as more than 2,000 new ETFs were launched (with a net gain of more than 1,000 ETFs even after others were merged or closed), pivoting from just representing broad-based indices into increasingly specialized thematic ETFs including shale gas, high-dividend stocks, robotics, biotech, and online gaming. In other words, Motif ironically got the theme right… but then struggled to compete with an ETF industry that saw so much opportunity in thematic investing that it built and launched entire ETF offerings nearly as nimbly as Motif could create motifs. In fact, by the second half of the 2010s, the theme was already shifting away from creating prepackaged baskets of thematic portfolios – from motifs to ETFs – and into creating ‘custom’ direct indexing solutions, where companies like Ethic Investing began to offer alternatives to thematic ETFs by allowing investors (or their advisers) to establish their own ESG screens and create their own custom basket of stocks (managed, thanks to technology, almost as easy as simply buying an ETF or motif) … a pivot that Motif itself pursued, but apparently too late to keep pace with the new competition. In the end, Motif reported only $868 million of assets across more than 300,000 retail customers – implying an average account size of less than $3,000, and that most of their users used Motif as more of a thematic side venture than their primary investment platform – all of which will be transferred to Folio Financial for an undisclosed sum (estimated to be a minuscule fraction of the $126M in venture capital that Motif originally raised). Which ultimately serves as a powerful reminder that despite the fact the financial services industry is generally a very ‘slow mover’ when it comes to technology innovation … the incumbents (in this case, ETF providers) are still quite capable of moving quickly and leapfrogging well-funded startups if they agree enough with an idea!

New Product Watch: Serial advisertech entrepreneur Steve Lockshi launches new estate planning service “Vanilla” for advisers. In the early days of financial planning, “estate planning” was a popular area of planning focus … driven in large part by the reality that throughout the 1980s and 1990s, the estate tax exemption peaked at just $650,000, such that any young couple with no personal wealth who simply bought term insurance to protect their children still had an “estate tax problem” to address. In the 20 years since, though, the estate tax exemption has risen dramatically, from $675,000 in 2000 to $11.58 million in 2020 (and double that amount for married couples with portability), shifting the focus away from estate tax planning into simply estate planning (i.e., planning for the management of both assets and health care decisions in the event of incapacity or death), where planning situations aren’t necessarily as complex but proper creation of estate planning documents is still crucial (including and especially to identify those situations where the client’s needs actually are more complex). For financial advisers, who may be the first line of defense in prompting the client to address an estate planning need, but are not estate planning attorneys able to draft documents, this leads to a challenging series of choices including whether to steer clients to do-it-yourself solutions like LegalZoom or Trust&Will, or try to find and refer out to a local estate planning attorney … neither of which will necessarily be very effective at including the adviser in the process or communicating progress. In this context, it is notable that serial advisertech entrepreneur Steve Lockshin announced this month the launch of a new estate planning solution for advisers dubbed “Vanilla.” In essence, Vanilla is a platform that helps financial advisers connect their clients to lawyers who can draft the necessary core estate planning documents, but that is built to keep the financial adviser at the center of the process (as Lockshin is a practicing adviser and principal himself in his own advisory firm AdvicePeriod). Accordingly, Vanilla serves up LegalZoom-style questionnaires for clients to complete and queues up their answers for an attorney to draft their documents (notably, done not with pure ‘robo’ automation but in partnership with actual attorneys, currently from national law firm Arnold & Porter), but co-branded with the advisory firm to highlight their role and value in the process. In turn, Vanilla will also not only provide a dashboard to help monitor the status of clients going through the process (and verifying after the fact that their accounts have been properly retitled), but also is building a suite of estate planning software tools themselves to help illustrate the key concepts and planning benefits to clients (e.g., visuals of the client’s balance sheet, the flow of assets to beneficiaries, prospective estate tax savings of strategies like GRATs, etc.), and sends reminder nudges both to advisers about when it’s time to review a client’s plan and to a client’s vault with “In Case Of Emergency” guidance to clients when death or disability strikes. The cost to have attorney-created documents drafted will start at $1,850 (more expensive than DIY services and competing matching-attorneys-to-advisers solutions like Helios, but less expensive than local estate planning attorneys in most areas) that clients would ostensibly pay themselves for the service (unless the adviser chooses to bundle the cost into their own advisory fees), with a $499 onboarding fee for advisory firms themselves (to be refunded once the firm has loaded 10 clients onto the platform). Ultimately, though, the real question for platforms like Vanilla (and Helios) is whether or to what extent advisory firms will really choose to integrate estate planning into their advice offerings as a way to add or expand value for clients … with the caveat that if technology can really make it easy enough, at some point the question may become “why not integrate a process for obtaining estate planning documents for clients who need to obtain their essential documents anyway?”

______________________________________________________________

In the meantime, we’ve updated the latest version of our Financial Advisor FinTech Solutions Map with several new companies, including highlights of the “Category Newcomers” in each area to highlight new FinTech innovation!

So what do you think? Will the new API-driven data feeds finally make account aggregation more consistent and less prone to breaking? Is the real value of financial planning software in Apprise-style interactivity with clients, or Advizr Market*r’s capabilities to modularly engage prospects? Should financial planning software show and illustrate ‘real-world’ financial services products and not just hypotheticals? And is there really a need for better note-taking software for advisors?

Disclosure: Michael Kitces is a co-founder of fpPathfinder and XY Planning Network, both of which were mentioned in this article.

Michael Kitces is the head of planning strategy at Buckingham Strategic Partners, co-founder of the XY Planning Network, AdvicePay, and fpPathfinder, and publisher of the continuing education blog for financial planners, Nerd’s Eye View. You can follow him on Twitter at @MichaelKitces.

Learn more about reprints and licensing for this article.